ComEd 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Duringtheyear endedDecember 31,2013,Exelon,Generation,ComEd, PECO and BGE incurredmerger andintegration-related

costsof$142million,$106million,$16million,$9million and$6million,respectively. Of theseamounts, Exelon,ComEd and BGE

deferred$17million,$11 million and$6million,respectively, asaregulatoryasset asofDecember 31,2013.Additionally, Exelon

and BGE establishedaregulatoryasset of$6million asofDecember 31,2013 for previouslyincurred2012 merger andintegration-

relatedcosts.

Duringtheyear endedDecember 31,2012,Exelon,Generation,ComEd, PECO and BGE incurredmerger andintegration-related

costsof$804million,$340million,$41million,$17million and$182million,respectively. Of theseamounts, Exelon,ComEd and

BGE deferred $58 million,$36million and$22 million,respectively, asaregulatoryasset asofDecember 31,2012.

Thecostsincurredare classifiedprimarilywithinOperatingandMaintenanceExpenseintheRegistrants’ respectiveConsolidated

StatementsofOperationsandComprehensiveIncome,withtheexception oftheBGE customer rate creditandthecreditfacility

fees, which are includedasareduction to operatingrevenuesandother,net,respectively, for yearsendedDecember 31,2013 and

2012.See Note 22—CommitmentsandContingenciesfor additional information.

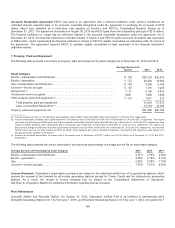

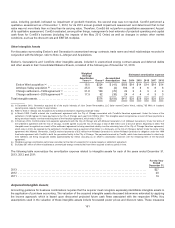

Pro-forma Impact of the Merger

Thefollowingunauditedpro formafinancial information reflectstheconsolidatedresultsofoperationsofExelon andGeneration asif

themerger withConstellation hadtaken placeonJanuary1,2011.The unauditedpro formainformation wascalculatedafter

applyingExelon’s andGeneration’s accountingpoliciesandadjustingConstellation’s resultsto reflect purchaseaccounting

adjustments.

The unauditedpro formafinancial information hasbeen presentedfor illustrative purposesonlyandisnot necessarilyindicativeof

resultsofoperationsthat wouldhavebeen achievedhadthemerger eventstaken placeonthedatesindicated, or thefuture

consolidatedresultsofoperationsofthecombinedcompany.

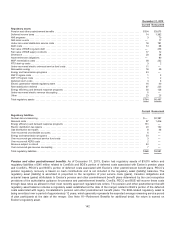

Year Ended December 31,

(unaudited) 2012 2011 (a)

Total Revenues........................................................................... $26,700 $30,712

Net income attributable to Exelon ............................................................ 2,092974

Basic Earnings Per Share .................................................................. $ 2.56 $ 1.15

DilutedEarnings Per Share ................................................................. 2.55 1.14

(a)Theamountsaboveinclude non-recurringcostsdirectlyrelatedto themerger of$236million for theyear endedDecember 31,2011.

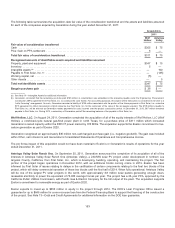

Acquisitions

Consistent withthe applicable accountingguidance,thefairvalue oftheassetsacquiredandliabilitiesassumedwasdeterminedas

oftheacquisition date through theuseof significant estimatesandassumptionsthat are judgmental in nature.Someofthemore

significant estimatesandassumptionsusedinclude:projectedfuture cash flows (includingtheamount andtiming); discount rates

reflectingtherisk inherent inthefuture cash flows; andfuture power andfuel market prices. Additionally, market pricesbasedon the

Market PriceReferent (MPR)establishedbytheCPUC for renewable energy resourceswere usedindeterminingthefairvalue of

the Antelope Valleyassetsacquiredandliabilitiesassumed. There were alsojudgmentsmadetodetermine theexpecteduseful lives

assignedto each class ofassetsacquiredandtheduration oftheliabilitiesassumed. Generation did not recordanygoodwill related

to anyoftherespectiveacquisitions.

152