Chrysler 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 59

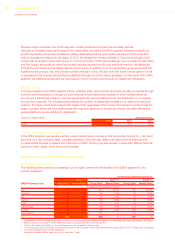

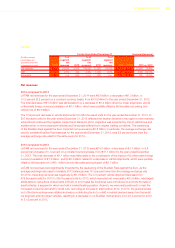

Selling, general and administrative costs

For the Years Ended December 31, Increase/(decrease)

(€ million, except

percentages) 2014

Percentage

of net

revenues 2013

Percentage

of net

revenues 2012

Percentage

of net

revenues 2014 vs. 2013 2013 vs. 2012

Selling, general and

administrative costs 7,084 7.4% 6,702 7.7% 6,775 8.1% 382 5.7% (73) (1.1)%

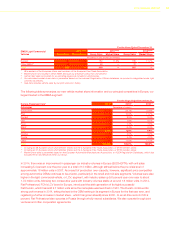

2014 compared to 2013

Selling, general and administrative costs include advertising, personnel, and other costs. Advertising costs accounted

for approximately 44.0 percent and 43.0 percent of total selling, general and administrative costs for the year ended

December 31, 2014 and 2013 respectively.

Selling, general and administrative costs for the year ended December 31, 2014 were €7,084 million, an increase

of €382 million, or 5.7 percent, from €6,702 million for the year ended December 31, 2013. As a percentage of net

revenues, selling, general and administrative costs were 7.4 percent for the year ended December 31, 2014 compared

to 7.7 percent for the year ended December 31, 2013.

The increase in selling, general and administrative costs was due to the combined effects of (i) a €293 million increase

in advertising expenses driven primarily by the NAFTA, APAC and EMEA segments, (ii) a €157 million increase in other

selling, general and administrative costs primarily attributable to the LATAM and Maserati segments, and to a lesser

extent, the APAC segment which were partially offset by (iii) a reduction in other general and administrative expenses

in the NAFTA segment and (iv) the impact of favorable foreign currency translation of €68 million.

The increase in advertising expenses was largely attributable to the APAC and NAFTA segments to support the

growth of the business in their respective markets. In addition, advertising expenses increased within the NAFTA

segment for new product launches, including the all-new 2014 Jeep Cherokee and the all-new 2015 Chrysler 200.

There were additional increases in advertising expenses for the EMEA segment related to the Jeep brand growth and

new product launches, including the all-new 2014 Jeep Cherokee and Renegade. The favorable foreign currency

translation impact of €68 million was primarily attributable to the LATAM segment, driven by the weakening of the

Brazilian Real against the Euro.

The increase in other selling, general and administrative costs attributable to the Maserati segment has been driven

by the increase in volumes. The increase in other selling, general and administrative costs attributable to the APAC

segment was driven by volume growth in the region, while the increase in the LATAM segment includes the start-up

costs of the Pernambuco plant.

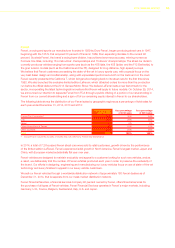

2013 compared to 2012

Selling, general and administrative costs for the year ended December 31, 2013 were €6,702 million, a decrease

of €73 million, or 1.1 percent, from €6,775 million for the year ended December 31, 2012. As a percentage of net

revenues, selling, general and administrative costs were 7.7 percent for the year ended December 31, 2013 compared

to 8.1 percent for the year ended December 31, 2012.

The decrease in selling, general and administrative costs was due to the combined effects of the positive impact of

foreign currency translation of €240 million, partially offset by a €102 million increase in personnel expenses, largely

related to the NAFTA segment, and an increase in advertising expenses of €37 million. In particular, advertising

expenses increased in 2013 due to the product launches in the NAFTA segment (2014 Jeep Grand Cherokee, the

all-new 2014 Jeep Cherokee and the all-new Fiat 500L), in the APAC segment (Dodge Journey) and the Maserati

segment (Quattroporte and Ghibli), which continued following launch to support the growth in their respective

markets, which were partially offset by a decrease in advertising expenses for the EMEA segment as a result of efforts

to improve the focus of advertising campaigns.