Chrysler 2014 Annual Report Download - page 253

Download and view the complete annual report

Please find page 253 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 251

Dealers and final customers for which the Group provides financing are subject to specific assessments of their

creditworthiness under a detailed scoring system; in addition to carrying out this screening process, the Group also

obtains financial and non-financial guarantees for risks arising from credit granted. These guarantees are further

strengthened where possible by reserve of title clauses on financed vehicle sales to the sales network made by Group

financial service companies and on vehicles assigned under finance and operating lease agreements.

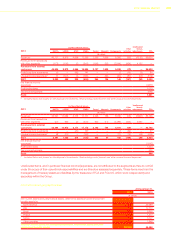

Receivables for financing activities amounting to €3,843 million at December 31, 2014 (€3,671 million at

December 31, 2013) contain balances totaling €3 million (€21 million at December 31, 2013), which have been

written down on an individual basis. Of the remainder, balances totaling €71 million are past due by up to one month

(€72 million at December 31, 2013), while balances totaling €31 million are past due by more than one month (€23

million at December 31, 2013). In the event of installment payments, even if only one installment is overdue, the entire

receivable balance is classified as overdue.

Trade receivables and Other current receivables amounting to €4,810 million at December 31, 2014 (€4,425 million

at December 31, 2013) contain balances totaling €19 million (€19 million at December 31, 2013) which have been

written down on an individual basis. Of the remainder, balances totaling €248 million are past due by up to one month

(€243 million at December 31, 2013), while balances totaling €280 million are past due by more than one month

(€376 million at December 31, 2013).

Provided that Current securities and Cash and cash equivalents consist of balances spread across various primary

national and international banking institutions and money market instruments that are measured at fair value, there

was no exposure to sovereign debt securities at December 31, 2014 which might lead to significant repayment risk.

Liquidity risk

Liquidity risk arises if the Group is unable to obtain the funds needed to carry out its operations under economic

conditions. Any actual or perceived limitations on the Group’s liquidity may affect the ability of counterparties to do

business with the Group or may require additional amounts of cash and cash equivalents to be allocated as collateral

for outstanding obligations.

The continuation of a difficult economic situation in the markets in which the Group operates and the uncertainties

that characterize the financial markets, necessitate special attention to the management of liquidity risk. In that sense,

measures taken to generate funds through operations and to maintain a conservative level of available liquidity are

important factors for ensuring operational flexibility and addressing strategic challenges over the next few years.

The two main factors that determine the Group’s liquidity situation are on the one hand the funds generated by or

used in operating and investing activities and on the other the debt lending period and its renewal features or the

liquidity of the funds employed and market terms and conditions.

The Group has adopted a series of policies and procedures whose purpose is to optimize the management of funds

and to reduce liquidity risk as follows:

centralizing the management of receipts and payments, where it may be economical in the context of the local civil,

currency and fiscal regulations of the countries in which the Group is present;

maintaining a conservative level of available liquidity;

diversifying the means by which funds are obtained and maintaining a continuous and active presence in the capital

markets;

obtaining adequate credit lines;

monitoring future liquidity on the basis of business planning.