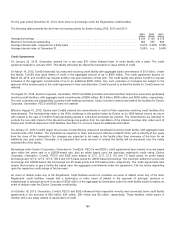

ComEd 2013 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

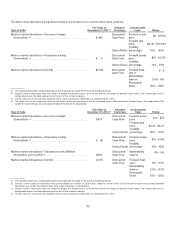

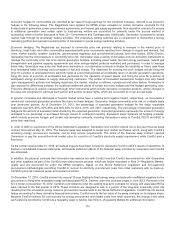

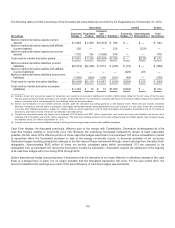

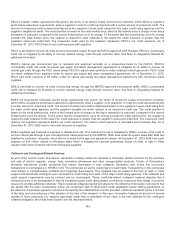

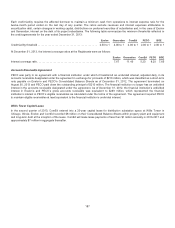

Thetablesbelowprovidetheactivityofaccumulated OCI relatedto cash flowhedgesfor theyearsendedDecember 31,2013 and

2012,containinginformation about thechangesinthefairvalue ofcash flowhedgesandthereclassification fromaccumulated OCI

into resultsofoperations. Theamountsreclassifiedfromaccumulated OCI, when combinedwiththeimpactsoftheactual physical

power sales, result inthe ultimate recognition ofnet revenuesat thecontractedprice.

Income Statement

Location

Total Cash Flow Hedge OCI Activity,

Net of Income Tax

Generation Exelon

Energy-Related

Hedges

Total Cash Flow

Hedges

Accumulated OCI derivativegainatJanuary1,2012 ................ $925(a)(d) $ 488

Effective portion ofchangesinfairvalue ........................... 432(b) 330(e)

Reclassificationsfromaccumulated OCI to net income............... OperatingRevenues(828)(c) (453)

Ineffective portion recognizedinincome........................... OperatingRevenues33

Accumulated OCI derivativegainatDecember 31,2012 ............. 532(a)(d) 368

Effective portion ofchangesinfairvalue ........................... — 29(e)

Reclassificationsfromaccumulated OCI to net income............... OperatingRevenues(413)(c) (277)

Accumulated OCI derivativegainatDecember 31,2013 ............. $119(d) $120

(a)Includes$133 million and$420 million ofgains, net oftaxes, relatedto thefairvalue ofthefive-year financial swap contractwithComEd for theyearsended

December 31,2012 and2011 .

(b) Includes $88 million ofgains, net oftaxes, relatedto theeffective portion ofchangesinfairvalue ofthefive-year financial swap contractwithComEd for theyear

endedDecember 31,2012.Asofthemerger date,cash flowhedgeswere discontinued, assuch, this amount representschangesinfairvalue prior to themerger

date.

(c) Includes$133 million and$375 million oflosses, net oftaxes, reclassifiedfromaccumulated OCI to recognizegainsin net income relatedto settlementsofthefive-

year financial swap contractwithComEd for theyearsendedDecember 31,2013 and2012,respectively.

(d) Excludes$5million oflossesand$20 million oflosses, net oftaxes, relatedto interest rate swapsandtreasuryrate locks for theyearsendedDecember 31,2013

and2012,respectively.

(e)Includes$15million and$9million oflosses, net oftaxes, relatedto theeffective portion ofchangesinfairvalue ofinterest rate swapsandtreasuryrate locks at

Generation for theyear endedDecember 31,2013 and2012,respectively.

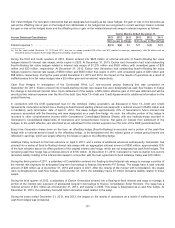

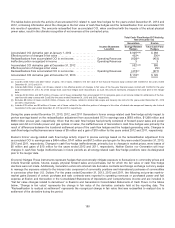

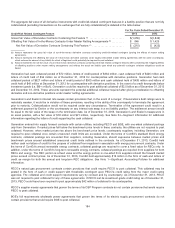

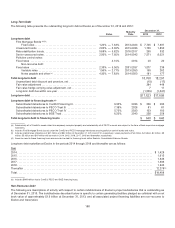

DuringtheyearsendedDecember 31,2013,2012,and2011 Generation’s former energy-relatedcash flowhedgeactivityimpactto

pre-taxearnings basedon thereclassification adjustment fromaccumulated OCI to earnings wasa$683million,$1,368 million and

$968 million pre-taxgain,respectively. Given that thecash flowhedgeshadprimarilyconsistedofforwardpower salesandpower

swapsand did not includepower andgasoptionsor sales, theineffectiveness ofGeneration’s cash flowhedgeswasprimarilythe

result of differencesbetween thelocational settlement pricesofthecash flowhedgesandthehedgedgeneratingunits. Changesin

cash flowhedgeineffectiveness were lossesof$5million andagainof$10 million for theyearsended2012 and2011,respectively.

Exelon’s former energy-relatedcash flowhedgeactivityimpact to pre-taxearnings basedon thereclassification adjustment from

accumulated OCI to earnings wasa$464 million, $747 million and$512 million pre-taxgainfor theyearsendedDecember 31,2013,

2012 and2011,respectively. Changesincash flowhedgeineffectiveness, primarilydue to changesinmarket prices, were lossesof

$5 million andgainsof$10 million for theyearsended2012 and2011,respectively. Neither Exelon nor Generation will incur

changesincash flowhedgeineffectiveness infuture periods asall energy-relatedcash flowhedgepositionswere de-designated

prior to themerger date.

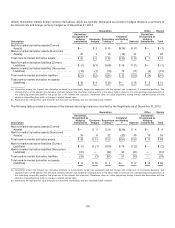

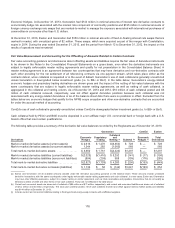

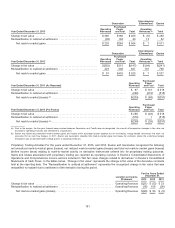

Economic Hedges Theseinstrumentsrepresent hedgesthat economicallymitigate exposure to fluctuationsincommoditypricesand

includefinancial options, futures, swaps, physical forwardsalesandpurchases, but for which thefairvalue or cash flowhedge

electionswere not made.Additionally, Generation entersinto interest rate derivativecontractsandforeignexchangecurrency swaps

to managetheexposure relatedto theinterest rate component ofcommoditypositionsandinternational purchasesofcommodities

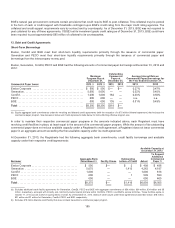

incurrenciesother than U.S. Dollars. For theyearsendedDecember 31,2013,2012 and2011,thefollowingnet pre-taxmark-to-

market gains(losses) ofcertain purchaseandsale contractswere reportedin operatingrevenuesor purchasedpower andfuel

expenseatExelon andGeneration intheConsolidatedStatementsofOperationsandComprehensiveIncomeandare includedin

“Net fairvalue changesrelatedto derivatives” inExelon’s andGeneration’s ConsolidatedStatementsofCash Flows. Inthetables

below, “Changeinfairvalue”representsthechangeinfairvalue ofthederivativecontractsheldat the reportingdate.The

“Reclassification to realizedat settlement”representstherecognizedchangeinfairvalue that wasreclassifiedto realizeddue to

settlement ofthederivativeduringthe period.

180