ComEd 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

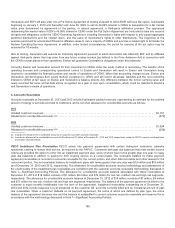

the proposedmerger.Duringthethirdquarter of2011,the partiesto thesuitsreachedan agreement inprinciple to settle thesuits

through additional disclosuresto Constellation shareholders. OnJune 26, 2012,thecourt approvedthesettlement andenteredfinal

judgment.

Accounting for the Merger Transaction

Thefairvalue ofConstellation’s non-regulatedbusiness assetsacquiredandliabilitiesassumedwasdeterminedbasedon significant

estimatesandassumptionsthat are judgmental in nature,includingprojectedfuture cash flows (includingtiming); discount rates

reflectingrisk inherent inthefuture cash flows; andfuture market prices. There were alsojudgmentsmadetodetermine the

expecteduseful livesassignedto each class ofassetsacquiredandduration ofliabilitiesassumed.

Thefinancial statementsof BGE do not includefairvalue adjustmentsfor assetsor liabilitiessubject to rate-settingprovisionsfor

BGE. BGE is subjecttothe rate-settingauthorityofFERCandtheMDPSC andisaccountedfor pursuant to theaccountingguidance

for regulatedoperations. The rate-settingandcostrecoveryprovisionscurrentlyin placefor BGE providerevenue derivedfromcosts

includinga return on investment ofassetsandliabilitiesincludedin rate base. Except for debt,fuel supplycontractsandregulatory

assetsnot earninga return,thefairvaluesof BGE’s tangible andintangible assetsandliabilitiessubjecttothese rate-setting

provisionsare assumedto approximate theircarryingvaluesand, therefore,do not reflectanynet adjustmentsrelatedto these

amounts. For BGE’s debt,fuel supplycontractsandregulatoryassetsnot earninga return,thedifferencebetween fairvalue and

bookvalue of BGE’s assetsacquiredandliabilitiesassumedisrecordedasaregulatoryasset andliabilityat Exelon Corporate as

Exelon did not applypush-downaccountingto BGE. See Note 1—Significant AccountingPoliciesfor additional information on BGE’s

push-downaccountingtreatment.Alsosee Note 3—RegulatoryMattersfor additional information on BGE’s regulatoryassets.

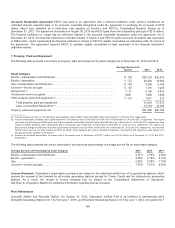

The preliminaryvaluationsperformedinthefirstquarter of2012 were updatedinthesecond, thirdandfourthquartersof2012,with

themostsignificant adjustmentsto the preliminaryvaluation amountshavingbeen madetothefairvaluesassignedto theacquired

power supplyandfuel contracts, unregulatedproperty, plant andequipment andinvestmentsinaffiliates. There were no significant

adjustmentsto the purchaseprice allocation inthefirstquarter of2013 andthe purchaseprice allocation wasfinal asofMarch 31,

2013.

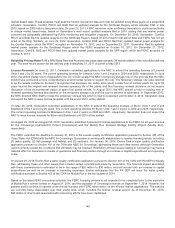

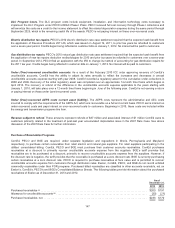

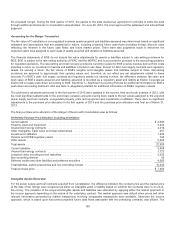

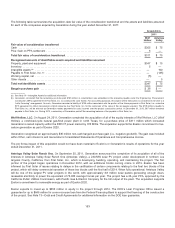

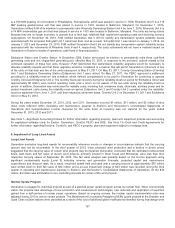

Thefinal purchaseprice allocation oftheMerger ofExelon withConstellation wasasfollows:

Preliminary Purchase Price Allocation, excluding amortization

Current assets ......................................................................................... $ 4,936

Property, plant andequipment ............................................................................ 9,342

Unamortizedenergy contracts ............................................................................ 3,218

Other intangibles, tradenameandretail relationships ......................................................... 457

Investment inaffiliates ................................................................................... 1,942

Pension and OPEB regulatoryasset ....................................................................... 740

Other assets ........................................................................................... 2,265

Total assets............................................................................................ 22,900

Current liabilities........................................................................................ 3,408

Unamortizedenergy contracts ............................................................................ 1,722

Long-termdebt,includingcurrent maturities ................................................................. 5,632

Non-controllinginterest.................................................................................. 90

Deferredcreditsandother liabilitiesandpreferredsecurities.................................................... 4,683

Total liabilities, preferredsecuritiesandnon-controllinginterest................................................. 15,535

Total purchaseprice..................................................................................... $ 7,365

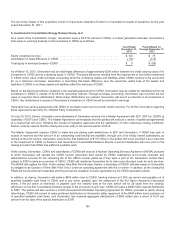

Intangible Assets Recorded

For thepower supplyandfuel contractsacquiredfromConstellation,thedifferencebetween thecontractpriceandthemarket price

at thedate ofthemerger wasrecognizedaseither an intangible asset or liabilitybasedon whether thecontractswere in or out-of-

the-money. Thevaluation oftheacquiredintangible assetsandliabilitieswasestimatedbyapplyingeither themarket approach or

theincome approach dependingon the nature oftheunderlyingcontract.Themarket approach wasutilizedwhen pricesandother

relevant information generatedbymarket transactionsinvolvingcomparable transactionswere available.Otherwisetheincome

approach, which is basedupon discountedprojectedfuture cash flows associatedwiththeunderlyingcontracts, wasutilized. The

150