ComEd 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

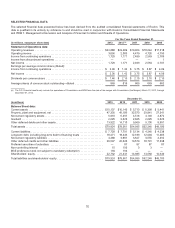

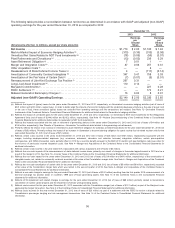

(n)Reflectscostsincurredto establish estimatedliabilitiesfor theyearsendedDecember 31,2013 andDecember 31,2012 (net oftaxesof$10 million and$5million,

respectively) pursuant to theMidwestGeneration bankruptcy, primarilyrelatedto leasepaymentsunder a coal railcar leaseandestimatedpaymentsfor asbestos-

relatedpersonal injuryclaims.

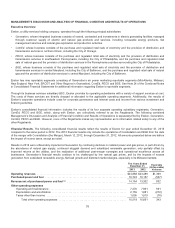

As discussedabove,Exelon hasincurredandwill continue to incur costsassociatedwiththeConstellation merger,including

meetingthevariouscommitmentsset forthbyregulatorsandagreed-upon withother interestedpartiesaspart ofthemerger

approval process, andintegratingtheformer Constellation businessesinto Exelon.

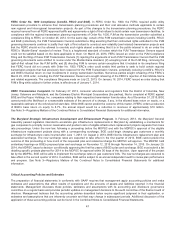

For theyear endedDecember 31,2013,expensehasbeen recognizedfor costsincurredto achievethemerger,prior to

consideration ofregulatoryaccountingtreatment,asfollows:

Pre-tax Expense

Twelve Months Ended

December 31, 2013

Merger and Integration Costs: Exelon (a)

Employee-Related(b) ......................................................................... 58

Other (c) .................................................................................... 84

Total ....................................................................................... $142

Pre-tax Expense

Twelve Months Ended

December 31, 2012

Merger and Integration Costs: Exelon (a)

MarylandCommitments ....................................................................... 328

Employee-Related(b) ......................................................................... 207

Other (c) .................................................................................... 211

Transaction (d) ............................................................................... $ 58

Total ....................................................................................... $804

(a)For Exelon,Generation and BGE, includesthe operationsoftheacquiredbusinessesfromthedate ofthemerger March 12,2012 through theyear ended

December 31,2013.

(b) Costsprimarilyfor employee severance,pension and OPEB expenseandretention bonuses. ComEd establishedregulatoryassetsof$2million and$21 million for

theyearsendedDecember 31,2013 andDecember 31,2012,respectively. BGE establishedregulatoryassetsof$0million and$22 million for theyearsended

December 31,2013 andDecember 31,2012,respectively. Themajorityofthesecostsare expectedto berecoveredover a five-year period.

(c) Coststo integrate Constellation processesand systems into Exelon andto terminate certainConstellation debtagreements. ComEd establishedaregulatoryasset of

$9 million and$15million for theyearsendedDecember 31,2013 andDecember 31,2012,respectively, for certainother merger andintegration costs. BGE

establishedaregulatoryasset of$12 million and$0million for theyearsendedDecember 31,2013 andDecember 31,2012,respectively, for certainother merger

andintegration costs.

(d) External,third-partycostspaid to advisors, consultants, lawyersandother expertsto assistinthedue diligenceandregulatoryapproval processesandintheclosing

ofthe transaction.

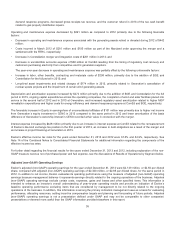

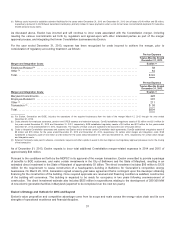

AsofDecember 31,2013,Exelon expectsto incur total additional Constellation merger-relatedexpensesin 2014and2015of

approximately$34million.

Pursuant to theconditionsset forthbytheMDPSC initsapproval ofthemerger transaction,Exelon committedto provideapackage

ofbenefitsto BGE customers, andmakecertaininvestmentsintheCityofBaltimore andtheState ofMaryland, resultinginan

estimateddirectinvestment intheState ofMarylandofapproximately$1billion.Thedirectinvestment includes $95 million to $120

million for therequirement to causeconstruction ofaheadquartersbuildinginBaltimore for Generation’s competitive energy

businesses. OnMarch 20,2013,Generation signedatwenty-year leaseagreement that is contingent upon thedeveloper obtaining

financingfor theconstruction ofthebuilding. Oncerequiredapprovalsare receivedandfinancingcondition is satisfied, construction

ofthebuildingwill commence.Thebuildingisexpectedto be ready for occupancy intwoyearsfollowingcommencement of

construction.Thedirectinvestment estimate alsoincludes$625million inexpendituresrelatingto thedevelopment of285-300 MW

ofnewelectric generation facilitiesinMaryland(expectedto becompletedover thenext ten years).

Exelon’s Strategy and Outlook for 2014 and Beyond

Exelon’s value proposition andcompetitiveadvantagecomefromitsscope andscale across the energy value chainanditscore

strengths ofoperational excellenceandfinancial discipline.

37