ComEd 2013 Annual Report Download - page 127

Download and view the complete annual report

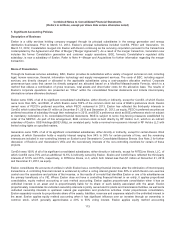

Please find page 127 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.groupsare impairedbycomparingtheirundiscountedexpectedfuture cash flows to theircarryingvalue.Cash flows for long-lived

assetsandasset groupsare determinedat thelowestlevel for which identifiable cash flows are largelyindependent ofthecash

flows ofother assetsandliabilities. Cash flows fromGeneration plant assetsare generallyevaluatedat a regional portfoliolevel

alongwithcash flows generatedfromGeneration’s supplyandrisk management activities, includingcash flows fromcontractsthat

are recordedasintangible contractassetsandliabilitieson thebalancesheet.Incertaincasesgeneration assetsmaybeevaluated

on an individual basis where thoseassetsare contractedon a long-termbasis withathirdpartyandoperationsare independent of

other generation assets(typicallycontractedrenewables).

Impairment mayoccur when thecarryingvalue oftheasset or asset group exceeds thefuture undiscountedcash flows. When the

undiscountedcash flowanalysis indicatesa long-livedasset or asset group is not recoverable,theamount oftheimpairment loss is

determinedbymeasuringtheexcess ofthecarryingamount ofthe long-livedasset or asset group over itsfairvalue.

Conditionsthat couldhaveanadverseimpactontheexpectedfuture cash flows andthefairvalue ofthe long-livedassetsandasset

groupsinclude,amongother factors, adeterioratingbusiness climate,includingenergy pricesandmarket conditions, revisionsto

regulatorylaws, or plansto disposeofa long-livedasset significantlybefore theendofitsuseful life.See Note 8—Impairment of

Long-LivedAssetsfor additional information.

Goodwill. Goodwill representstheexcess ofthe purchasepricepaid over theestimatedfairvalue oftheassetsacquiredand

liabilitiesassumedintheacquisition ofabusiness. Goodwill is not amortized, but is testedfor impairment at least annuallyor on an

interim basis if an event occursor circumstanceschangethat wouldmore likelythan not reducethefairvalue ofa reportingunit

belowitscarryingvalue.See Note 10—Intangible Assetsfor additional information regardingExelon’s andComEd’s goodwill.

Equity Method Investments. Exelon andGeneration regularlymonitor andevaluate equitymethodinvestmentsto determine

whether theyare impaired. An impairment is recordedwhen theinvestment hasexperiencedadecline invalue that is not temporary

in nature.Additionally, if the projectinwhich Generation holds an investment recognizesan impairment loss, Exelon andGeneration

wouldrecordtheir proportionate share ofthat impairment loss andevaluate theinvestment for an other than temporarydecline in

value.

Direct Financing Lease Investments. Directfinancingleaseinvestmentsrepresent theestimatedresidual valuesofleasedcoal-

firedplantsinGeorgiaandTexas. Exelon reviews theestimatedresidual valuesofitsdirectfinancingleaseinvestmentsandrecords

an impairment chargeif thereviewindicatesan other than temporarydecline inthefairvalue oftheresidual valuesbelowtheir

carryingvalues. See Note 8—Impairment ofLong-LivedAssetsfor additional information.

Derivative Financial Instruments

All derivativesare recognizedon thebalancesheet at theirfairvalue unless theyqualify for certainexceptions, includingthe normal

purchasesandnormal salesexception.Additionally, derivativesthat qualify andare designatedfor hedgeaccountingare classified

aseither hedgesofthefairvalue ofarecognizedasset or liabilityor ofan unrecognizedfirmcommitment (fairvalue hedge)or

hedgesofaforecastedtransaction or thevariabilityofcash flows to bereceivedor paid relatedto a recognizedasset or liability

(cash flowhedge). For fairvalue hedges, changesinfairvaluesfor boththederivativeandtheunderlyinghedgedexposure are

recognizedin earnings each period. For cash flowhedges, the portion ofthederivativegainorloss that is effectiveinoffsettingthe

changeinthecostorvalue oftheunderlyingexposure is deferredinaccumulated OCI andlater reclassifiedinto earnings when the

underlyingtransaction occurs. Gainsandlossesfromtheineffective portion ofanyhedge are recognizedin earnings immediately.

For derivativecontractsintendedto serveaseconomic hedgesandthat are not designatedor do not qualify for hedgeaccountingor

the normal purchasesandnormal salesexception,changesinthefairvalue ofthederivativesare recognizedin earnings each

period. Amountsclassifiedin earnings are includedinrevenue,purchasedpower andfuel,interestexpenseorother,net on the

ConsolidatedStatement ofOperationsbasedon theactivitythe transaction is economicallyhedging. For energy-relatedderivatives

enteredinto for proprietarytradingpurposes, which are subjecttoExelon’s Risk Management Policy, changesinthefairvalue ofthe

derivativesare recognizedin earnings each period. All amountsclassifiedin earnings relatedto proprietarytradingare includedin

revenue on theConsolidatedStatement ofOperations. Cash inflows andoutflows relatedto derivativeinstrumentsare includedasa

component ofoperating, investingor financingcash flows intheConsolidatedStatementsofCash Flows, dependingon the nature of

each transaction.

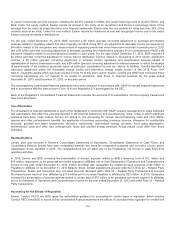

For commodityderivativecontracts, effectivewiththedate ofthemerger withConstellation,Generation no longer utilizesthe

election providedfor by thecash flowhedgedesignation andde-designatedall ofitsexistingcash flowhedgesprior to themerger.

Becausetheunderlyingforecastedtransactionsremain probable,thefairvalue oftheeffective portion ofthesecash flowhedges

121