ComEd 2013 Annual Report Download - page 102

Download and view the complete annual report

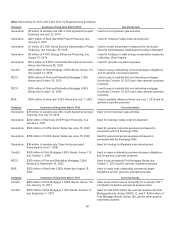

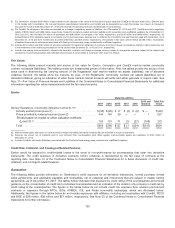

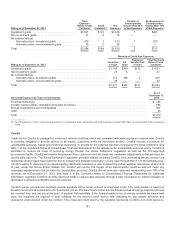

Please find page 102 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(b) Interestpaymentsare estimatedbasedon final maturitydatesofdebtsecuritiesoutstandingat December 31,2013 anddo not reflect anticipatedfuture

refinancing, earlyredemptionsor debtissuances. Variable rate interestobligationsare estimatedbasedon ratesasofDecember 31,2013.Includes

estimatedinterestpaymentsdue to ComEd, PECO andBGEfinancingtrusts.

(c) AsofDecember 31,2013,Exelon’s liabilityfor uncertaintaxpositionsandrelatedinterestpayable was$906million and$349 million,respectively. Exelon wasunable

to reasonablyestimate thetimingofliabilityandinterestpaymentsandreceiptsinindividual yearsbeyond12 months due to uncertaintiesinthetimingoftheeffective

settlement oftaxpositions. Exelon hasother unrecognizedtaxpositionsthat were not recordedon theConsolidatedBalanceSheet inaccordancewithauthoritative

guidance.See Note 14oftheCombinedNotesto ConsolidatedFinancial Statementsfor further information regardingunrecognizedtaxpositions.

(d) ExcludesPPAsandother capacitycontractsthat are accountedfor asoperatingleases. Theseamountsare includedwithin purchasepower

obligations. Includesestimatedcash paymentsfor servicefeesrelatedto PECO’s meter readingoperatinglease.

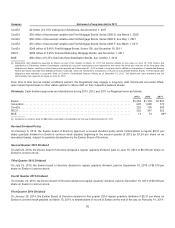

(e)Purchasepower obligationsincludePPAsandother capacitycontractsincludingthosethat are accountedfor asoperatingleases. Amountspresentedrepresent

Generation’s expectedpaymentsunder these arrangementsat December 31,2013,includingthose relatedto CENG. Expectedpaymentsincludecertainfixed

capacitycharges which maybereducedbasedon plant availability. Expectedpaymentsexclude renewable PPAcontractsthat are contingent in nature.These

obligationsdo not includeComEd’s SFCs asthesecontractsdo not require purchasesof fixedor minimumquantities. See Notes3and22 oftheCombinedNotesto

ConsolidatedFinancial Statements.

(f) Representscommitmentsto purchasenuclear fuel,natural gasandrelatedtransportation,storagecapacityandservices, procure electric supply, andpurchaseAECs

andcurtailment services. See Note 22 oftheCombinedNotesto ConsolidatedFinancial Statementsfor electric andgaspurchasecommitments.

(g) ComEd enteredinto 20-year contractsfor renewable energy andRECs beginninginJune 2012.ComEd is permittedto recover itsrenewable energy andREC costs

fromretailcustomerswithno mark-up.The annual commitmentsrepresent themaximumsettlementswithsuppliersfor renewable energy andRECs under the

existingcontract terms. Pursuant to theICC’s December 19, 2012 order,ComEd’s commitmentsunder theexistinglong-termcontractswere reducedfor theJune

2013 through May2014procurement period. TheICC’s December 18, 2013 order approvedthereduction ofComEd’s commitmentsunder the long-termcontractsfor

theJune 2014through May2015procurement period, however theamount ofthereduction will not befinalizedandapprovedbytheICC untilMarch 2014. See Note

3ofCombinedNotesto ConsolidatedFinancial Statementsfor additional information.

(h) Under their operatingagreementswith PJM, ComEd, PECO and BGE are committedto theconstruction oftransmission facilitiesto maintainsystemreliability. These

amountsrepresent ComEd’s, PECO’s and BGE’s expectedportion ofthecoststo payfor thecompletion oftherequiredconstruction projects. See Note 3 of

CombinedNotesto ConsolidatedFinancial Statementsfor additional information.

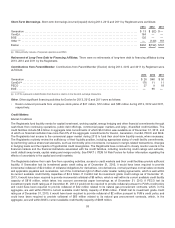

(i) Theseamountsrepresent Exelon’s estimatedminimumpension contributionsto itsqualifiedplansrequiredunder ERISAandthePension Protection Actof2006, as

well ascontributionsnecessaryto avoid benefitrestrictionsandat-risk status. For Exelon’s largestqualifiedpension plan,the projectedcontributionsreflectafunding

strategy ofcontributingthegreater of$250million or theminimumamountsunder ERISAtoavoid benefitrestrictionsandat-risk status. Theseamountsrepresent

estimatesthat are basedon assumptionsthat are subjecttochange.Theminimumrequiredcontributionsfor yearsafter 2019are not included. See Note 16ofthe

CombinedNotesto ConsolidatedFinancial Statementsfor further information regardingestimatedfuture pension benefitpayments.

See Note 22 oftheCombinedNotesto ConsolidatedFinancial Statementsfor discussion oftheRegistrants’ other commitments

potentiallytriggeredbyfuture events.

For additional information regarding:

•commercial paper,see Note 13 oftheCombinedNotesto ConsolidatedFinancial Statements.

•long-termdebt,see Note 13 oftheCombinedNotesto ConsolidatedFinancial Statements.

•liabilitiesrelatedto uncertaintaxpositions, see Note 14oftheCombinedNotesto ConsolidatedFinancial Statements.

•capital leaseobligations, see Note 13 oftheCombinedNotesto ConsolidatedFinancial Statements.

•operatingleases, energy commitments, fuel purchaseagreements, construction commitmentsandrate reliefcommitments, see

Note 22 oftheCombinedNotesto ConsolidatedFinancial Statements.

•thenuclear decommissioningand SNF obligations, see Notes15and22 oftheCombinedNotesto ConsolidatedFinancial

Statements.

•regulatorycommitments, see Note 3 oftheCombinedNotesto ConsolidatedFinancial Statements.

•variable interest entities, see Note 1 oftheCombinedNotesto ConsolidatedFinancial Statements.

•nuclear insurance,see Note 22 oftheCombinedNotesto ConsolidatedFinancial Statements.

•newaccountingpronouncements, see Note 1 oftheCombinedNotesto ConsolidatedFinancial Statements.

96