Chrysler 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 2014 | ANNUAL REPORT

Overview of Our Business

During the year, FCA maintained its focus on production of a select number of models as it implemented a strategic

re-focus and realignment of the Fiat brand. Central to this strategy has been the expansion of the Fiat 500 family and

other selected economy models. This has resulted in FCA achieving a leading position in the “mini” and “compact

MPV” segments in Europe. We continued expansion of the 500 family in 2014, with the introduction of the 500X

crossover, which was debuted at the Paris Motor Show in October. Building on the history of Alfa Romeo, Fiat

and Lancia, we sell mini, small and compact passenger cars in the EMEA region under these brands. We are also

leveraging Jeep’s global brand recognition to offer Jeep brand SUVs, all of which the EMEA segment categorizes as

passenger cars. In September 2014, the Group launched the Jeep Renegade, FCA’s first model designed in the U.S.

and produced in Italy. In addition, we sell LCV’s under the Fiat Professional brand, which mainly include half-ton pick-

up trucks and commercial vans.

In Europe, FCA’s sales are largely weighted to passenger cars, with approximately 53 percent of our total vehicle

sales in Europe in 2014 in the small car segment, reflecting demand for smaller vehicles driven by driving conditions

prevalent in many European cities and stringent environmental regulations.

EMEA Distribution

In certain markets, such as Europe, our relationship with individual dealer entities can be represented by a number

of contracts (typically, we enter into one agreement per brand of vehicles to be sold), and the dealer can sell those

vehicles through one or more points of sale. In those markets, points of sale tend to be physically small and carry

limited inventory.

In Europe, we sell our vehicles directly to independent and our own dealer entities located in most European markets.

In other markets in the EMEA segment in which we do not have a substantial presence, we have agreements with

general distributors for the distribution of our vehicles through their existing distribution networks.

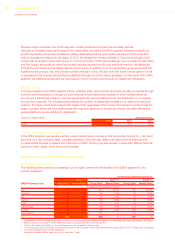

The following table summarizes the number of independent entities in our dealer and distributor network. The table

counts each independent dealer entity, regardless of the number of contracts or points of sale the dealer operates.

Where we have relationships with a general distributor in a particular market, this table reflects that general distributor

as one distribution relationship:

Distribution Relationships At December 31,

2014 2013 2012

EMEA 2,143 2,300 2,495

EMEA Dealer and Customer Financing

In the EMEA segment, dealer and retail customer financing is primarily managed by FCA Bank, our 50/50 joint

venture with Crédit Agricole Consumer Finance S.A., or Crédit Agricole. FCA Bank operates in 14 European countries

including Italy, France, Germany, the U.K. and Spain. We began this joint venture in 2007, and in July 2013, we

reached an agreement with Crédit Agricole to extend its term through December 31, 2021. Under the agreement, FCA

Bank will continue to benefit from the financial support of the Crédit Agricole Group while continuing to strengthen its

position as an active player in the securitization and debt markets. FCA Bank provides retail and dealer financing to

support our mass-market brands and Maserati, as well as certain other OEMs.

Fidis S.p.A., our wholly-owned captive finance company, provides dealer and other wholesale customer financing in

certain markets in the EMEA segment in which FCA Bank does not operate. We also operate a joint venture providing

financial services to retail customers in Turkey, and operate vendor programs with bank partners in other markets to

provide access to financing in those markets.