ComEd 2013 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

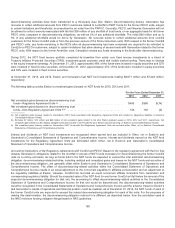

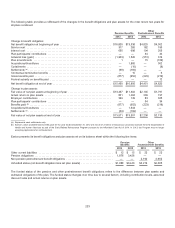

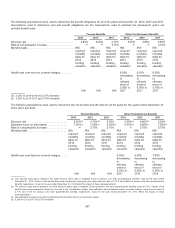

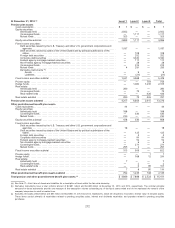

Thefollowingtablesprovidethe projectedbenefitobligations (PBO), accumulatedbenefitobligation (ABO), andfairvalue ofplan

assetsfor all pension planswithaPBO or ABO inexcess ofplan assets.

PBO in

excess of plan assets

2013 2012

Projectedbenefitobligation ................................................................. $15,452$16,800

Fairvalue ofnet plan assets ................................................................ 13,564 13,357

ABO in

excess of plan assets

2013 2012

Projectedbenefitobligation ................................................................. $15,452$16,796

Accumulatedbenefitobligation .............................................................. 14,55215,657

Fairvalue ofnet plan assets ................................................................ 13,564 13,353

OnaPBO basis, the planswere fundedat 88% at December 31,2013 comparedto 80%at December 31,2012.OnanABO basis,

the planswere fundedat 93%at December 31,2013 comparedto 85% at December 31,2012.TheABO differsfromthePBO inthat

theABO includesno assumption about future compensation levels.

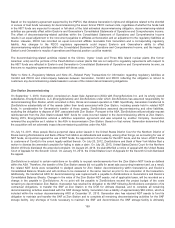

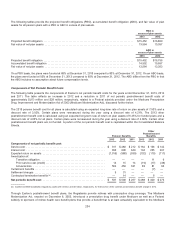

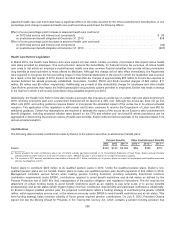

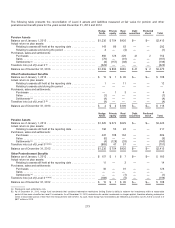

Components of Net Periodic Benefit Costs

Thefollowingtable presentsthecomponentsofExelon’s net periodic benefitcostsfor theyearsendedDecember 31,2013,2012

and2011.Thetable reflectsan increasein 2012 andareduction in 2011 ofnet periodic postretirement benefitcostsof

approximately$(17) million and$28million,respectively, relatedto a Federal subsidy providedunder theMedicare Prescription

Drug, Improvement andModernization Actof2003 (Medicare Modernization Act), discussedfurther below.

The 2013 pension benefitcostfor all plansiscalculatedusingan expectedlong-termrate ofreturn on plan assetsof 7.50%anda

discount rate of3.92%. Certain planswere remeasuredduringtheyear usingadiscount rate of4.21%. The 2013 other

postretirement benefitcostis calculatedusingan expectedlong-termrate ofreturn on plan assetsof 6.45% for fundedplansanda

discount rate of4.00%for all plans. Certain planswere remeasuredduringtheyear usingadiscount rate of 4.66%. Certainother

postretirement benefit plansare not funded. A portion ofthe net periodic benefitcostis capitalizedwithintheConsolidatedBalance

Sheets.

Pension Benefits

Other

Postretirement

Benefits

2013 2012 2011 2013 2012 2011

Components of net periodic benefit cost:

Servicecost......................................................... $ 317$280$212 $162$156 $ 142

Interestcost......................................................... 650698 649 194 205207

Expectedreturn on assets ............................................. (1,015) (988) (939) (132)(115) (111)

Amortization of:

Transition obligation ............................................... ———— 11 9

Prior servicecost(credit)........................................... 141514(19) (17) (38)

Actuarial loss .................................................... 562450 331 838166

Curtailment benefits................................................... ———— (7)—

Settlement charges ................................................... 9 31 ————

Contractual termination benefits(a)....................................... — 14— — 6—

Net periodic benefit cost ............................................. $ 537$500 $267 $ 288 $ 320 $275

(a)ComEd and BGE establishedregulatoryassetsof$1million and$4million,respectively, for their portion ofthecontractual termination benefitchargein 2012.

Through Exelon’s postretirement benefit plans, theRegistrantsprovide retireeswithprescription drugcoverage.TheMedicare

Modernization Act,enactedon December 8, 2003,introduceda prescription drugbenefitunder Medicare aswell asaFederal

subsidy to sponsorsofretiree healthcare benefit plansthat provideabenefitthat is at leastactuariallyequivalent to theMedicare

204