Chrysler 2014 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 233

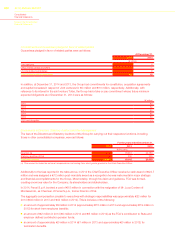

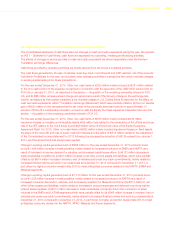

The Senior Credit Agreements include a number of affirmative covenants, many of which are customary, including,

but not limited to, the reporting of financial results and other developments, compliance with laws, payment of

taxes, maintenance of insurance and similar requirements. The Senior Credit Agreements also include negative

covenants, including but not limited to: (i) limitations on incurrence, repayment and prepayment of indebtedness;

(ii) limitations on incurrence of liens; (iii) limitations on making certain payments; (iv) limitations on transactions with

affiliates, swap agreements and sale and leaseback transactions; (v) limitations on fundamental changes, including

certain asset sales and (vi) restrictions on certain subsidiary distributions. In addition, the Senior Credit Agreements

require FCA US to maintain a minimum ratio of “borrowing base” to “covered debt” (as defined in the Senior Credit

Agreements), as well as a minimum liquidity of US$3.0 billion (€2.5 billion), which includes any undrawn amounts on

the Revolving Credit Facility.

The Senior Credit Agreements contain a number of events of default related to: (i) failure to make payments when due;

(ii) failure to comply with covenants; (iii) breaches of representations and warranties; (iv) certain changes of control;

(v) cross–default with certain other debt and hedging agreements and (vi) the failure to pay or post bond for certain

material judgments. As of December 31, 2014, FCA US was in compliance with all covenants under the Senior Credit

Agreements.

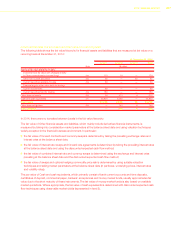

Medium/long term committed credit lines currently available to the treasury companies of the Group (excluding FCA

US) amount to approximately €3.3 billion at December 31, 2014 (€3.2 billion at December 31, 2013), of which €2.1

billion related to the 3-year syndicated revolving credit line due in July 2016 that was undrawn at December 31, 2014

and at December 31, 2013. The €2.1 billion syndicated credit facility of the Group contains typical covenants for

contracts of this type and size, such as financial covenants (Net Debt/EBITDA and EBITDA/Net Interest ratios related

to industrial activities) and negative pledge, cross default and change of control clauses. The failure to comply with

these covenants, in certain cases, if not suitably remedied, can lead to the requirement for early repayment of the

outstanding loans. Similar covenants are included in the loans granted by the European Investment Bank for a total

of €1.1 billion used to fund the Group’s investments and research and development costs. In addition, the above

syndicated credit facility, currently includes limits on the ability to extend guarantees or loans to FCA US.

Additionally, the operating entities of the Group (excluding FCA US) have committed credit lines available, with residual

maturity after twelve months, to fund scheduled investments, of which approximately €0.9 billion was undrawn at

December 31, 2014 (€1.8 billion at December 31, 2013).

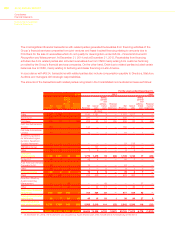

Payables represented by securities

At December 31, 2014, Group’s Payables represented by securities primarily included the unsecured Canadian Health

Care Trust Notes totaling €651 million, including accrued interest, (€703 million at December 31, 2013, including

accrued interest), which represents FCA US’s financial liability to the Canadian Health Care Trust arising from the

settlement of its obligations for postretirement health care benefits for National Automobile, Aerospace, Transportation

and General Workers Union of Canada “CAW” (now part of Unifor), which represented employees, retirees and

dependents.

As described in more detail in Note 23, FCA issued aggregate notional amount of U.S.$2,875 million (€2,293 million)

of Mandatory Convertible Securities on December 16, 2014. The obligation to pay coupons as required by the

Mandatory Convertible Securities meets the definition of a financial liability as it is a contractual obligation to deliver

cash to another entity. The fair value amount determined for the liability component at issuance of the Mandatory

Convertible Securities was U.S.$419 million (€335 million) calculated as the present value of the coupon payments

due less allocated transaction costs of U.S.$9 million (€7 million) that are accounted for as a debt discount.

Subsequent to issuance, the financial liability for the coupon payments is accounted for at amortized cost. At

December 31, 2014, the financial liability component was U.S.$420 million (€346 million).