Chrysler 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 2014 | ANNUAL REPORT

Operating Results

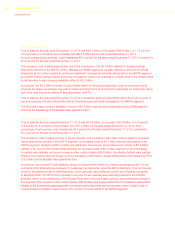

EBIT

2014 compared to 2013

NAFTA EBIT for the year ended December 31, 2014 was €1,647 million, a decrease of €643 million, or 28.1 percent,

from EBIT of €2,290 million for the year ended December 31, 2013.

The decrease in NAFTA EBIT was primarily attributable to the combination of (i) increased industrial costs of €1,577

million (ii) an increase of €575 million in other unusual expenses and (iii) a €29 million increase in selling, general and

administrative costs largely attributable to higher advertising costs to support new vehicle launches, including the

all-new 2014 Jeep Cherokee and the all-new 2015 Chrysler 200, partially offset by (iv) the favorable volume/mix

impact of €1,129 million, driven by the previously described increase in shipments, and (v) favorable net pricing of

€411 million due to favorable pricing and pricing for enhanced content, partially offset by incentive spending on certain

vehicles in portfolio.

The increase in industrial costs was attributable to an increase in warranty expenses of approximately €800 million

which included the effects of certain recall campaigns, an increase in base material costs of €978 million mainly

related to higher base material costs associated with vehicles and components and content enhancements on new

models and €262 million in higher research and development costs and depreciation and amortization.

For the year ended December 31, 2014, unusual items were negative by €504 million primarily reflecting the

€495 million charge in the first quarter of 2014 connected with the UAW MOU entered into by FCA US on

January 21, 2014.

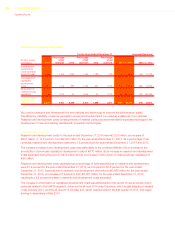

For the year ended December 31, 2013, unusual items were positive by €71 million, primarily including (i) a

€115 million charge related to the June 2013 voluntary safety recall for the 1993-1998 Jeep Grand Cherokee and

the 2002-2007 Jeep Liberty, as well as the customer satisfaction action for the 1999-2004 Jeep Grand Cherokee,

partially offset by (ii) the impacts of a curtailment gain and plan amendments of €166 million with a corresponding net

reduction pension obligation in NAFTA.

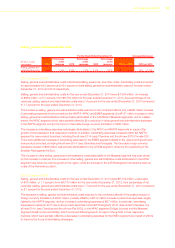

2013 compared to 2012

NAFTA EBIT for the year ended December 31, 2013 was €2,290 million, a decrease of €201 million, or 8.1 percent

(4.9 percent on a constant currency basis), from €2,491 million for the year ended December 31, 2012.

The decrease in NAFTA EBIT was primarily attributable to the combination of (i) favorable pricing effects of

€868 million, driven by our ability to increase sales price of current year models for enhancements made and

(ii) favorable volume/mix impact of €588 million, driven by an increase of shipments of trucks and certain SUVs as

compared to passenger cars, which were more than offset by (iii) increased industrial costs of €1,456 million (iv) an

increase in selling, general and administrative costs of €90 million largely attributable to costs incurred in launching

new products during 2013, (v) unfavorable foreign currency translation of €79 million, driven by the weakening of

the U.S. dollar against the Euro during 2013, and (vi) a €23 million increase in other unusual income. In particular,

the increase in industrial costs was attributable to an increase in cost of sales related to new-model content

enhancements, an increase in depreciation and amortization, driven by the new product launches, including the

all-new 2014 Jeep Cherokee, the Jeep Grand Cherokee and the Ram 1500 pick-up truck and an increase in labor

costs in order to meet increased production requirements. The increase in other unusual income was attributable

to the combined effects of a gain recognized from amendments to FCA US’s U.S. and Canadian defined benefit

pension plans, offset by charges related to voluntary safety recalls and customer satisfaction action for certain models

produced in various years from 1993 to 2007 by Old Carco.