Chrysler 2014 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

252 2014 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

From an operating point of view, the Group manages liquidity risk by monitoring cash flows and keeping an adequate

level of funds at its disposal. The operating cash flows, main funding operations and liquidity of the Group (excluding

FCA US) are centrally managed in the Group’s treasury companies with the aim of ensuring effective and efficient

management of the Group’s funds. These companies obtain funds in the financial markets various funding sources.

FCA US currently manages its liquidity independently from the rest of the Group. Intercompany financing from FCA US

to other Group entities is not restricted other than through the application of covenants requiring that transactions with

related parties be conducted at arm’s length terms or be approved by a majority of the “disinterested” members of the

Board of Directors of FCA US. In addition certain of FCA US ’s finance agreements restrict the distributions which it is

permitted to make. In particular, dividend distributions, other than certain exceptions including permitted distributions

and distributions with respect to taxes, are generally limited to an amount not to exceed 50.0 percent of cumulative

consolidated net income (as defined in the agreements) from January 1, 2012 less the amount of the January 2014

distribution that was used to pay the VEBA Trust for the acquisition of the remaining 41.5 percent interest in FCA US

not previously owned by FCA.

FCA has not provided any guarantee, commitment or similar obligation in relation to any of FCA US’s financial

indebtedness, nor has it assumed any kind of obligation or commitment to fund FCA US. However, certain bonds

issued by FCA and its subsidiaries (other than FCA US and its subsidiaries) include covenants which may be affected

by circumstances related to FCA US, in particular in relation to cross-default clauses which may accelerate the

repayments in the event that FCA US fails to pay certain of its debt obligations.

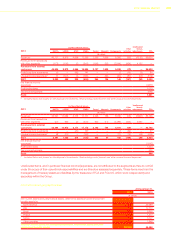

Details of the repayment structure of the Group’s financial assets and liabilities are provided in Note 18 and in Note 27.

Details of the repayment structure of derivative financial instruments are provided in Note 20.

The Group believes that the funds currently available to the treasuries of the Group and FCA US, in addition to those

that will be generated from operating and financing activities, will enable the Group to satisfy the requirements of its

investing activities and working capital needs, fulfill its obligations to repay its debt at the natural due dates and ensure

an appropriate level of operating and strategic flexibility.

Financial market risks

Due to the nature of our business, the Group is exposed to a variety of market risks, including foreign currency

exchange rate risk, commodity price risk and interest rate risk.

The Group’s exposure to foreign currency exchange rate risk arises both in connection with the geographical

distribution of the Group’s industrial activities compared to the markets in which it sells its products, and in relation to

the use of external borrowing denominated in foreign currencies.

The Group’s exposure to interest rate risk arises from the need to fund industrial and financial operating activities and

the necessity to deploy surplus funds. Changes in market interest rates may have the effect of either increasing or

decreasing the Group’s net profit/(loss), thereby indirectly affecting the costs and returns of financing and investing

transactions.

The Group’s exposure to commodity price risk arises from the risk of changes occurring in the price of certain raw

materials and energy used in production. Changes in the price of raw materials could have a significant effect on the

Group’s results by indirectly affecting costs and product margins.

These risks could significantly affect the Group’s financial position and results, and for this reason these risks are

systematically identified and monitored, in order to detect potential negative effects in advance and take the necessary

actions to mitigate them, primarily through its operating and financing activities and if required, through the use of

derivative financial instruments in accordance with its established risk management policies.

The Group’s policy permits derivatives to be used only for managing the exposure to fluctuations in foreign currency

exchange rates and interest rates as well as commodities prices connected with future cash flows and assets and

liabilities, and not for speculative purposes.