Chrysler 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 2014 | ANNUAL REPORT

Major Shareholders

Major Shareholders

Exor is the largest shareholder of FCA through its 29.19 percent shareholding interest in our issued common

shares (as of February 27, 2015). See “The FCA Merger.” Exor also purchased U.S.$886 million (€730 million) in

aggregate notional amount of mandatory convertible securities that were issued in December 2014 (see Note 23 of

the Consolidated financial statements included elsewhere in this report). As a result of the loyalty voting mechanism,

Exor’s voting power is approximately 44.31 percent.

Consequently, Exor could strongly influence all matters submitted to a vote of FCA shareholders, including approval of

annual dividends, election and removal of directors and approval of extraordinary business combinations.

Exor is controlled by Giovanni Agnelli e C. S.a.p.az., (“G.A.”) which holds 51.39 percent of its share capital. G.A. is a

limited partnership with interests represented by shares (Societa’ in Accomandita per Azioni), founded by Giovanni

Agnelli and currently held by members of the Agnelli and Nasi families, descendants of Giovanni Agnelli, founder of

Fiat. Its present principal business activity is to purchase, administer and dispose of equity interests in public and

private entities and, in particular, to ensure the cohesion and continuity of the administration of its controlling equity

interests. The managing directors of G.A. are John Elkann, Tiberto Brandolini d’Adda, Alessandro Nasi, Andrea

Agnelli, Gianluigi Gabetti, Gianluca Ferrero, Luca Ferrero de’ Gubernatis Ventimiglia and Maria Sole Agnelli.

Based on the information in FCA’s shareholder register, regulatory filings with the Netherlands Authority for the

Financial Markets (stichting Autoriteit Financiële Markten, the “AFM”) and the SEC and other sources available to FCA,

the following persons owned, directly or indirectly, in excess of three percent of the common shares of FCA, as of

February 27, 2015:

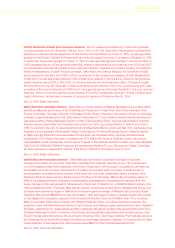

FCA Shareholders

Number of Issued

Common Shares Percentage Owned

Exor(1) 375,803,870 29.19

Baillie Gifford & Co.(2) 68,432,691 5.32

(1) As a result of the issuance of the mandatory convertible securities completed in December 2014 (“MCS Offering”), Exor beneficially owns

444,352,804 common shares of FCA, consisting of (i) 375,803,870 common shares of FCA owned prior to the MCS Offering, and (ii)

68,548,934 common shares underlying the mandatory convertible securities purchased in the MCS Offering, at the minimum conversion

rate of 7.7369 common shares per mandatory convertible security (being the rate at which Exor may convert the mandatory convertibles

securities into common shares at its option). Including the common shares into which the mandatory convertibles securities sold in the offering

completed in December 2014, are convertible at the option of the holders, the percentage is 29.43%. In addition, Exor holds 375,803,870

special voting shares. Exor’s beneficial ownership in FCA was approximately 44.31% prior to the issuance of the mandatory convertible

securities. Current Exor’s beneficial ownership in FCA is approximately 42.75%, calculated as the ratio of (i) the aggregate number of common

and special voting shares owned prior to the MCS Offering, and the common shares underlying the mandatory convertible securities purchased

by Exor in the MCS Offering, at the minimum conversion rate as set forth above and (ii) the aggregate number of outstanding common and

special voting shares, and the common shares underlying all of the mandatory convertible securities sold in the MCS Offering, at the minimum

conversion rate set forth above.

(2) Baillie Gifford & Co., as an investment adviser in accordance with rule 240.13d-1 (b), beneficially owns 123,397,920 common shares with sole

dispositive power (7.27% of the issued shares), of which 68,432,691 common shares are held with sole voting power (4.03% of the issued

shares).

As of February 27, 2015, approximately 1,000 holders of record of FCA common shares had registered addresses in

the U.S. and in total held approximately 320 million common shares, or 25 percent of the FCA common shares.