ComEd 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OnOctober 11,2012,thePJM Transmission OwnersfiledwithFERCacost allocation for newtransmission facilitiesaskingthat the

newcost allocation methodology applyto all transmission approvedbythePJM Boardon or after February1,2013.The proposed

methodology is ahybrid methodology that wouldsocialize50%ofthecostsofnewfacilitiesat 500kV andaboveanddouble-circuit

345kV lines, andallocate theremaining50%to directbeneficiaries. For all other facilities, thecostswouldbe allocatedto thedirect

beneficiaries. OnMarch 22,2013,FERC issuedan order acceptingthecost allocation withminor exceptionsandrequiringa

compliancefilingon thosefew issueswithin 120 days oftheorder.ThecompliancefilingwasmadeonJuly22,2013.

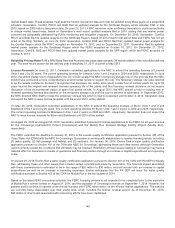

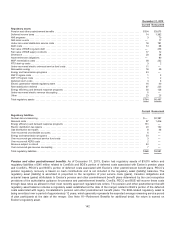

ComEd, PECO and BGE are committedto theconstruction oftransmission facilitiesunder their operatingagreementswith PJM to

maintainsystemreliability. ComEd, PECO and BGE will workwith PJM to continue to evaluate thescope andtimingofanyrequired

construction projects. ComEd, PECO and BGE’s estimatedcommitmentsare asfollows:

Total 2014 2015 2016 2017 2018

ComEd .................................................................. $486 $134$173$177 $ 2$—

PECO ................................................................... 133 32 2940248

BGE ..................................................................... 400 428395 87 93

PJM Minimum Offer Price Rule PJM’s capacitymarket rulesincludeaMinimum Offer Price Rule (MOPR)that is intendedto

precludesellersfromartificiallysuppressingthecompetitivepricesignalsfor generation capacity. The proceedings leadingto

FERC’s approval oftheMOPRwere extensive,andthere havebeen numerouschangesto theMOPRandlitigation relatedto it

sinceitwasoriginallyimplemented. For example,in 2011 the parties disputednumerouselementsoftheMOPRincluding: (i) the

default pricethat shouldapplyto bids foundsubjecttotheMOPR, (ii) theduration oftheMOPRand (iii) the application oftheMOPR

to self-supplyingcapacityandstate-sponsoredcapacity. TheFERCordersapprovingthat MOPRhavebeen appealedto theUnited

StatesCourt ofAppealsfor theThirdCircuit.Aresolution ofthat appeal is not expecteduntilsometimein 2014.

InMay2012 (basedon theMOPR provisionstheFERCapprovedin 2011), PJM announcedtheresultsofitscapacityauction

coveringthedeliveryyear endingMay31,2016. Several newunitswithstate-sanctionedsubsidy contractsclearedintheauction at

pricesbelowtheMOPR.Potentially, thesestatescouldexpandsuch state-sanctionedsubsidy programs or other statesmayseekto

establish similar programs. Generation believedthat further revisionsto that MOPRwere necessaryto ensure that the potential to

artificiallyreducecapacityauction pricesisappropriatelylimitedinPJM. In earlyDecember 2012, PJM filedanew MOPRfor

approval at theFERC, which Exelon believedwouldbemore effectivein preventingstate-sanctionedsubsidy contractsfrom

artificiallyreducingcapacityprices. Generation wasactivelyinvolvedinthe process through which thoseMOPRchangeswere

developedandsupportedthechanges. OnMay3,2013,theFERC issueditsorder. While theFERCorder acceptedcertainaspects

ofthe proposal that Exelon supported(such asapplyingtheMOPR to all of PJM andnot justcertainzoneswithinPJM), theFERC

required PJM to retainakeyelement ofitsprevious MOPRstructure,theunit-specific exemption,an element that Exelon had

supportedremoving. Several entities, includingtwocapacitysuppliersthat Exelon hasbeen workingwithsoughtrehearingofthat

order.

InMay2013 (basedon theMOPR provisionstheFERCapprovedearlier that month), PJM announcedtheresultsofitscapacity

auction coveringthedeliveryyear endingMay31,2017. Exelon is workingwith PJM stakeholderson several proposedchangesto

thePJM tariff aimedat ensuringthat capacityresources(includingthosewithstate-sanctionedsubsidy contracts, excessive

importedcapacityresourcesandcertainlimitedavailabilitydemandresponseresources) cannot inappropriatelyaffectcapacity

auction pricesinPJM.

Market-Based Rates Generation,ComEd, PECO and BGE are public utilitiesfor purposesoftheFederal Power Actandare

requiredto obtainFERC’s acceptanceofrate schedulesfor wholesale electricitysales. Currently, Generation,ComEd, PECO and

BGE have authorityto execute wholesale electricitysalesat market-basedrates. Asiscustomarywithmarket-basedrate schedules,

FERChasreservedtherighttosuspendmarket-basedrate authorityon a retroactivebasis if itsubsequentlydeterminesthat

Generation,ComEd, PECO or BGE hasviolatedthe terms andconditionsofitstariff or theFederal Power Act.FERCisalso

authorizedto order refunds incertaininstancesifitfinds that themarket-basedratesare not justandreasonable under theFederal

Power Act.

AsrequiredbyFERC’s regulations, aspromulgatedintheOrder No. 697 series, Generation,ComEd, PECO and BGE file market

power analysesusingthe prescribedmarket share screensto demonstrate that Generation,ComEd, PECO and BGE qualify for

market-basedratesintheregionswhere theyare sellingenergy, capacity, andancillaryservicesunder market-basedrate tariffs.

FERCacceptedthe 2008filings on September 16, 2008, January15, 2009andSeptember 2,2009andacceptedthe 2009filings on

July28, 2009, October 26, 2009, February23,2010 andApril30,2010,affirmingExelon’s affiliatescontinuedrighttomakesalesat

139