Chrysler 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

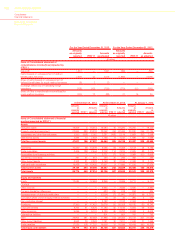

160 2014 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

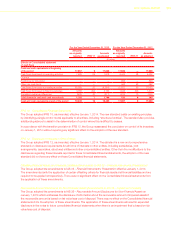

Derivative financial instruments

Derivative financial instruments are used for economic hedging purposes, in order to reduce currency, interest

rate and market price risks (primarily related to commodities and securities). In accordance with IAS 39 - Financial

Instruments: Recognition and Measurement, derivative financial instruments qualify for hedge accounting only when

there is formal designation and documentation of the hedging relationship at inception of the hedge, the hedge is

expected to be highly effective, its effectiveness can be reliably measured and it is highly effective throughout the

financial reporting periods for which it is designated.

All derivative financial instruments are measured at fair value.

When derivative financial instruments qualify for hedge accounting, the following accounting treatments apply:

Fair value hedges – Where a derivative financial instrument is designated as a hedge of the exposure to changes in

fair value of a recognized asset or liability that is attributable to a particular risk and could affect the Consolidated

income statement, the gain or loss from remeasuring the hedging instrument at fair value is recognized in the

Consolidated income statement. The gain or loss on the hedged item attributable to the hedged risk adjusts the

carrying amount of the hedged item and is recognized in the Consolidated income statement.

Cash flow hedges – Where a derivative financial instrument is designated as a hedge of the exposure to variability

in future cash flows of a recognized asset or liability or a highly probable forecasted transaction and could affect

the Consolidated income statement, the effective portion of any gain or loss on the derivative financial instrument

is recognized directly in Other comprehensive income/(loss). The cumulative gain or loss is reclassified from Other

comprehensive income/(loss) to the Consolidated income statement at the same time as the economic effect

arising from the hedged item affects the Consolidated income statement. The gain or loss associated with a hedge

or part of a hedge that has become ineffective is recognized in the Consolidated income statement immediately.

When a hedging instrument or hedge relationship is terminated but the hedged transaction is still expected to

occur, the cumulative gain or loss realized to the point of termination remains in Other comprehensive income/(loss)

and is recognized in the Consolidated income statement at the same time as the underlying transaction occurs. If

the hedged transaction is no longer probable, the cumulative unrealized gain or loss held in Other comprehensive

income/(loss) is recognized in the Consolidated income statement immediately.

Hedges of a net investment – If a derivative financial instrument is designated as a hedging instrument for a net

investment in a foreign operation, the effective portion of the gain or loss on the derivative financial instrument

is recognized in Other comprehensive income/(loss). The cumulative gain or loss is reclassified from Other

comprehensive income/(loss) to the Consolidated income statement upon disposal of the foreign operation.

If hedge accounting cannot be applied, the gains or losses from the fair value measurement of derivative financial

instruments are recognized immediately in the Consolidated income statement.

Transfers of financial assets

The Group de-recognizes financial assets when the contractual rights to the cash flows arising from the asset are no

longer held or if it transfers the financial asset and transfers substantially all the risks and rewards of ownership of the

financial asset. On derecognition of financial assets, the difference between the carrying amount of the asset and the

consideration received or receivable for the transfer of the asset is recognized in the Consolidated income statement.

The Group transfers certain of its financial, trade and tax receivables, mainly through factoring transactions. Factoring

transactions may be either with recourse or without recourse. Certain transfers include deferred payment clauses

(for example, when the payment by the factor of a minor part of the purchase price is dependent on the total amount

collected from the receivables) requiring first loss cover, meaning that the transferor takes priority participation

in the losses, or requires a significant exposure to the cash flows arising from the transferred receivables to be

retained. These types of transactions do not meet the requirements of IAS 39 – Financial Instruments: Recognition

and Measurement for the derecognition of the assets since the risks and rewards connected with collection are

not transferred, and accordingly the Group continues to recognize the receivables transferred by this means on the

Consolidated balance sheet and recognizes a financial liability of the same amount under Asset-backed financing. The

gains and losses arising from the transfer of these receivables are only recognized when they are de-recognized.