ComEd 2013 Annual Report Download - page 169

Download and view the complete annual report

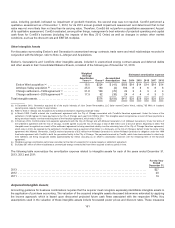

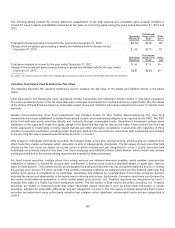

Please find page 169 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Thefairvalue ofGeneration’s non-government-backed fixedrate projectfinancingdebt(Level 3)isbasedon market andquoted

pricesfor itsownandother projectfinancingdebtwith similar risk profiles. Given thelowtradingvolumeinthe projectfinancingdebt

market,thepricequotesusedto determine fairvalue will reflectcertainqualitativefactors, such asmarket conditions, investor

demand, newdevelopmentsthat mightsignificantlyimpactthe projectcash flows or off-taker credit,andother circumstancesrelated

to the project(e.g., political andregulatoryenvironment). Thefairvalue ofGeneration’s government-back fixedrate projectfinancing

debt(Level 3)islargelybasedon a discountedcash flowmethodology that is similar to thetaxable debtsecuritiesmethodology

describedabove.Due to thelack ofmarket tradingdata on similar debt,thediscount ratesare derivedbasedon theoriginal loan

interest rate spreadto the applicable Treasuryrate aswell asacurrent market curvederivedfromgovernment-backed

securities. Variable rate projectfinancingdebtresetson a quarterlybasis andthecarryingvalue approximatesfairvalue.

Exelon alsohastax-exempt debt(Level 3). Due to lowtradingvolumeinthis market,qualitativefactors, such asmarket conditions,

investor demand, andcircumstancesrelatedto theissuer (i.e., political andregulatoryenvironment), maybeincorporatedinto the

creditspreads that are usedto obtainthefairvalue asdescribedabove.

SNF Obligation. Thecarryingamount ofGeneration’s SNF obligation (Level 2)isderivedfromacontractwiththeDOE to providefor

disposal of SNF fromGeneration’s nuclear generatingstations. When determiningthefairvalue oftheobligation,thefuture carrying

amount oftheSNF obligation estimatedto besettledin 2025iscalculatedbycompoundingthecurrent bookvalue oftheSNF

obligation at the13-weekTreasuryrate.Thecompoundedobligation amount is discountedback to present value usingGeneration’s

discount rate, which is calculatedusingthesamemethodology asdescribedabovefor thetaxable debtsecurities, andan estimated

maturitydate of2025.

Long-Term Debt to Financing Trusts. Exelon’s long-termdebttofinancingtrustsisvaluedbasedon publiclytradedsecurities issued

by thefinancingtrusts. Due to lowtradingvolumeofthesesecurities, qualitativefactors, such asmarket conditions, investor

demand, andcircumstancesrelatedto each issue,this debtis classifiedasLevel 3.

Preferred Securities. Thefairvalue ofthesesecuritiesisdeterminedbasedon thelastclosingpriceprior to quarter end, less

accruedinterest.Thesecuritiesare registeredwiththeSEC andare public. PECO redeemedall outstandingseriesofpreferred

securitieson May1,2013.See Note 20—Earnings Per Share andEquityfor additional information.

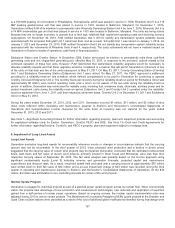

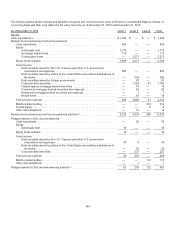

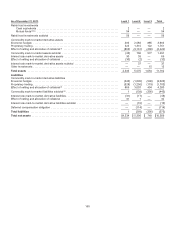

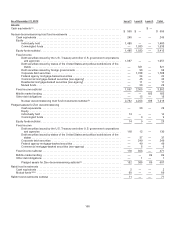

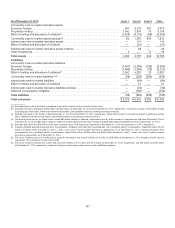

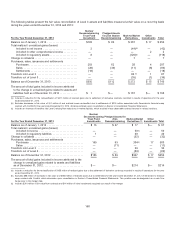

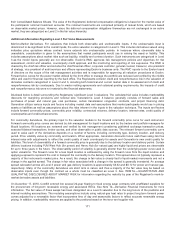

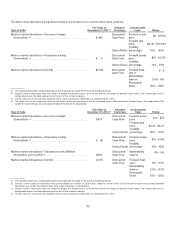

Recurring Fair Value Measurements

Exelon records thefairvalue ofassetsandliabilitiesinaccordancewiththehierarchy establishedbythe authoritativeguidancefor

fairvalue measurements. Thehierarchy prioritizestheinputsto valuation techniquesusedto measure fairvalue into three levelsas

follows:

•Level 1—quotedprices(unadjusted) inactivemarketsfor identical assetsor liabilitiesthat theRegistrantshavetheabilityto

access asofthe reportingdate.Financial assetsandliabilitiesutilizingLevel 1 inputsincludeactiveexchange-tradedequity

securitiesandfunds, certainexchange-basedderivatives, andmoneymarket funds.

•Level 2—inputsother than quotedpricesincludedwithinLevel 1 that are directlyobservable for theasset or liabilityor indirectly

observable through corroboration withobservable market data.Financial assetsandliabilitiesutilizingLevel 2 inputsinclude

fixedincomesecurities, derivatives, commingledandmutual investment funds pricedat NAVper fundshare andfairvalue

hedges.

•Level 3—unobservable inputs, such asinternallydevelopedpricingmodelsor third-partyvaluationsfor theasset or liabilitydue

to little or no market activityfor theasset or liability. Financial assetsandliabilitiesutilizingLevel 3 inputsincludeinfrequently

tradedsecuritiesandderivatives, andinvestmentspricedusingan alternativepricingmechanism or thirdpartyvaluation.

163