ComEd 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

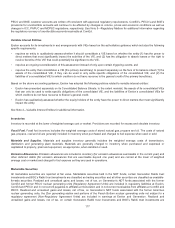

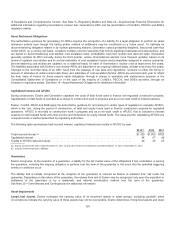

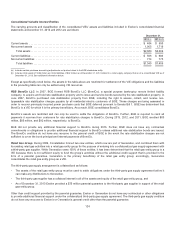

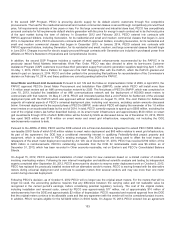

Consolidated Variable Interest Entities

Thecarryingamountsandclassification oftheconsolidated VIEs’ assetsandliabilitiesincludedinExelon’s consolidatedfinancial

statementsat December 31,2013 and2012 are asfollows:

December 31,

2013 (a) 2012 (a)(b)

Current assets ................................................................................. $ 484 $ 550

Noncurrent assets .............................................................................. 1,9051,719

Total assets................................................................................ $2,389 $2,269

Current liabilities................................................................................ $ 566 $ 684

Noncurrent liabilities ............................................................................ 774 775

Total liabilities .............................................................................. $1,340$1,459

(a)Includescertain purchaseaccountingadjustmentsnot pusheddowntotheBGE standalone entity.

(b) Includestotal assetsof$146 million andtotal liabilitiesof$42million asofDecember 31,2012 relatedto a retailsupplycompanythat is not a consolidated VIE asof

December 31,2013.See additional information below.

Except asspecificallynotedbelow, theassetsinthetable above are restrictedfor settlement oftheVIE obligationsandtheliabilities

inthe precedingtable can onlybesettledusing VIE resources.

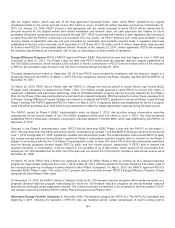

RSB BondCo LLC.In 2007, BGE formedRSB BondCoLLC (BondCo), aspecial purposebankruptcy remote limitedliability

company, to acquire andholdrate stabilization propertyandto issue andservicebonds securedbythe rate stabilization property. In

June 2007, BondCo purchasedrate stabilization propertyfrom BGE, includingtherighttoassess, collect,andreceive non-

bypassable rate stabilization chargespayable by all residential electric customersof BGE. Thesechargesare beingassessedin

order to recover previouslyincurredpower purchasecoststhat BGE deferredpursuant to Senate Bill 1. BGE hasdeterminedthat

BondCois aVIE for which itis theprimarybeneficiary. Asaresult, BGE consolidatesBondCo.

BondCo’s assetsare restrictedandcan onlybeusedto settle theobligationsofBondCo.Further, BGE is requiredto remit all

paymentsitreceivesfromcustomersfor rate stabilization chargesto BondCo.During2013,2012,and2011, BGE remitted$83

million, $85 million,and$92million,respectively, to BondCo.

BGE did not provideanyadditional financial support to BondCoduring2013.Further, BGE doesnot haveanycontractual

commitmentsor obligationsto provideadditional financial support to BondCo unless additional rate stabilization bonds are issued.

TheBondCocreditorsdo not haveanyrecoursetothegeneral creditof BGE intheevent the rate stabilization chargesare not

sufficient to cover thebondprincipal andinterestpaymentsofBondCo.

Retail Gas Group.During2009, Constellation formedtwonewentities, which noware part ofGeneration,andcombinedthemwith

itsexistingretailgasactivitiesinto a retailgasentitygroup for the purposeofenteringinto a collateralizedgassupplyagreement with

athird-partygassupplier. While Generation owns100%ofthese entities, ithasbeen determinedthat the retailgasentitygroup is a

VIE becausethere is not sufficient equityto fundthegroup’s activitieswithout theadditional creditsupport that is providedinthe

formofa parental guarantee.Generation is theprimarybeneficiaryofthe retailgasentitygroup;accordingly, Generation

consolidatesthe retailgasentitygroup asaVIE.

Thethird-partygassupplyarrangement is collateralizedasfollows:

•Theassetsofthe retailgasentitygroup mustbeusedto settle obligationsunder thethird-partygassupplyagreement before it

can makeany distributionsto Generation,

•Thethird-partygassupplier hasacollateral interestin all oftheassetsandequityofthe retailgasentitygroup,and

•AsofDecember 31,2013 Exelon provideda$75 million parental guarantee to thethird-partygassupplier insupport ofthe retail

gasentitygroup.

Other than creditsupport providedbythe parental guarantee,Exelon or Generation do not haveanycontractual or other obligations

to provideadditional financial support under thecollateralizedthird-partygassupplyagreement.Thethird-partygassupplycreditors

do not haveanyrecoursetoExelon’s or Generation’s general creditother than the parental guarantee.

124