ComEd 2013 Annual Report Download - page 228

Download and view the complete annual report

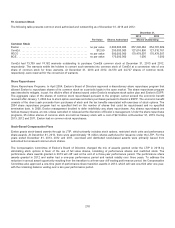

Please find page 228 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.presidentsand higher officersthat maybesettled100%incash if certainownershiprequirementsare satisfied. The performance

sharesgrantedprior to 2012 generallyvestandsettle over a three-year periodwiththeholdersreceivingsharesofcommon stock

and/or cash annuallyduringthevestingperiod.

The one-time 2013 performanceshare transition awards, which provide an opportunityto earn an awardcontingent on company

performance,will besettled50%incommon stock and50%incash, except for awards grantedto executivevice presidentsand

higher officersthat maybesettled100%incash if certainownershiprequirementsare satisfied. One-thirdoftheawardvestsandis

payable after a one-year performance period while theremainingtwo-thirds vestsandispayable after a two-year performance

period.

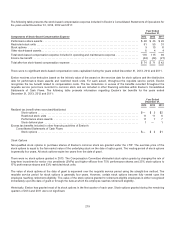

Thepayout ofthe 2013 performanceshare awards andone-time performanceshare transition awards are basedon theCompany’s

performanceagainstspecific operational andfinancial goalsset annuallyduringtherespective performance periods. Asaresult,the

2013 performanceshare awards havebeen dividedinto equal tranchesfor the purposeofexpenserecognition asthough the

respectiveawardwere multiple awards; witheach tranche representingacorresponding fiscal year.The one-time performance

share transition awards havealsobeen dividedinto multiple tranchesfor the purposeofexpenserecognition.One tranchereflects

the one-thirdoftheawards that vestsandare payable after a one-year period. Thetwo-thirds ofthe one-time performanceshare

transition awards that are subjecttoatwo-year performance periodhavealsobeen dividedinto equal tranches; witheach tranche

representingacorresponding fiscal year.Thegrant date for each trancheofthe 2013 performanceshare andone-time performance

share transition awards is thedate inwhich the performancegoalsfor that fiscal year are approvedandcommunicated, which

typicallyoccursat thecorrespondingJanuaryCompensation Committee meeting.

The 2013 performanceshare awards andone-time performanceshare transition awards are recordedat fairvalue at thegrant dates

for each tranche,withtheestimatedgrant date fairvalue basedon theexpectedpayout oftheaward, which mayrangefrom50%to

150%ofthepayout target.The 2013 performanceshare awards alsoinclude a total shareholder return modifier (TSR)that may

increaseordecreasetheawardup to 25% andan individual performancemodifier (IPM) that can decreasetheawardbyup to 50%

or increasetheawardbyup to 10%for SVPs and higher officersor up to 20%for vice presidents. The one-time performanceshare

transition awardisnot affectedbyeither TSRortheIPM.

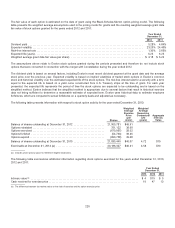

Thecommon stock portion ofthe performanceshare andone-time performanceshare transition awards is consideredan equity

awardbeingvaluedbasedon Exelon’s stock priceonthegrant date.Thecash portion oftheawards is consideredaliabilityaward

which is remeasuredeach reportingperiodbasedon Exelon’s current stock price.Asthevalue ofthecommon stock andcash

portionsoftheawards are basedon Exelon’s stock priceduringthe performance period, coupledwithchangesinthe total

shareholder return modifier andexpectedpayout oftheaward, thecompensation costsare subjecttovolatilityuntilpayout is

established.

The 2012 performanceshare awards are recordedat fairvalue at thedate ofgrant withtheestimatedgrant date fairvalue basedon

theexpectedpayout oftheaward, which mayrangefrom 75% to 125% ofthepayout target.Thecommon stock portion is

consideredan equityawardwiththe75% payout floor beingvaluedbasedon Exelon’s stock priceonthegrant date.Thecash

portion oftheawardisconsideredaliabilityawardwiththe75% payout floor beingremeasuredeach reportingperiodbasedon

Exelon’s current stock price.Theexpectedpayout inexcess ofthe75% floor for theequityandliabilityportionsare remeasured

each reportingperiodbasedon Exelon’s current stock priceandchangesintheexpectedpayout oftheaward; therefore these

portionsoftheawardare subjecttovolatilityuntilthepayout is established.

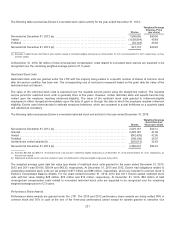

For nonretirement-eligible employees, stock-basedcompensation costsare recognizedover thevestingperiodofthree yearsusing

thegraded-vestingmethod. For performanceshare andone-time performanceshare transition awards grantedto retirement-eligible

employees, thevalue ofthe performancesharesinrecognizedratablyover thevestingperiod, which is theyear ofgrant.

222