Chrysler 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

2014 | ANNUAL REPORT 49

LATAM Dealer and Customer Financing

In the LATAM segment, we provide access to dealer and retail customer financing through both wholly-owned captive

finance companies and through strategic relationships with financial institutions.

We have two wholly-owned captive finance companies in the LATAM segment: Banco Fidis S.A. in Brazil and Fiat

Credito Compañia Financiera S.A. in Argentina. These captive finance companies offer dealer and retail customer

financing. In addition, in Brazil we have a significant commercial partnership with Banco Itaù, a leading vehicle retail

financing company in Brazil, to provide financing to retail customers purchasing Fiat brand vehicles. This partnership

was renewed in August 2013 for a ten-year term ending in 2023. Under this agreement, Banco Itaù has exclusivity

on our promotional campaigns and preferential rights on non-promotional financing. We receive commissions in

connection with each vehicle financing above a certain threshold. This agreement applies only to our retail customers

purchasing Fiat branded vehicles and excludes Chrysler, Jeep, Dodge and Ram brand vehicles, which are directly

financed by Banco Fidis S.A.

APAC Vehicle Sales, Competition and Distribution

APAC Sales and Competition

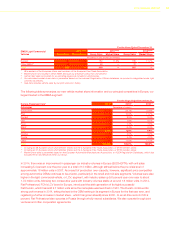

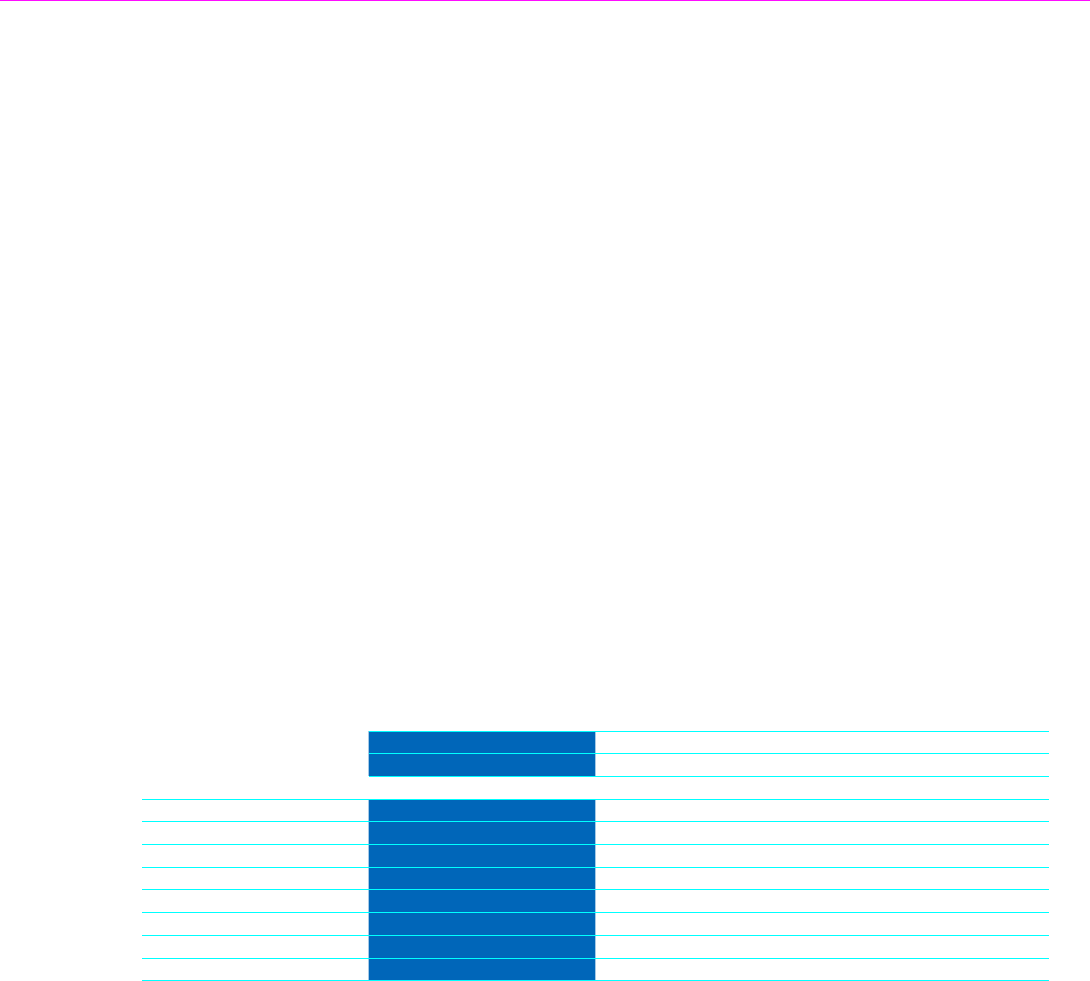

The following table presents our vehicle sales in the APAC segment for the periods presented:

For the Years Ended December 31,

2014(1)(2) 2013(1)(2) 2012(1)(2)

APAC Group Sales Market Share Group Sales Market Share Group Sales Market Share

Thousands of units (except percentages)

China 182 1.0% 129 0.8% 57 0.4%

India(3) 12 0.5% 10 0.4% 11 0.4%

Australia 44 4.0% 34 3.1% 23 2.1%

Japan 18 0.4% 16 0.4% 15 0.3%

South Korea 6 0.5% 5 0.4% 4 0.3%

APAC 5 major Markets 262 0.9% 194 0.7% 109 0.5%

Other APAC 5 — 6 — 6 —

Total 267 — 199 — 115 —

(1) Our estimated market share data presented are based on management’s estimates of industry sales data, which use certain data provided by

third-party sources, including R.L. Polk Data, and National Automobile Manufacturing Associations.

(2) Sales data include vehicles sold by certain of our joint ventures within the Chinese and, until 2012, the Indian market. Beginning in 2013, we

took over the distribution from the joint venture partner and we started distributing vehicles in India through wholly-owned subsidiaries.

(3) India market share is based on wholesale volumes.

The automotive industry in the APAC segment has shown strong year-over-year growth. Industry sales in the five

key markets (China, India, Japan, Australia and South Korea) where we compete increased from 16.3 million in 2009

to 28.2 million in 2014, a compound annual growth rate, or CAGR, of approximately 12 percent. Industry sales in

the five key markets for 2013, 2012, 2011 and 2010 were 26.1 million, 23.8 million, 21.3 million and 20.3 million,

respectively. China was the driving force behind the significant growth in the region. China’s industry volume increased

from 8.5 million passenger cars in 2009 to 18.4 million passenger cars in 2014, representing a CAGR of 17 percent.

Industry volumes in China for 2013, 2012, 2011 and 2010 were 16.7 million, 14.2 million, 13.1 million and 11.5 million

passenger cars, respectively. In 2014, the five key markets grew by 8 percent over 2013, primarily driven by a 10

percent increase in China.