Chrysler 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

2014 | ANNUAL REPORT 183

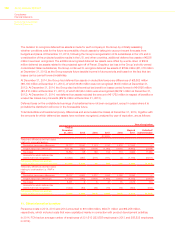

For the year ended December 31, 2013, Other unusual expenses amounted to €686 million and primarily related to

write-downs totaling €272 million as a result of the rationalization of architectures associated with the new product

strategy, particularly for the Alfa Romeo, Maserati and Fiat brands; specifically, €226 million related to development

costs and €46 million to tangible assets. In addition, in relation to the expected market trends, the assets of the

cast-iron business in the Components segment (Teksid) were written down by €57 million. Moreover, there was a

€56 million write-off of the book value of the Equity Recapture Agreement Right considering the agreement closed

on January 21, 2014 to purchase the remaining ownership interest in FCA US from the VEBA Trust (as described

above). Other unusual charges also included a €115 million charge related to the June 2013 voluntary safety recall for

the 1993-1998 Jeep Grand Cherokee and the 2002-2007 Jeep Liberty, as well as the customer satisfaction action

for the 1999-2004 Jeep Grand Cherokee. This item also includes a €59 million foreign currency translation loss

related to the February 2013 devaluation of the official exchange rate of the Venezuelan Bolivar (“VEF”) relative to the

U.S. Dollar from 4.30 VEF per U.S. dollar to 6.30 VEF per U.S. Dollar. During the second and third quarter of 2013,

certain monetary liabilities, which had been submitted to the Commission for the Administration of Foreign Exchange

(“CADIVI”) for payment approval through the ordinary course of business prior to the devaluation date, were approved

to be paid at an exchange rate of 4.30 VEF per U.S. Dollar. As a result, €12 million in the second quarter of 2013 and

€4 million in the third quarter of 2013 of foreign currency transaction gains were recognized due to these monetary

liabilities being previously remeasured at the 6.30 VEF per U.S. Dollar at the devaluation date.

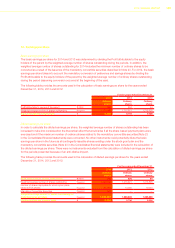

In 2012, Other unusual expenses, net were €138 million mainly including €145 million of costs arising from disputes

relating to operations terminated in prior years and costs related to the agreement with PSA Peugeot Citroën providing

for the transfer of the Group’s interest in the company Sevelnord Société Anonyme at a symbolic value.

In 2014, Other unusual income amounted to €249 million which primarily included €223 million related to the fair value

measurement of the previously exercised options for approximately 10 percent interest in FCA US that were settled in

connection with the acquisition of the remaining interest in FCA US as described in the section Changes in the Scope

of Consolidation, above.

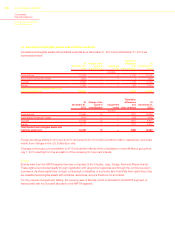

In 2013, Other unusual income amounted to €187 million which primarily included the impacts of a curtailment gain

and plan amendments of €166 million with a corresponding net reduction to FCA US’s pension obligation. During the

second quarter of 2013, FCA US amended its U.S. and Canadian salaried defined benefit pension plans. The U.S.

plans were amended in order to comply with Internal Revenue Service regulations, cease the accrual of future benefits

effective December 31, 2013, and enhanced the retirement factors. The Canada amendment ceased the accrual of

future benefits effective December 31, 2014, enhanced the retirement factors and continued to consider future salary

increases for the affected employees. An interim remeasurement was required for these plans, which resulted in an

additional €509 million net reduction to the pension obligation, a €7 million reduction to defined benefit plan assets

and a corresponding €502 million increase in Total other comprehensive income/(loss).