ComEd 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TheFederal Power Actdeclaresittobe unlawful for anyofficer or director ofanypublic utility“to participate inthemakingor paying

ofany dividends ofsuch public utilityfromanyfunds properlyincludedincapital account.” What constitutes“funds properlyincluded

incapital account”isundefinedintheFederal Power Actorthe relatedregulations; however,FERChasconsistentlyinterpretedthe

provision to allow dividends to bepaid aslongas(1)thesourceofthedividends is clearly disclosed, (2)thedividendisnot

excessiveand(3)there is no self-dealingon the part ofcorporate officials. While theserestrictionsmaylimittheabsolute amount of

dividends that a particular subsidiarymaypay, Exelon doesnot believetheselimitationsare materiallylimitingbecause,under these

limitations, thesubsidiariesare allowedto pay dividends sufficient to meet Exelon’s actual cash needs.

Under Illinois law, ComEd maynot payany dividendon itsstock unless, amongother things, “[its] earnings andearnedsurplusare

sufficient to declare andpaysameafter provision is madefor reasonable andproper reserves,” or unless ithasspecific authorization

fromtheICC. ComEd hasalsoagreedinconnection withafinancingarrangedthrough ComEd Financing III that ComEd will not

declare dividends on anysharesofitscapital stock intheevent that:(1)itexercisesitsrighttoextendtheinterestpayment periods

on thesubordinateddebtsecurities issuedto ComEd Financing III; (2)itdefaultson itsguarantee ofthepayment of distributionson

the preferredtrustsecuritiesofComEd Financing III; or (3)an event ofdefault occursunder theIndenture under which the

subordinateddebtsecuritiesare issued. Nosuch event hasoccurred.

PECO hasagreedinconnection withfinancings arrangedthrough PEC L.P. and PECO TrustIV that PECO will not declare

dividends on anysharesofitscapital stock intheevent that:(1)itexercisesitsrighttoextendtheinterestpayment periods on the

subordinateddebentures which were issuedto PEC L.P. or PECO TrustIV; (2)itdefaultson itsguarantee ofthepayment of

distributionson theSeriesDPreferredSecuritiesof PEC L.P. or the preferredtrustsecuritiesof PECO TrustIV; or (3)an event of

default occursunder theIndenture under which thesubordinateddebenturesare issued. Nosuch event hasoccurred.

BGE is subjecttocertaindividendrestrictionsestablishedbytheMDPSC. First, BGE is prohibitedfrompayingadividendon its

common sharesthrough theendof2014. Second, BGE is prohibitedfrompayingadividendon itscommon sharesif(a)after the

dividendpayment, BGE’s equityratiowouldbebelow 48% ascalculatedpursuant to theMDPSC’s ratemakingprecedentsor

(b) BGE’s senior unsecuredcredit ratingisratedbytwoofthethree major credit ratingagenciesbelowinvestment grade.Finally,

BGE must notify theMDPSC that itintends to declare a dividendon itscommon sharesat least30days before such adividendis

paid. There are no other limitationson BGE payingcommon stock dividends unless: (1) BGE electsto defer interestpaymentson

the6.20%Deferrable InterestSubordinatedDebenturesdue 2043,andanydeferredinterestremainsunpaid; or (2)any dividends

(andanyredemption payments) due on BGE’s preferencestock have not been paid.

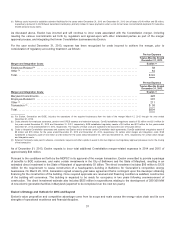

At December 31,2013,Exelon hadretainedearnings of$10,358 million,includingGeneration’s undistributedearnings of$3,613

million,ComEd’s retainedearnings of $750million consistingofretainedearnings appropriatedfor future dividends of$2,389 million,

partiallyoffset by $1,639million ofunappropriatedretaineddeficits, PECO’s retainedearnings of $649 million,and BGE’s retained

earnings of$1,005million.

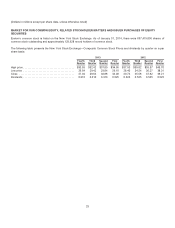

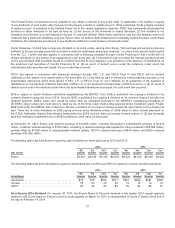

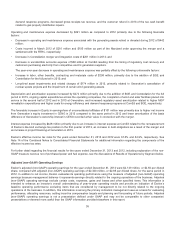

Thefollowingtable setsforthExelon’s quarterlycash dividends per share paid during2013 and2012:

2013 2012

(per share)

4th

Quarter

3rd

Quarter

2nd

Quarter

1st

Quarter

4th

Quarter

3rd

Quarter

2nd

Quarter

1st

Quarter

Exelon ....................................... $0.310 $0.310 $0.310 $0.525$0.525$0.525$0.525$0.525

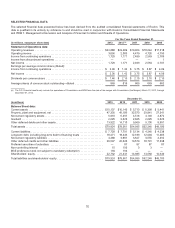

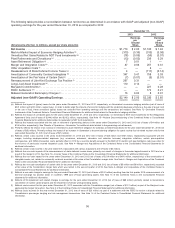

Thefollowingtable setsforthGeneration’s quarterly distributionsandComEd’s and PECO’s quarterlycommon dividendpayments:

2013 2012

(in millions)

4th

Quarter

3rd

Quarter

2nd

Quarter

1st

Quarter

4th

Quarter

3rd

Quarter

2nd

Quarter

1st

Quarter

Generation .................................... $75 $76 $263$211 $242$493$291$600

ComEd ....................................... 55 55 55 55 10 10 10 75

PECO ........................................ 8383838385 86 85 87

First Quarter 2014 Dividend. OnJanuary28, 2014, theExelon BoardofDirectorsdeclaredafirstquarter 2014regular quarterly

dividendof$0.31 per share on Exelon’s common stock payable on March 10,2014, to shareholdersofrecordofExelon at theendof

thedayon February14, 2014.

31