ComEd 2013 Annual Report Download - page 179

Download and view the complete annual report

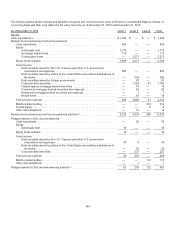

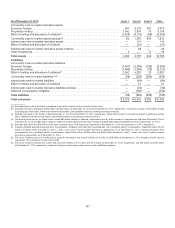

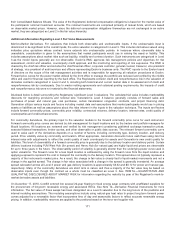

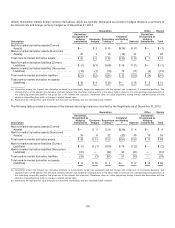

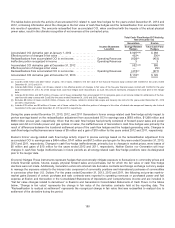

Please find page 179 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Theinputslistedabovewouldhaveadirectimpactonthefairvaluesoftheaboveinstrumentsiftheywere adjusted. Thesignificant

unobservable inputsusedinthefairvalue measurement ofGeneration’s commodityderivativesare forwardcommoditypricesand

for optionsisvolatility. Increases(decreases) intheforwardcommoditypriceinisolation wouldresult insignificantly higher (lower)

fairvaluesfor longpositions(contractsthat giveGeneration theobligation or option to purchaseacommodity), withoffsetting

impactsto short positions(contractsthat giveGeneration theobligation or righttosell a commodity). Increases(decreases) in

volatilitywouldincrease(decrease)thevalue for theholder ofthe option (writer ofthe option). Generally, achangeintheestimate of

forwardcommoditypricesisunrelatedto a changeintheestimate ofvolatilityofprices. An increasetothereserveslistedabove

woulddecreasethefairvalue ofthepositions. An increasetotheheat rate or renewable factorswouldincreasethefairvalue

accordingly. Generally, interrelationshipsexistbetween market pricesofnatural gasandpower.Assuch, an increasein natural gas

pricingwouldpotentiallyhaveasimilar impactonforwardpower markets.

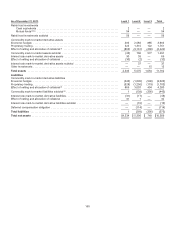

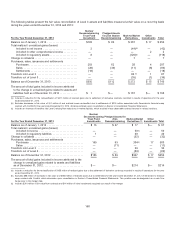

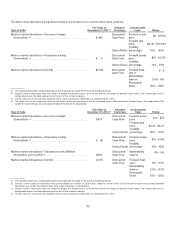

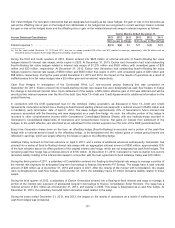

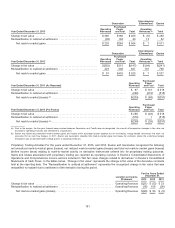

Nuclear Decommissioning Trust Fund Investments and Pledged Assets for Zion Station Decommissioning For middle market

lending, certaincorporate debtsecurities, andprivate equityinvestmentsthefairvalue is determinedusingacombination of

valuation modelsincludingcostmodels, market modelsandincomemodels. Thevaluation estimatesare basedon valuationsof

comparable companies, discountingtheforecastedcash flows ofthe portfoliocompany, estimatingtheliquidation or collateral value

ofthe portfoliocompanyor itsassets, consideringoffersfromthirdpartiesto buythe portfoliocompany, its historical andprojected

financial results, aswell asother factorsthat mayimpactvalue. Significant judgment is requiredinthe application of discountsor

premiums appliedto thepricesofcomparable companiesfor factorssuch as size,marketability, creditrisk andrelative

performance.

BecauseGeneration relieson third-partyfundmanagersto develop thequantitative unobservable inputswithout adjustment for the

valuationsofits’ Level 3 investments, quantitativeinformation about significant unobservable inputsusedinvaluingthese

investmentsisnot reasonablyavailable to Generation. This includesinformation regardingthesensitivityofthefairvaluesto

changesinthe unobservable inputs. Generation gainsan understandingofthefundmanagers’ inputsandassumptionsusedin

preparingthevaluations. Generation performedproceduresto assess the reasonableness ofthevaluations. For a sample ofits’

Level 3 investments, Generation reviewedindependent valuationsandreviewedtheassumptionsinthedetailedpricingmodelsused

by thefundmanagers.

AsofDecember 31,2013,Generation hasoutstandingcommitmentsto investinmiddle market lending, corporate debtsecurities,

andprivate equityinvestmentsofapproximately $448 million.Thesecommitmentswill befundedbyGeneration’s existingnuclear

decommissioningtrustfunds.

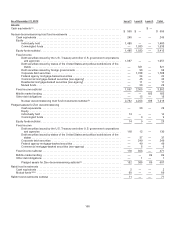

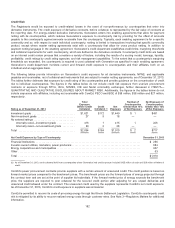

12. Derivative Financial Instruments

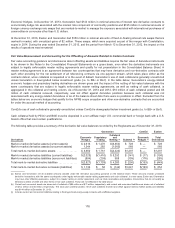

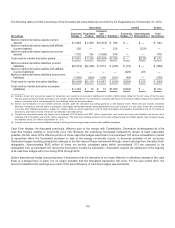

TheRegistrantsare exposedto certainrisks relatedto ongoingbusiness operations. Theprimaryrisks managedbyusingderivative

instrumentsare commoditypricerisk andinterest rate risk.

Commodity Price Risk

Totheextent theamount ofenergy Exelon generates differsfromtheamount ofenergy ithascontractedto sell,theRegistrantsare

exposedto market fluctuationsinthepricesofelectricity, fossilfuelsandother commodities. TheRegistrantsemployestablished

policiesandproceduresto managetheirrisks associatedwithmarket fluctuationsbyenteringinto physical andfinancial derivative

contracts, includingswaps, futures, forwards, optionsandshort-termandlong-termcommitmentsto purchaseandsell energy and

energy-relatedproducts. TheRegistrantsbelievetheseinstruments, which are classifiedaseither economic hedgesor non-

derivatives, mitigate exposure to fluctuationsincommodityprices.

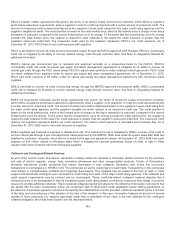

Derivativeaccountingguidancerequiresthat derivativeinstrumentsberecognizedaseither assetsor liabilitiesat fairvalue,with

changesinfairvalue ofthederivativerecognizedin earnings each period. Other accountingtreatmentsare available through special

election anddesignation,providedtheymeet specific, restrictivecriteriabothat thetimeofdesignation andon an ongoingbasis.

These alternative permissible accountingtreatmentsinclude normal purchase normal sale (NPNS), cash flowhedge,andfairvalue

hedge.For commoditytransactions, effectivewiththedate ofmerger withConstellation,Generation no longer utilizesthespecial

election providedfor by thecash flowhedgedesignation andde-designatedall ofitsexistingcash flowhedgesprior to themerger.

Becausetheunderlyingforecastedtransactionsremain at least reasonablypossible,thefairvalue oftheeffective portion ofthese

cash flowhedgeswasfrozen inaccumulated OCI andreclassifiedto resultsofoperationswhen theforecastedpurchaseorsale of

the energy commodityoccurs, or becomesprobable ofnot occurring. None ofConstellation’s designatedcash flowhedgesfor

commoditytransactionsprior to themerger were re-designatedascash flowhedges. Theeffectofthis decision is that all derivative

173