ComEd 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

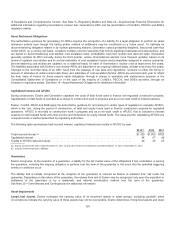

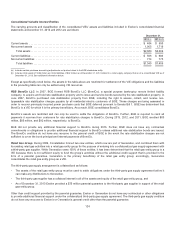

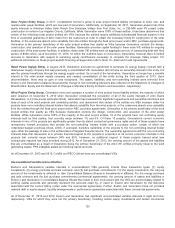

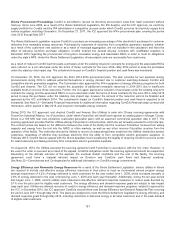

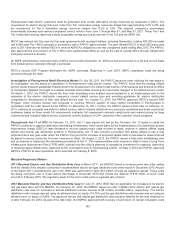

agreements. Thechangeinthenumber ofunconsolidatedvariable interestsisdriven by thecompletion ofcertainobligations which

causethe entitiesto no longer beunconsolidatedvariable interestsoffset by theaddition ofan equityinvestment inaresidential

solar provider.Thefollowingtablespresent summaryinformation about thesignificant unconsolidated VIE entities:

December 31, 2013

Commercial

Agreement

VIEs

Equity

Investment

VIEs Total

Total assets(a)..................................................................... $128$332 $460

Total liabilities(a).................................................................... 17123 140

Registrants’ ownershipinterest(a)...................................................... — 86 86

Other ownershipinterests(a).......................................................... 111 123 234

Registrants’ maximumexposure to loss:

Carryingamount ofequityinvestments.............................................. 7 67 74

Contractintangible asset ......................................................... 9 — 9

Debtandpayment guarantees .................................................... — 5 5

Net assetspledgedfor Zion Station decommissioning(b) ............................... 44 — 44

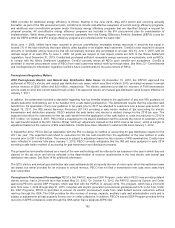

December 31, 2012

Commercial

Agreement

VIEs

Equity

Investment

VIEs Total

Total assets(a)..................................................................... $386 $354 $740

Total liabilities(a).................................................................... 219114333

Registrants’ ownershipinterest(a)...................................................... — 97 97

Other ownershipinterests(a).......................................................... 167 143 310

Registrants’ maximumexposure to loss:

Lettersofcredit................................................................. 5 — 5

Carryingamount ofequityinvestments.............................................. — 77 77

Contractintangible asset ......................................................... 8 — 8

Debtandpayment guarantees .................................................... — 5 5

Net assetspledgedfor Zion Station decommissioning(b) ............................... 50—50

(a)Theseitems represent amountson theunconsolidated VIE balancesheets, not on Exelon’s or Generation’s ConsolidatedBalanceSheets. Theseitems are included

to provideinformation regardingthe relativesizeoftheunconsolidated VIEs.

(b) Theseitems represent amountson Exelon’s andGeneration’s ConsolidatedBalanceSheetsrelatedto theasset sale agreement withZionSolutions, LLC. The net

assetspledgedfor Zion Station decommissioningincludesgross pledgedassetsof $458 million and$614million asofDecember 31,2013 andDecember 31,2012,

respectively; offset by payablesto ZionSolutions LLC of$414million and $564 million asofDecember 31,2013 andDecember 31,2012,respectively. Theseitems

are includedto provideinformation regardingthe relativesizeoftheZionSolutions LLC unconsolidated VIE. See Note 15—Asset Retirement Obligationsfor further

discussion.

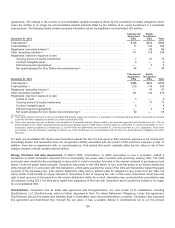

For each unconsolidated VIE, Exelon andGeneration assess therisk ofaloss equal to theirmaximumexposure to beremote and,

accordinglyExelon andGeneration have not recognizedaliabilityassociatedwithanyportion ofthemaximumexposure to loss. In

addition,there are no agreementswith, or commitments by, thirdpartiesthat wouldmateriallyaffectthefairvalue or risk oftheir

variable interestsinthesevariable interest entities.

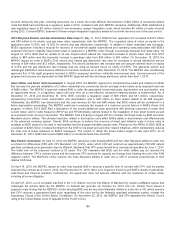

Energy Purchase and Sale Agreements. InMarch 2005, Constellation,to which Generation is nowasuccessor,closeda

transaction inwhich Generation assumedfromacounterpartytwopower salescontractswithpreviouslyexisting VIEs. TheVIEs

previouslywere createdbythecounterpartyto issue debtinorder to monetizethevalue oftheoriginal contractsto purchaseandsell

power.Under thepower salescontracts, Generation soldpower to theVIEs which, in turn,soldthat power to an electric distribution

utilitythrough 2013.Inconnection withthis transaction,athird-partyacquiredtheequityoftheVIEs andGeneration loanedthat party

a portion ofthe purchaseprice.Ifthe electric distribution utilitywere to default under itsobligation to buypower fromtheVIEs, the

equityholder couldtransfer itsequityintereststo Generation inlieu ofrepayingthe loan.Inthis event,Generation wouldhavethe

righttoseekrecoveryofitslossesfromthe electric distribution utility. Asaresult,Generation hasconcludedthat consolidation was

not required. During2013,thethird-partyrepaid theirobligationsofthe loan withGeneration which causedthe entitiesto no longer

beunconsolidated VIEs.

ZionSolutions. Generation hasan asset sale agreement withEnergySolutions, Inc. andcertainofitssubsidiaries, including

ZionSolutions, LLC (ZionSolutions), which is further discussedinNote 15—Asset Retirement Obligations. Under this agreement,

ZionSolutionscan put theassetsandliabilitiesback to Generation when decommissioningiscomplete.Generation hasevaluated

this agreement anddeterminedthat,through the put option,ithasavariable interestinZionSolutionsbut is not theprimary

126