ComEd 2013 Annual Report Download - page 152

Download and view the complete annual report

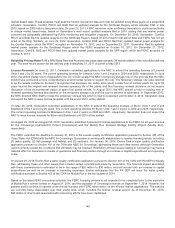

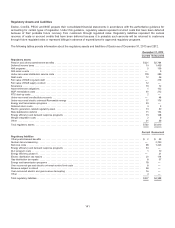

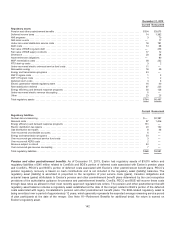

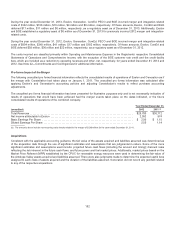

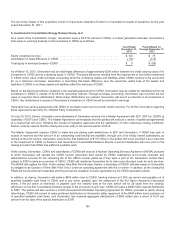

Please find page 152 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Rate stabilization deferral. InJune 2006, Senate Bill 1 wasenactedinMarylandandimposeda rate stabilization measure that

cappedrate increases by BGE for residential electric customersat 15% fromJuly1,2006, to May31,2007. Asaresult, BGE

recordedaregulatoryasset on itsConsolidatedBalanceSheetsequal to thedifferencebetween thecoststo purchasepower and

therevenuescollectedfromcustomers, aswell asrelatedcarryingchargesbasedon short-terminterest ratesfromJuly1,2006, to

May31,2007. Inaddition,asrequiredbySenate Bill 1,theMDPSC approveda plan that allowedresidential electric customersthe

option to further defer the transition to market ratesfromJune 1,2007, to January1,2008. During2007, BGE deferred$306million

ofelectricitypurchasedfor resale expensesandcertain applicable carryingcharges, which are calculatedusingtheimpliedinterest

ratesofthe rate stabilization bonds, asaregulatoryasset relatedto the rate stabilization plans. During2013 and2012, BGE

recovered $66 million and $67 million,respectively, ofelectricitypurchasedfor resale expensesandcarryingchargesrelatedto the

rate stabilization plan regulatoryasset. BGE began amortizingtheregulatoryasset associatedwiththedeferral which endedinMay

2007to earnings over a periodnot to exceedten yearswhen collection fromcustomersbegan inJune 2007.

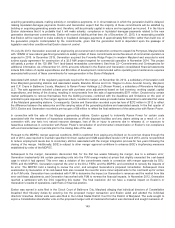

Energy efficiency and demand response programs. Theseamountsrepresent costsrecoverable (refundable)under ComEd’s

ICC approvedEnergy Efficiency andDemandResponsePlan, PECO’s PAPUC-approved EE&C Plan,andtheBGE Smart Energy

SaversProgram®.ComEd began recoveringthesecostsor refundingover-collectionsofthesecostson June 1,2008through a

rider.ComEd earnsa return on thecapital investment incurredunder the programbut doesnot earn (pay) interestonunder (over)

collections. For PECO, this amount representsan over-collection ofprogramcostsrelatedto bothPhaseIandPhaseII ofits EE&C

Plan. PECO doesnot earn (pay) interestonunder (over)collections. PECO began recoveringthecostsofitsPhaseIandPhaseII

EE&C Plansthrough asurchargeinJanuary2010 andJune 2013,respectively, basedon projectedspendingunder the programs.

PhaseIrecoverycontinuedover thelifeofthe program, which expiredon May31,2013 andexcess funds collectedbegan being

refundedinJune 2013.PhaseII ofthe programbegan on June 1,2013,andwill continue over thelifeofthe program, which will

expire on May31,2016. Excess funds collectedare requiredto berefundedbeginninginJune 2016. PECO earneda return on the

capital investment incurredunder PhaseIofthe program. BGE’s Smart Energy SaversProgram®includesboth MDPSC approved

demandresponseandenergy efficiency programs. For theBGE PeakRewardsSM demandresponse program which began in

January2008, actual marketingandcustomer bonuscostsincurredinthedemandresponse programare beingrecoveredover a 5-

year amortization periodfromthedate incurredpursuant to an order by theMDPSC. Fixedassetsrelatedto thedemandresponse

programare recoveredover thelifeoftheequipment.Alsoincludedinthedemandresponse programare customer bill credits

relatedto BGE’s Smart Energy Rewards program which began inJuly2013.Actual costsincurredintheconservation programare

beingamortizedover a 5-year periodwithrecoverybeginningin 2010 pursuant to an order by theMDPSC. BGE earnsa rate of

return on thecapital investmentsanddeferredcostsincurredunder the programandearns(pays) interestonunder (over)

collections.

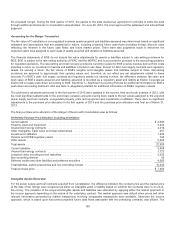

Merger integration costs. Theseamountsrepresent integration coststo achievedistribution synergiesrelatedto themerger

transaction.Asaresult oftheMDPSC’s February2013 rate order, BGE deferred$8million relatedto non-severancemerger

integration costsincurredduring2012 andthefirstquarter of2013.Ofthesecosts, $4 million wasauthorizedto beamortizedover a

5-year periodthat began inMarch 2013.Therecoveryoftheremaining$4million wasdeferred. IntheMDPSC’s December 2013

rate order, BGE wasauthorizedto recover theremaining$4million andan additional $4 million ofnon-severancemerger integration

costsincurredduring2013.Thesecostsare beingamortizedover a 5-year periodthat began inDecember 2013. BGE is earninga

return on this regulatoryasset includedinbase rates.

Under (Over)-recovered electric and gas revenue decoupling. Theseamountsrepresent the electric andgas distribution costs

recoverable fromor refundable to customersunder BGE’s decouplingmechanism, which doesnot earn a rate ofreturn.Asof

December 31,2013, BGE hadaregulatoryliabilityof$7million relatedto over-recoveredelectric revenue decouplingand$9million

relatedto over-recoverednatural gasrevenue decoupling. AsofDecember 31,2012, BGE hadaregulatoryasset of$5million

relatedto under-recoveredelectric revenue decouplingandaregulatoryliabilityof$7million relatedto over-recoverednatural gas

revenue decoupling.

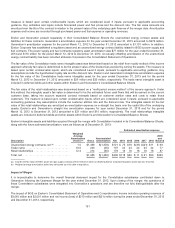

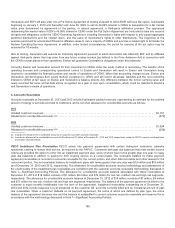

Nuclear decommissioning. Theseamountsrepresent estimatedfuture nuclear decommissioningcostsfor former ComEd and

PECO plantsthat exceed(regulatoryasset)or are less than (regulatoryliability) theassociateddecommissioningtrustfundassets.

Exelon believesthe trustfundassets, includingprospective earnings thereon andanyfuture collectionsfromcustomers, will be

sufficient to fundtheassociatedfuture decommissioningcostsat thetimeofdecommissioning. See Note 15—Asset Retirement

Obligationsfor additional information.

Removal costs. Theseamountsrepresent funds ComEd and BGE havereceivedfromcustomersthrough depreciation ratesto

cover thefuture non-legallyrequiredcostofremoval ofproperty, plant andequipment which reducesrate basefor ratemaking

purposes. This liabilityisreducedascostsare incurred.

146