Chrysler 2014 Annual Report Download - page 274

Download and view the complete annual report

Please find page 274 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

272 2014 | ANNUAL REPORT

Company Financial

Statements

Other Information

Other Information

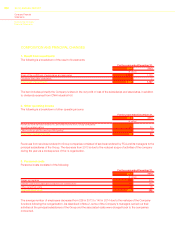

Independent Auditor’s Report

The report of the Company’s independent auditor, Ernst & Young Accountants LLP, the Netherlands is set forth

following this Annual Report.

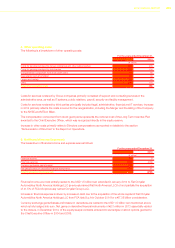

Dividends

Dividends will be determined in accordance with the articles 23 of the Articles of Association of Fiat Chrysler

Automobiles N.V. The relevant provisions of the Articles of Association read as follows:

1. The Company shall maintain a special capital reserve to be credited against the share premium exclusively for the

purpose of facilitating any issuance or cancellation of special voting shares. The special voting shares shall not

carry any entitlement to the balance of the special capital reserve. The Board of Directors shall be authorized to

resolve upon (i) any distribution out of the special capital reserve to pay up special voting shares or (ii) re-allocation

of amounts to credit or debit the special capital reserve against or in favor of the share premium reserve.

2. The Company shall maintain a separate dividend reserve for the special voting shares. The special voting shares

shall not carry any entitlement to any other reserve of the Company. Any distribution out of the special voting rights

dividend reserve or the partial or full release of such reserve will require a prior proposal from the Board of Directors

and a subsequent resolution of the meeting of holders of special voting shares.

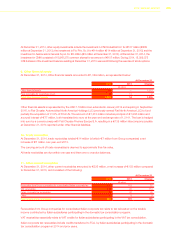

3. From the profits, shown in the annual accounts, as adopted, such amounts shall be reserved as the Board of

Directors may determine.

4. The profits remaining thereafter shall first be applied to allocate and add to the special voting shares dividend

reserve an amount equal to one percent (1%) of the aggregate nominal value of all outstanding special voting

shares. The calculation of the amount to be allocated and added to the special voting shares dividend reserve

shall occur on a time-proportionate basis. If special voting shares are issued during the financial year to which the

allocation and addition pertains, then the amount to be allocated and added to the special voting shares dividend

reserve in respect of these newly issued special voting shares shall be calculated as from the date on which such

special voting shares were issued until the last day of the financial year concerned. The special voting shares shall

not carry any other entitlement to the profits.

5. Any profits remaining thereafter shall be at the disposal of the general meeting of Shareholders for distribution of

profits on the common shares only, subject to the provision of paragraph 8 of this article.

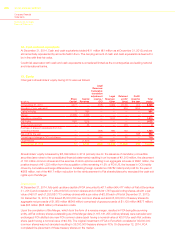

6. Subject to a prior proposal of the Board of Directors, the general meeting of Shareholders may declare and pay

distribution of profits and other distributions in United States Dollars. Furthermore, subject to the approval of the

general meeting of Shareholders and the Board of Directors having been designated as the body competent

to pass a resolution for the issuance of shares in accordance with Article 6, the Board of Directors may decide

that a distribution shall be made in the form of shares or that Shareholders shall be given the option to receive a

distribution either in cash or in the form of shares.

7. The Company shall only have power to make distributions to Shareholders and other persons entitled to

distributable profits to the extent the Company’s equity exceeds the sum of the paid in and called up part of the

share capital and the reserves that must be maintained pursuant to Dutch law and the Company’s Articles of

Association. No distribution of profits or other distributions may be made to the Company itself for shares that the

Company holds in its own share capital.

8. The distribution of profits shall be made after the adoption of the annual accounts, from which it appears that the

same is permitted.