Chrysler 2014 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 215

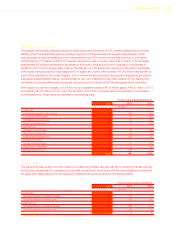

As a result of these dilutive events and pursuant to the anti-dilution provisions in the share-based compensation

plans, the FCA US’s Compensation Committee approved an anti-dilution adjustment factor to increase the number

of outstanding FCA US Units (excluding performance share units granted under the 2012 LTIP Plan (“LTIP PSUs”))

in order to preserve the economic benefit intended to be provided to each participant. The value of the outstanding

awards immediately prior to the dilutive events is equal to the value of the adjusted awards subsequent to the dilutive

events. No additional expense was recognized as a result of this modification during 2014. For comparative purposes,

the number of FCA US Units and all December 31, 2013, and 2012 fair value references have been adjusted to reflect

the impact of the dilutive transactions and the anti-dilution adjustment.

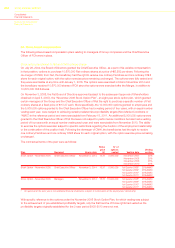

Restricted Stock Unit Plans issued by FCA US

During 2009, the U.S. Treasury’s Office of the Special Master for Troubled Asset Relief Program Executive

Compensation (the “Special Master”) and FCA US’s Compensation Committee approved the FCA US Restricted

Stock Unit Plan (“RSU Plan”), which authorized the issuance of Restricted Stock Units (“RSUs”) to certain key

employees. RSUs represent a contractual right to receive a payment in an amount equal to the fair value of one FCA

US Unit, as defined in the RSU plan. Originally, RSUs granted to FCA US’s employees in 2009 and 2010 vested

in two tranches. In September 2012, FCA US’s Compensation Committee approved a modification to the second

tranche of RSUs. The modification removed the performance condition requiring an IPO to occur prior to the award

vesting. Prior to this modification, the second tranche of the 2009 and 2010 RSUs were equity-classified awards.

In connection with the modification of these awards, FCA US determined that it was no longer probable that the

awards would be settled with FCA US’s company stock and accordingly reclassified the second tranche of the

2009 and 2010 RSUs from equity-classified awards to liability-classified awards. As a result of this modification,

additional compensation expense of €12 million was recognized during 2012. RSUs granted to employees

generally vest if the participant is continuously employed by FCA US through the third anniversary of the grant date.

The settlement of these awards is in cash.

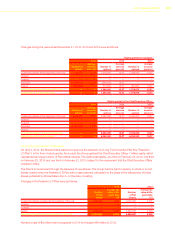

In addition, during 2009, FCA US established the Directors’ RSU Plan. In April 2012, FCA US’s Compensation

Committee amended and restated the FCA US 2009 Directors’ RSU Plan to allow grants having a one-year

vesting term to be granted on an annual basis. Director RSUs are granted to FCA US non-employee members of

the FCA US Board of Directors. Prior to the change, Director RSUs were granted at the beginning of a three-year

performance period and vested in three equal tranches on the first, second, and third anniversary of the date of

grant, subject to the participant remaining a member of the FCA US Board of Directors on each vesting date. Under

the plan, settlement of the awards is made within 60 days of the Director’s cessation of service on the Board of

Directors and awards are paid in cash; however, upon completion of an IPO, FCA US has the option to settle the

awards in cash or shares. The value of the awards is recorded as compensation expense over the requisite service

periods and is measured at fair value.

The liability resulting from these awards is measured and adjusted to fair value at each reporting date. The expense

recognized in total for both the RSU Plan and the Directors RSU plan for the years ended December 31, 2014, 2013

and 2012 was approximately €6 million, €14 million and €28 million, respectively. Total unrecognized compensation

expense at December 31, 2014 and at December 31, 2013 for both the RSU Plan and the Directors RSU plan was

less than €1 million.