ComEd 2013 Annual Report Download - page 142

Download and view the complete annual report

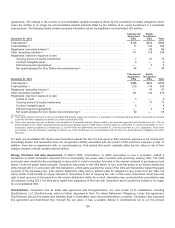

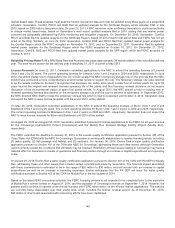

Please find page 142 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incurredduringthetestyear,includingseverance.Asaresult,theorder affirmedthe treatment of$20 million ofseverance-related

coststhat BGE hadrecordedasaregulatoryasset in 2012,consistent withprior MDPSC decisions. Additionally, BGE establisheda

newregulatoryasset of$8million relatedto non-severancemerger integration costs, which includes$6million ofcostsincurred

during2012.Current MDPSC treatment ofthesemerger integration regulatoryassetsisto providerecoveryover a fiveyear period.

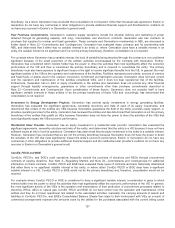

2013 Maryland Electric and Gas Distribution Rate Case OnMay17, 2013, BGE filedan application for increasesof$101 million

and$30 million to itselectric andgasbase rates, respectively, withtheMDPSC. Therequestedratesofreturn on equityinthe

application were 10.50%and10.35% for electric andgas distribution,respectively. Inaddition to theserequestedrate increases,

BGE’s application includesarequestfor recoveryofincremental capital expendituresandoperatingcostsassociatedwith BGE’s

proposedshort-termreliabilityimprovement plan inresponsetoaMDPSC order through asurchargeseparate frombase rates. On

August23,2013, BGE filedan update to itsrate requestwhich alteredtherequestedincrease to electric base ratesfrom$101

million to $83million andtherequestedincreasetogasbase ratesfrom$30 million to $24million.OnDecember 13,2013,the

MDPSC issuedan order inBGE’s 2013 electric andnatural gas distribution rate casefor increasesin annual distribution service

revenue of$34million and$12 million,respectively. The electric distribution rate increasewasset usingan allowedreturn on equity

of 9.75% andthegas distribution rate increasewasset usingan allowedreturn on equityof 9.60%. The approvedelectric and

natural gas distribution ratesbecameeffectivefor servicesrenderedon or after December 13,2013.TheMDPSC alsoconditionally

approved fiveoftheeight programs includedinBGE’s proposedshort-termreliabilityimprovement plan.Commencement ofthe

programandrecoveryare dependent on final MDPSC approval withthesurchargestartingno earlier than April1,2014.

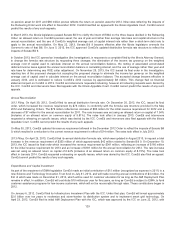

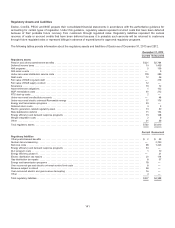

Smart Meter and Smart Grid Investments InAugust 2010,theMDPSC approvedacomprehensivesmart grid initiativefor BGE

that includesthe plannedinstallation of2million residential andcommercial electric andgassmart metersat an expectedtotal cost

of $480million.TheMDPSC’s approval ordered BGE to defer theassociatedincremental costs, depreciation andamortization,and

an appropriate return,inaregulatoryasset untilsuch timeasacost-effectiveadvancedmetering systemisimplemented. Asof

December 31,2013 andDecember 31,2012, BGE recordedaregulatoryasset of $66 million and$31 million,respectively,

representingincremental costs, depreciation andamortization,andadebt return on fixedassetsrelatedto itsAMI program.

Additionally, theMDPSC hasdeterminedthat thecostrecoveryfor the non-AMI metersthat BGE retireswill beconsideredina

future depreciation proceeding. TheMDPSC continuesto evaluate theimpactsofacustomer opt-out feature inBGE’s Smart Grid

program. InMarch 2013, BGE filedadescription oftheoverall additional costsassociatedwithallowingcustomersto retaintheir

current meter,andfor radiofrequency (RF)-Free andRF-Minimizingoptionsrelatedto theinstallation oftheirsmart metersaswell

asa proposedcostrecoverymechanism. TheMDPSC heldahearinginAugust 2013 to consider thefilings madeby BGE andother

Marylandelectric utilities. The ultimate resolution relatedto this feature couldaffectBGE’s abilityto demonstrate cost-effectiveness

oftheadvancedmetering system. Overall, BGE continuesto believetherecoveryofsmart grid initiativecostsinfuture ratesis

probable as BGE expectsto beable to demonstrate that the programbenefitsexceedcosts. Pursuant to the ARRA of2009, BGE is

arecipient of$200 million infederal fundingfromtheDOE for itssmart grid andother relatedinitiatives, which substantiallyreduces

the total costoftheseinitiativesto BGE’s ratepayers. The projecttoinstall thesmart metersbegan in late April 2012.Asof

December 31,2013, BGE hadreceived$200 million inreimbursementsfromtheDOE.

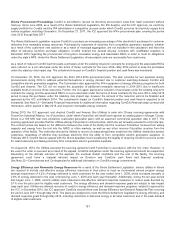

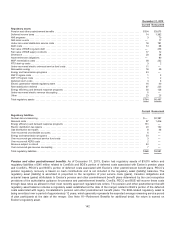

New Electric Generation On April12,2012,theMDPSC issuedan order directing BGE andtwoother Marylandutilitiesto enter into

acontractfor differences (CfD) with CPV Maryland, LLC (CPV), under which CPV will construct an approximately700 MW natural

gas-firedcombined-cycle generation plant inWaldorf, Maryland, that CPV projectedwill beincommercial operation by June 1,2015.

Theinitial termofthe proposedcontractis 20 years. TheCfD mandatesthat BGE andtheother utilitiespay(or receive)the

differencebetween CPV’s contractpricesandtherevenues CPV receivesfor capacityandenergy fromclearingtheunitinthePJM

capacitymarket.TheMDPSC’s Order requiresthethree Marylandutilitiesto enter into a CfD inamountsproportionate to their

relativeSOS load.

On April16, 2013,theMDPSC issuedan order that required BGE to execute a specific formofcontractwith CPV, andthe parties

executedthecontractasofJune 6, 2013.AsofDecember 31,2013,there is no impactonExelon’s and BGE’s resultsofoperations,

cash flows andfinancial positions. Furthermore,theagreement doesnot becomeeffective untiltheresolution ofcertainitems,

includingall current litigation.

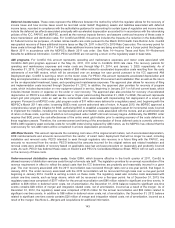

On April27, 2012,acivilcomplaint wasfiledintheU.S. DistrictCourt for theDistrictofMarylandbycertain unaffiliatedpartiesthat

challengestheactionstaken by theMDPSC on Federal lawgrounds. OnOctober 24, 2013,theU.S. DistrictCourt issueda

judgment order findingthat theMDPSC’s Order directing BGE andthetwoother Marylandutilitiesto enter into a CfD, which assures

that CPV receivesaguaranteed fixedpriceregardless ofthepriceset by thefederallyregulatedwholesale market,violatesthe

Supremacy ClauseoftheUnitedStatesConstitution.OnNovember 22,2013,theMDPSC and CPV appealedtheDistrictCourt’s

rulingto theUnitedStatesCourt ofAppealsfor theFourthCircuit.

136