Chrysler 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

82014 | ANNUAL REPORT

Letter from the

Chief Executive Officer

Letter from the Chief Executive Officer

Shareholders,

Our Group has just closed a truly momentous year that included: the acquisition of the remaining non-controlling

interest in Chrysler; the formation of Fiat Chrysler Automobiles – the world’s seventh-largest automaker; the debut

of our shares on the NYSE; our return to the U.S. equity markets; record sales for both Jeep and Maserati; and Alfa

Romeo’s return to North America after a 20-year absence.

We presented an ambitious five-year plan to grow our business and continue building an extraordinary enterprise with

even greater potential to deliver sustainable long-term value.

To further enhance shareholder value, we also announced our plan to spin Ferrari off from FCA, list it on the stock

exchange and distribute FCA’s remaining Ferrari shares to FCA shareholders. We believe this course will give Ferrari

the necessary independence, as well as ensuring it a solid platform for future growth opportunities.

Our strong operating results in 2014 are testimony to our commitment to our values, our ability to remain focused on

our key objectives and our determination to continue building a truly unique organization. In fact, the Group was able

to post a profit in all regions for the fourth quarter of the year.

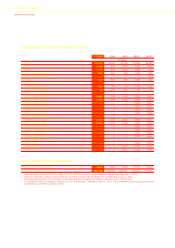

Worldwide vehicle shipments were up 6% over the prior year to 4.6 million units, driving revenues 11% higher to

€96.1 billion.

Adjusted for unusual items, EBIT was €3.7 billion and net profit was €955 million.

Available liquidity at year end totaled €26.2 billion.

In order to further fund the capital requirements of the Group’s five-year business plan, the Board of Directors has

decided not to recommend a dividend on FCA common shares for 2014.

Looking at the performance of our mass-market operations by region, in NAFTA we continued to outperform the

market, with sales up 15% over the prior year.

In the U.S., we closed the year posting our 57th consecutive month of year-over-year sales gains and our best annual

sales since 2006. In addition, our market share was up 100 basis points which was the highest share growth of any

OEM. In Canada, we recorded 61 straight months of growth and the strongest annual sales performance in our

history.

In LATAM, results were positive, although below the prior year’s level primarily as a result of weaker demand in the

region’s main markets. Despite those conditions, FCA maintained its leadership in Brazil, a position we have held for

13 years, increasing the lead over our nearest competitor to 350 basis points. In Argentina, market share increased

140 basis points.

In APAC, we posted strong earnings on the back of significant volume growth. Retail sales in the region, including JVs,

were up 34% and we significantly outperformed the industry in each major market.

In EMEA, there were initial signs of a recovery in Europe with the industry registering a 5% increase – the first after six

straight years of decline.

On the back of a more favorable product mix, increased volumes and industrial efficiencies, EMEA reduced losses

significantly. EBIT adjusted for unusual items improved by €198 million for the full year, with a return to profitability in

the fourth quarter indicating that we are turning the corner in the region as our focus on producing premium vehicles

for export begins to pay off.