ComEd 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fee which includesashareholder return component andan incremental costcomponent.However,through December 2016, BGE

providesall residential electric customersacreditfor theresidential shareholder return component oftheadministrativecharge.

BGE hasalso enteredinto derivative natural gascontracts, which qualify for the normal purchasesandnormal salesscope

exception,to hedgeitspricerisk inthe natural gasmarket.Thehedgingprogramfor natural gasprocurement hasno directimpact

on BGE’s financial position.However,under BGE’s market-basedratesincentivemechanism, BGE’s actual costofgasiscompared

to a market index(ameasure ofthemarket priceofgasinagiven period). Thedifferencebetween BGE’s actual costandthemarket

indexissharedequallybetween shareholdersandcustomers.

BGE doesnot enter into derivativesfor speculative or proprietarytradingpurposes. For additional information on thesecontracts,

see Note 12 oftheCombinedNotesto ConsolidatedFinancial Statements.

Trading and Non-Trading Marketing Activities

Thefollowingdetailedpresentation ofExelon’s tradingandnon-tradingmarketingactivitiesisincludedto address therecommended

disclosuresbythe energy industry’s Committee of ChiefRisk Officers (CCRO).

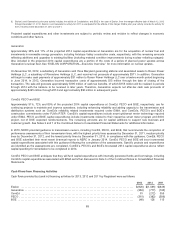

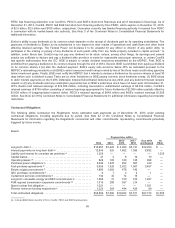

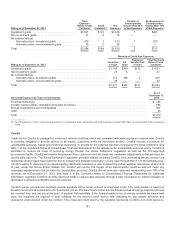

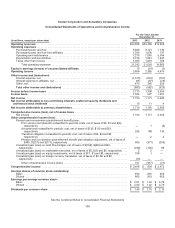

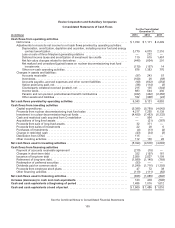

Thefollowingtable providesdetailonchangesinExelon’s mark-to-market net asset or liabilitybalancesheet position from

January1,2012,to December 31,2013.Itindicatesthedriversbehindchangesinthebalancesheet amounts. This table

incorporatesthemark-to-market activitiesthat are immediatelyrecordedin earnings, aswell asthesettlementsfrom OCI to earnings

andchangesinfairvalue for thecash flowhedgingactivitiesthat are recordedinaccumulated OCI on theConsolidatedBalance

Sheets. This table excludesall normal purchaseandnormal salescontractsanddoesnot segregate proprietarytradingactivity. See

Note 12 oftheCombinedNotesto theConsolidatedFinancial Statementsfor more information on thebalancesheet classification of

themark-to-market energy contract net assets(liabilities) recordedasofDecember 31,2013,andDecember 31,2012.

Exelon(b)

Total mark-to-market energy contract net assets(liabilities) at January1,2012 (a).................................. $ 848

Contractsacquiredat merger date (c) ........................................................................ 140

Total changeinfairvalue during2012 ofcontractsrecordedinresult ofoperations.................................. (152)

Reclassification to realizedat settlement ofcontractsrecordedinresultsofoperations............................... 775

Ineffective portion recognizedinincome(d) ................................................................... (5)

Reclassification to realizedat settlement fromaccumulated OCI (e)............................................... (747)

Effective portion ofchangesinfairvalue—recordedinOCI (f) .................................................... 573

Changesinfairvalue—energy derivatives(g) ................................................................. 25

Changesin allocatedcollateral ............................................................................ (89)

Changesin net option premiumpaid/(received) ............................................................... 114

Option premiumamortization (h) ............................................................................ (160)

Intercompanyelimination ofexistingderivativecontractswithConstellation ........................................ (103)

Other balancesheet reclassifications ....................................................................... (7)

Total mark-to-market energy contract net assets(liabilities) at December 31,2012 (a)................................ $1,212

Total changeinfairvalue during2013 ofcontractsrecordedinresult ofoperations.................................. 438

Reclassification to realizedat settlement ofcontractsrecordedinresultsofoperations............................... 34

Reclassification to realizedat settlement fromaccumulated OCI (e)............................................... (464)

Changesinfairvalue—energy derivatives(g) ................................................................. (126)

Changesin allocatedcollateral ............................................................................ (175)

Changesin net option premiumpaid/(received) ............................................................... 36

Option premiumamortization (h) ............................................................................ (104)

Other balancesheet reclassifications ....................................................................... 4

Total mark-to-market energy contract net assets(liabilities) at December 31,2013 (a)(i) ............................. $ 855

(a)Amountsare shown net ofcollateral paid to andreceivedfromcounterparties.

(b) Excelon amountspresentedafter intercompanyactivityrelatedto thefive-year financial swap between Generation andComEd.

(c) For Generation,includes $660million ofcollateral paid to counterparties, offset by $520 million ofunrealizedlosseson commodityderivativepositions.

(d) For Generation,reflects$5million ofchangesincash flowhedgeineffectiveness.

(e)For Generation,includes$219million and$621 million oflossesfromreclassificationsfromaccumulated OCI to recognizegainsin net income relatedto settlements

ofthefive-year financial swap contractwithComEd for theyearsendedDecember 31,2013 and2012,respectively.

99