ComEd 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

TheRegistrantsare exposedto market risks associatedwithadversechangesincommodityprices, counterpartycredit,interest

ratesandequityprices. Exelon’s RMC approvesrisk management policiesandobjectivesfor risk assessment,control andvaluation,

counterpartycredit approval,andthemonitoringandreportingofrisk exposures. TheRMC is chairedbythechiefrisk officer and

includesthechiefexecutiveofficer, chieffinancial officer,corporate controller,general counsel,treasurer, vice president ofstrategy,

vice president ofauditservicesandofficersrepresentingExelon’s business units. TheRMC reportsto therisk oversightcommittee

oftheExelon boardofdirectorson thescope oftherisk management activities.

Commodity Price Risk

Commoditypricerisk is associatedwithpricemovementsresultingfromchangesinsupplyanddemand, fuel costs, market liquidity,

weather conditions, governmental regulatoryandenvironmental policies, andother factors. Totheextent theamount ofenergy

Exelon generates differsfromtheamount ofenergy ithascontractedto sell,Exelon haspricerisk fromcommoditypricemovements.

Exelon seeks to mitigate itscommoditypricerisk through thesale andpurchaseofelectricity, fossilfuel,andother commodities.

Generation

Normal Operations and Hedging Activities. Electricityavailable fromGeneration’s ownedor contractedgeneration supplyin

excess ofGeneration’s obligationsto customers, includingportionsofComEd’s, PECO’s and BGE’s retail load, is soldinto the

wholesale markets. Toreducepricerisk causedbymarket fluctuations, Generation entersinto non-derivativecontractsaswell as

derivativecontracts, includingforwards, futures, swaps, andoptions, withapprovedcounterpartiesto hedge anticipatedexposures.

Generation believestheseinstrumentsrepresent economic hedgesthat mitigate exposure to fluctuationsincommodityprices.

Generation expectsthesettlement ofthemajorityofitseconomic hedgeswill occur during2014through 2016.

Ingeneral,increasesanddecreasesinforwardmarket priceshaveapositiveandnegativeimpact,respectively, on Generation’s

ownedandcontractedgeneration positions which have not been hedged. Generation hedgescommodityrisk on a ratable basis over

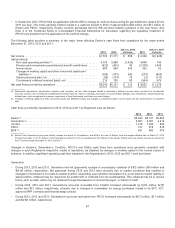

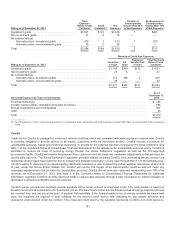

thethree yearsleadingto thespot market.AsofDecember 31,2013,the percentageofexpectedgeneration hedgedfor themajor

reportable segmentswas92%-95%, 62%-65% and30%-33%for 2014, 2015and2016, respectively. The percentageofexpected

generation hedgedistheamount ofequivalent sales dividedbytheexpectedgeneration.Expectedgeneration representsthe

amount ofenergy estimatedto begeneratedor purchasedthrough ownedor contractedcapacity. Equivalent salesrepresent all

hedgingproducts, which includeeconomic hedgesandcertain non-derivativecontractsincludingsalesto ComEd, PECO and BGE

to servetheir retail load.

A portion ofGeneration’s hedgingstrategy maybeaccomplishedwithfuel productsbasedon assumedcorrelationsbetween power

andfuel prices, which routinelychangeinthemarket.Market pricerisk exposure is therisk ofachangeinthevalue ofunhedged

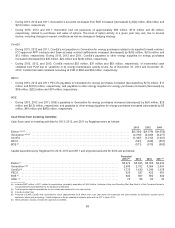

positions. Theforecastedmarket pricerisk exposure for Generation’s entire non-tradingportfolioassociatedwitha$5 reduction in

the annual average around-the-clock energy pricebasedon December 31,2013,market conditionsandhedgedposition wouldbea

decreasein pre-taxnet incomeofapproximately$30 million,$520 million and$820 million,respectively, for 2014, 2015and2016.

Power pricesensitivitiesare derivedbyadjustingpower priceassumptions while keepingall other priceinputsconstant.Generation

expectsto activelymanageitsportfoliotomitigate market pricerisk exposure for itsunhedgedposition.Actual resultscould differ

dependingon thespecific timingof, andmarketsaffected by, pricechanges, aswell asfuture changesinGeneration’s portfolio.

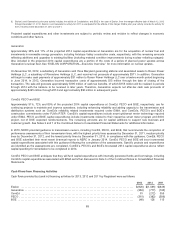

Proprietary Trading Activities. Generation also entersinto certain energy-relatedderivativesfor proprietarytradingpurposes.

Proprietarytradingincludesall contractsenteredinto withtheintent ofbenefitingfrom shiftsor changesinmarket pricesasopposed

to those enteredinto withtheintent ofhedgingor managingrisk. Proprietarytradingactivitiesare subjecttolimitsestablishedby

Exelon’s RMC. The proprietarytradingportfoliois subjecttoarisk management policy that includesstringent risk management

limits, includingvolume,stop loss andValue-at-Risk (VaR)limitsto manageexposure to market risk. Additionally, theExelon risk

management group andExelon’s RMC monitor thefinancial risks ofthe proprietarytradingactivities. The proprietarytrading

activities, which includedphysical volumesof 8,762GWh, 12,958 GWh, and 5,742GWh for theyearsendedDecember 31,2013,

2012 and2011 respectively, are a complement to Generation’s energy marketingportfolio,but represent a small portion of

Generation’s overall revenue fromenergy marketingactivities. Tradingportfolioactivityfor theyear endedDecember 31,2013,

resultedin pre-taxlossesof$8million due to net mark-to-market lossesof$39million andrealizedgainsof$31 million.Generation

usesa95% confidenceinterval,assumingstandardnormal distribution,one dayholdingperiod, one-tailedstatistical measure in

calculatingitsVaR.ThedailyVaR on proprietarytradingactivityaveraged$1.0million ofexposure duringtheyear.Generation has

97