ComEd 2013 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

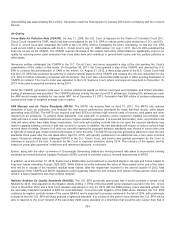

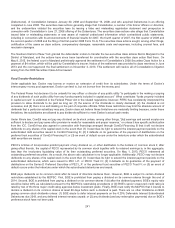

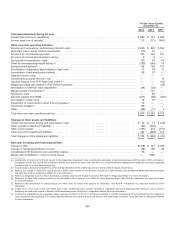

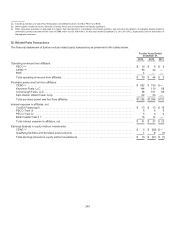

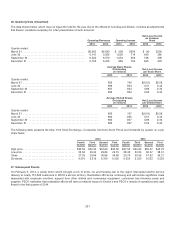

For the Years Ended

December 31,

2013 2012 2011

Cash paid (refunded) during the year:

Interest(net ofamount capitalized) .................................................................. $866 $ 761$ 649

Incometaxes(net ofrefunds) ....................................................................... 112 (171) (457)

Other non-cash operating activities:

Pension andnon-pension postretirement benefitcosts .................................................. $825$820 $542

(Earnings) loss inequitymethodinvestments.......................................................... (10)91—

Provision for uncollectible accounts .................................................................. 101 164 121

Provision for excess andobsolete inventory ........................................................... 9 6 —

Stock-basedcompensation costs.................................................................... 120 94 67

Other decommissioning-relatedactivity(a)............................................................. (169) (145) 16

Energy-relatedoptions(b) ........................................................................... 104160137

Amortization ofregulatoryasset relatedto debtcosts ................................................... 12 1821

Amortization ofrate stabilization deferral .............................................................. 66 57 —

Deferral ofstormcosts ............................................................................ — — —

Uncollectible accountsrecovery, net ................................................................. — — 14

Discrete impactsfrom2010 Rate CaseOrder (g) ........................................................ — — (32)

Bargain purchasegain relatedto WolfHollowAcquisition ................................................ — — (36)

Amortization ofdebtfairvalue adjustment ............................................................. (34) (34) —

Merger-relatedcommitments(d) ..................................................................... — 141—

Severancecosts.................................................................................. — 99 —

Discrete impactsfrom EIMA........................................................................ (271) (96) (82)(h)

Amortization ofdebtcosts .......................................................................... 1819—

Impairment ofinvestmentsindirectfinancingleases(e).................................................. 14——

Impairment charges(f) ............................................................................. 149 — —

Other ........................................................................................... (58) (11)2

Total other non-cash operatingactivities .............................................................. $876 $1,383$770

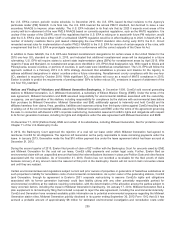

Changes in other assets and liabilities:

Under/over-recoveredenergy andtransmission costs................................................... $ 12 $71$ (45)

Other regulatoryassetsandliabilities ................................................................ (64) (404) —

Other current assets .............................................................................. (165) 213 (101)

Other noncurrent assetsandliabilities................................................................ 322 (248) 122

Total changesinother assetsandliabilities ........................................................... $105$(368) $ (24)

Non-cash investing and financing activities:

ChangeinARC .................................................................................. $(128) $ 781$186

Changeincapital expendituresnot paid .............................................................. (38) 16096

Consolidated VIE dividendto non-controllinginterest................................................... 63——

Merger withConstellation,common stock issued....................................................... — 7,365 —

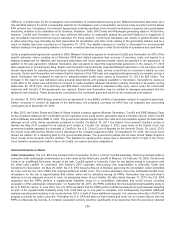

(a)Includestheelimination of NDT fundactivityfor theRegulatoryAgreement Units, includingtheelimination ofoperatingrevenues, AROaccretion,ARCamortization,

investment incomeandincometaxesrelatedto all NDT fundactivityfor theseunits. See Note 15—Asset Retirement Obligationsfor additional information regarding

theaccountingfor nuclear decommissioning.

(b) Includesoption premiums reclassifiedto realizedat thesettlement oftheunderlyingcontractsandrecordedto resultsofoperations.

(c) Reflectsthechangeindistribution ratespursuant to EIMA, which allows for therecoveryofcostsbyautilitythrough a pre-establishedperformance-basedformula

rate tariff. See Note 3—RegulatoryMattersfor more information.

(d) Relatesto integration coststo achievedistribution synergiesrelatedto themerger transaction.See Note 3—RegulatoryMattersfor more information.

(e)Relatesto an other than temporarydecline intheestimatedresidual value ofone ofExelon’s directfinancingleases. See Note 8—Impairment ofLong-LivedAssets

for more information.

(f) Relatesto thecancellation ofuprate projectsandwrite downofcertainwindprojectsat Generation.See Note 8—Impairment ofLong-LivedAssetsfor more

information.

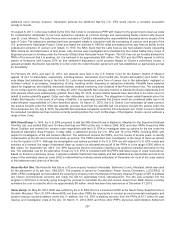

(g) InMay2011,asaresult ofthe 2010 Rate Caseorder,ComEd recordedone-timebenefitsto reestablish previouslyexpensedplant balancesandto recover

previouslyincurredcostsrelatedto Exelon’s 2009restructuringplan.See Note 3—RegulatoryMattersfor more information.

(h) Includestheestablishment ofaregulatoryasset,pursuant to EIMA,for the 2011 annual reconciliation inComEd’s distribution formula rate tariff andthedeferral of

costsassociatedwith significant 2011 storms, partiallyoffset by an accrual to fundanew ScienceandTechnology Innovation Trust.See Note 3—RegulatoryMatters

for more information.

244