ComEd 2013 Annual Report Download - page 189

Download and view the complete annual report

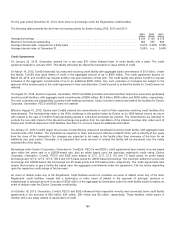

Please find page 189 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PECO’s supplier master agreementsthat govern the terms ofitselectric supplyprocurement contracts, which define a supplier’s

performanceassurancerequirements, allowasupplier to meet itscreditrequirementswithacertainamount ofunsecuredcredit.The

amount ofunsecuredcreditis determinedbasedon thesupplier’s lowestcredit ratingfromthemajor credit ratingagenciesandthe

supplier’s tangible net worth. Thecreditposition is basedon theinitial market price, which is theforwardpriceofenergy on thedaya

transaction is executed, comparedto thecurrent forwardpricecurvefor energy. Totheextent that theforwardpricecurvefor energy

exceeds theinitial market price,thesupplier is requiredto postcollateral to theextent thecreditexposure is greater than the

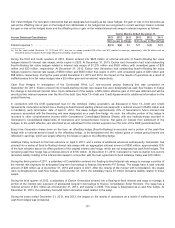

supplier’s unsecuredcreditlimit.Theunsecuredcreditusedbythesuppliersrepresents PECO’s net creditexposure.Asof

December 31,2013, PECO hadno net creditexposure withsuppliers.

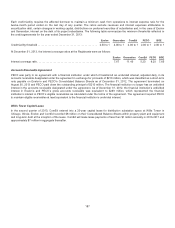

PECO is permittedto recover itscostsofprocuringelectric supplythrough itsPAPUC-approved DSP Program. PECO’s counterparty

creditrisk is mitigatedbyitsabilityto recover realizedenergy coststhrough customer rates. See Note 3—RegulatoryMattersfor

additional information.

PECO’s natural gasprocurement plan is reviewedandapprovedannuallyon a prospectivebasis by thePAPUC. PECO’s

counterpartycreditrisk under itsnatural gassupplyandasset management agreementsismitigatedbyitsabilityto recover its

natural gascoststhrough thePGC, which allows PECO to adjust ratesquarterlyto reflect realizednatural gasprices. PECO does

not obtaincollateral fromsuppliersunder itsnatural gassupplyandasset management agreements. AsofDecember 31,2013,

PECO hadcreditexposure of$9million under itsnatural gassupplyandasset management agreementswithinvestment grade

suppliers.

BGE is permittedto recover itscostsofprocuringenergy through theMDPSC-approvedprocurement tariffs. BGE’s counterparty

creditrisk is mitigatedbyitsabilityto recover realizedenergy coststhrough customer rates. See Note 3—RegulatoryMattersfor

additional information.

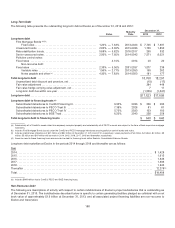

BGE’s full requirement wholesale electric power agreementsthat govern the terms ofitselectric supplyprocurement contracts,

which define a supplier’s performanceassurancerequirements, allowasupplier,or itsguarantor,to meet itscreditrequirementswith

acertainamount ofunsecuredcredit.Theamount ofunsecuredcreditis determinedbasedon thesupplier’s lowestcredit ratingfrom

themajor credit ratingagenciesandthesupplier’s tangible net worth, subjecttoanunsecuredcreditcap.Thecreditposition is

basedon theinitial market price, which is theforwardpriceofenergy on thedaya transaction is executed, comparedto thecurrent

forwardpricecurvefor energy. Totheextent that theforwardpricecurvefor energy exceeds theinitial market price,thesupplier is

requiredto postcollateral to theextent thecreditexposure is greater than thesupplier’s unsecuredcreditlimit.Theunsecuredcredit

usedbythesuppliersrepresents BGE’s net creditexposure.Theseller’s creditexposure is calculatedeach business day. Asof

December 31,2013, BGE hadno net creditexposure to suppliers.

BGE’s regulatedgasbusiness is exposedto market-pricerisk. This market-pricerisk is mitigated by BGE’s recoveryofitscoststo

procure natural gasthrough agascostadjustment clause approvedbytheMDPSC. BGE doesmakeoff-systemsalesafter BGE has

satisfieditscustomers’ demands, which are not coveredbythegascostadjustment clause.At December 31,2013, BGE hadcredit

exposure of$14million relatedto off-systemsales which is mitigatedbyparental guarantees, lettersofcredit,or righttooffset

clauseswithinother contractswiththosethird-partysuppliers.

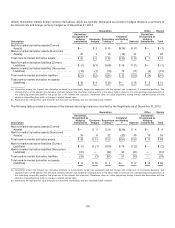

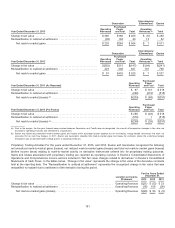

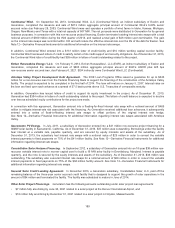

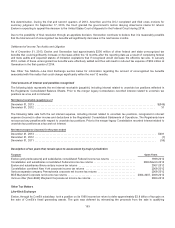

Collateral and Contingent-Related Features

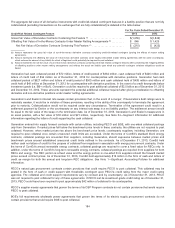

Aspart ofthe normal courseofbusiness, Generation routinelyentersinto physical or financiallysettledcontractsfor the purchase

andsale ofelectric capacity, energy, fuels, emissionsallowancesandother energy-relatedproducts. CertainofGeneration’s

derivativeinstrumentscontain provisionsthat require Generation to postcollateral.Generation also entersinto commodity

transactionson exchanges (i.e. NYMEX, ICE). Theexchangesactasthecounterpartyto each trade.Transactionson theexchanges

mustadhere to comprehensivecollateral andmarginingrequirements. This collateral maybepostedintheformofcash or credit

support withthresholds contingent upon Generation’s credit ratingfromeach ofthemajor credit ratingagencies. Thecollateral and

creditsupport requirementsvarybycontractandbycounterparty. Thesecredit-risk-relatedcontingent featuresstipulate that if

Generation were to bedowngradedor loseitsinvestment gradecredit rating(basedon itssenior unsecureddebt rating), itwouldbe

requiredto provideadditional collateral. This incremental collateral requirement allows for theoffsettingofderivativeinstrumentsthat

are assetswiththesamecounterparty, where thecontractual rightofoffset existsunder applicable master nettingagreements. In

theabsenceofexpresslyagreed-to provisionsthat specify thecollateral that mustbe provided, collateral requestedwill beafunction

ofthefactsandcircumstancesofthesituation at thetimeofthedemand. Inthis case,Generation believesan amount ofseveral

months offuture payments (i.e.capacitypayments) rather than a calculation offairvalue is thebestestimate for thecontingent

collateral obligation, which hasbeen factoredinto thedisclosure below.

183