ComEd 2013 Annual Report Download - page 144

Download and view the complete annual report

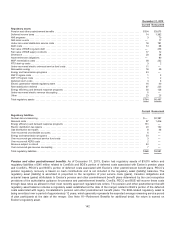

Please find page 144 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ComEd’s updatedformula transmission rate currentlyprovidesfor a weightedaveragedebtandequityreturn on transmission rate

baseof 8.70%, adecreasefromthe8.91%return previouslyauthorized. Thedecreasein return wasprimarilydue to lower interest

rateson ComEd’s long-termdebt outstanding. Aspart oftheFERC-approvedsettlement ofComEd’s 2007transmission rate case,

the rate ofreturn on common equityis11.5% andthecommon equitycomponent ofthe ratiousedto calculate theweightedaverage

debtandequityreturn for theformula transmission rate is currentlycappedat 55%.

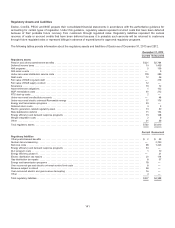

BGE’s mostrecent annual formula rate update filedin April 2013 reflectsactual 2012 expensesandinvestmentsplusforecasted

2013 capital additions. Theupdate resultedinarevenue requirement of$158 million offset by a$1million reduction relatedto the

reconciliation of2012 actual costsfor a net revenue requirement of$157 million. This comparesto the April 2012 updatedrevenue

requirement of$156 million increasedby$2million relatedto thereconciliation of2011 actual costsfor a net revenue requirement of

$158 million.Thedecreaseintherevenue requirement wasprimarilydriven by alower allowedrate ofreturn associatedwitha

reducedequityratioandreducedrate base,offset partially by higher depreciation andoperatingandmaintenancecosts. The 2013

net revenue requirement becameeffectiveJune 1,2013,andisbeingrecoveredover the periodextendingthrough May31,

2014. Theregulatoryliabilityassociatedwiththe true-up is beingamortizedastheassociatedamountsare recoveredthrough rates.

BGE’s updatedformula transmission rate currentlyprovidesfor a weightedaveragedebtandequityreturn on transmission rate base

of8.35%, adecreasefromthe8.43%includedintheprior year formula update.Thedecreasein return wasprimarilydue to a debt

issuancein 2012 andlower interest rateson BGE’s debt outstanding. Aspart oftheFERC-approvedsettlement in 2006of BGE’s

2005transmission rate case,thebase rate ofreturn on common equityfor BGE’s electric transmission business for new

transmission projectsplacedinserviceonandafter January1,2006is11.3%, inclusiveofa50basis point incentivefor participating

inPJM.

FERC Transmission Complaint OnFebruary27, 2013,consumer advocatesandregulatorsfromtheDistrictofColumbia,New

Jersey, Delaware andMaryland, andtheDelaware Electric Municipal Cooperatives(the parties), filedacomplaint at FERCagainst

BGE andthePepcoHoldings, Inc. companiesrelatingto theirrespective transmission formula rates. BGE’s formula rate includesa

10.8% base rate ofreturn on common equity(ROE) for mostinvestmentsincludedinitsrate baseand11.3%for theremaining

transmission investment (the latter of which is conditionedupon creditingthefirst50basis pointsofanyincentiveROE adders). The

partiesseekareduction inthebase return on equityto 8.7% andchangesto theformula rate process. FERCdocketedthematter

andset April3,2013 asthedeadline for interventions, protestsandanswers. Under FERCrules, the earliestdate from which the

base return on equitycouldbeadjustedandrefunds requiredisthedate ofthecomplaint.OnMarch 19, 2013, BGE filedamotion to

dismiss or sever thecomplaint.AsofDecember 31,2013, BGE cannot predictthelikelihoodor a reasonable estimate oftheamount

ofachange,ifany, inthe allowedbase return on equity, or a reasonable estimate oftherefundperiodstart date. While BGE cannot

predictthe outcomeofthis matter,ifFERCordersareduction of BGE’s base return on equityto 8.7% (while retainingthe50basis

pointsofanyincentivesthat were creditedto thebase return on equityfor certainnewtransmission investment), theestimated

annual impactwouldbeareduction inrevenuesofapproximately$10 million.

PJM Transmission Rate Design and Operating Agreements PJM Transmission Rate Designspecifiesthe ratesfor transmission

servicechargedto customerswithinPJM. Currently, ComEd, PECO and BGE incur costsbasedon theexistingrate design, which

chargescustomersbasedon thecostoftheexistingtransmission facilitieswithintheir loadzone andthecostofnewtransmission

facilitiesbasedon thosewhobenefitfromthosefacilities. In April 2007, FERC issuedan order concludingthat PJM’s current rate

designfor existingfacilitiesisjustandreasonable andshouldnot bechanged. Inthesameorder,FERCheldthat thecostsofnew

facilities500 kV andaboveshouldbesocializedacross the entire PJM footprint andthat thecostsofnewfacilitiesless than 500 kV

shouldbe allocatedto thecustomersofthenewfacilitieswhocausedthe needfor thosefacilities. After FERCultimatelydeniedall

requestsfor rehearingon all issues, several partiesfiledpetitionsintheU.S. Court ofAppealsfor theSeventhCircuitfor reviewof

thedecision.OnAugust6, 2009, that court issueditsdecision affirmingFERC’s order withregardto thecostsofexistingfacilitiesbut

reversingandremandingto FERCfor further consideration itsdecision withregardto thecostsofnewfacilities500 kV andabove.

OnMarch 30,2012,FERC issuedan order on remandaffirmingthecost allocation initsApril 2007order.OnMarch 22,2013,FERC

issuedan order denyingrehearingofitsMarch 30,2012 Order andmadeitclear that thecost allocation at issue concernsonly

projectsapprovedprior to February1,2013.Anumber ofentitieshavefiledappealsoftheFERCorders. ComEd, and BGE

anticipate that all impactsofanyrate designchangeseffectiveafter December 31,2006andJune 30,2006, respectively, shouldbe

recoverable through retail ratesand, thus, the rate designchangesare not expectedto haveamaterial impactontheirrespective

resultsofoperations, cash flows or financial position. PECO anticipatesthat all impactsofanyrate designchangesshouldbe

recoverable through the transmission servicechargerider approvedinPECO’s 2010 electric distribution rate casesettlement and,

thus, the rate designchangesare not expectedto haveamaterial impactonPECO’s resultsofoperations, cash flows or financial

position.Totheextent that anyrate designchangesare retroactive to periods prior to January1,2011,however,there maybean

impactonPECO’s resultsofoperations.

138