Chrysler 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 2014 | ANNUAL REPORT

Operating Results

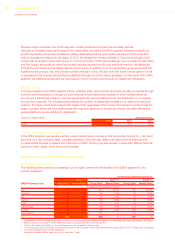

2014 compared to 2013

Cost of sales for the year ended December 31, 2014 was €83.1 billion, an increase of €8.8 billion, or 11.9 percent

(12.8 percent on a constant currency basis), from €74.3 billion for the year ended December 31, 2013.

As a percentage of net revenues, cost of sales was 86.5 percent for the year ended December 31, 2014 compared to

85.8 percent for the year ended December 31, 2013.

The increase in cost of sales was primarily due to the combination of (i) €5.6 billion related to increased vehicle

shipments, primarily in the NAFTA, APAC, Maserati and EMEA segments, partially offset by a reduction in LATAM

shipments, (ii) €2.5 billion related to vehicle and distribution channel mix primarily attributable to the NAFTA segment,

and (iii) €0.5 billion arising primarily from price increases for certain raw materials in LATAM, which were partially offset

by (iv) favorable foreign currency translation effect of €0.7 billion.

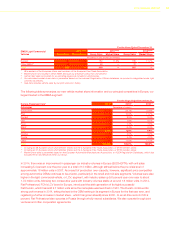

In particular, the €2.5 billion increase in cost of sales related to vehicle and distribution channel mix was primarily

driven by the higher percentage of growth in certain SUV shipments as compared to passenger car shipments, along

with more retail shipments relative to fleet shipments in NAFTA.

Cost of sales for the year ended December 31, 2014 increased by approximately €800 million due to an increase of

warranty expense and also included the effects of recently approved recall campaigns in the NAFTA segment.

The favorable foreign currency translation impact of €0.7 billion was primarily attributable to the LATAM segment,

driven by the weakening of the Brazilian Real against the Euro.

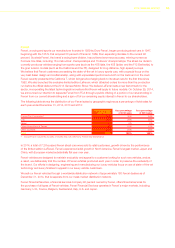

2013 compared to 2012

Cost of sales for the year ended December 31, 2013 was €74.3 billion, an increase of €2.8 billion, or 4.0 percent

(7.9 percent on a constant currency basis), from €71.5 billion for the year ended December 31, 2012. As a

percentage of net revenues, cost of sales was 85.8 percent for the year ended December 31, 2013 compared to

85.3 percent for the year ended December 31, 2012.

The increase in costs of sales was due to the combination of (i) increased costs of €2.1 billion related to increased

vehicle shipments, primarily in the NAFTA segment, (ii) increased costs of €1.7 billion primarily attributable to the

NAFTA segment, related to shifts in vehicle and distribution channel mix, (iii) increased cost of sales of €0.9 billion

relating to the new-model content enhancements, (iv) increased costs of €0.5 billion arising from price increases

for certain raw materials, and (v) an increase in other costs of sales of €0.5 billion, the effects of which were partially

offset by the positive impact of foreign currency translation of €2.8 billion, largely attributable to the weakening of the

U.S. Dollar and the Brazilian Real against the Euro.

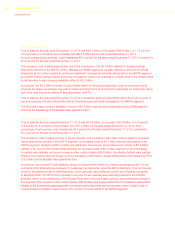

In particular, the increase in cost related to vehicle mix was primarily driven by a higher percentage growth in truck

and certain SUV shipments as compared to passenger car shipments, while the shift in distribution channel mix was

driven by the relative growth in retail shipments, which generally have additional content per vehicle as compared

to fleet shipments. The €0.5 billion increase in the price of raw materials was particularly related to the LATAM

segment, driven by the weakening of the Brazilian Real, which impacts foreign currency denominated purchases in

that segment. The increase in other costs of sales of €0.5 billion was largely attributable to increases in depreciation

relating to the investments associated with our recent product launches and an increase in labor costs in order to

meet increased production requirements both of which primarily related to the NAFTA segment.