Chrysler 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 2014 | ANNUAL REPORT

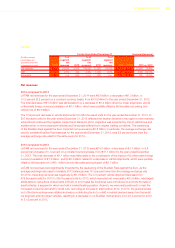

Operating Results

2013 compared to 2012

Components EBIT for the year ended December 31, 2013 was €146 million, a decrease of €19 million,

or 11.5 percent (6.7 percent on a constant currency basis), from €165 million for the year ended December 31, 2012.

Magneti Marelli

Magneti Marelli EBIT for the year ended December 31, 2013 was €169 million, an increase of €38 million, or 29.0

percent, from €131 million for the year ended December 31, 2012, attributable to the previously described increase in

net revenues, which was partially offset by higher costs incurred in relation to product launches in North America, and

the impact of unusual charges recognized in 2012.

Teksid

Teksid EBIT for the year ended December 31, 2013 was a loss of €70 million, compared to a gain of €4 million for

the year ended December 31, 2012, attributable to the combined effects of volume decreases from the cast iron

business, and €60 million other unusual expenses, related to asset impairments of the cast iron business.

Comau

Comau EBIT for the year ended December 31, 2013 was €47 million, an increase of €17 million, or 56.7 percent,

from €30 million for the year ended December 31, 2012, primarily attributable to the body welding operations.

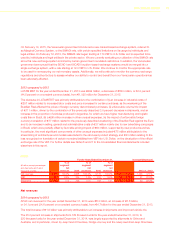

Liquidity and Capital Resources

Liquidity Overview

We require significant liquidity in order to meet our obligations and fund our business. Short-term liquidity is required

to purchase raw materials, parts and components for vehicle production, and to fund selling, administrative, research

and development, and other expenses. In addition to our general working capital and operational needs, we expect

to use significant amounts of cash for the following purposes: (i) capital expenditures to support our existing and

future products; (ii) principal and interest payments under our financial obligations and (iii) pension and employee

benefit payments. We make capital investments in the regions in which we operate primarily related to initiatives to

introduce new products, enhance manufacturing efficiency, improve capacity, and for maintenance and environmental

compliance. Our capital expenditures in 2015 are expected to be approximately between €8.5 and €9.0 billion, which

we plan to fund primarily with cash generated from our operating activities, as well as with credit lines provided to

certain of our Group entities.

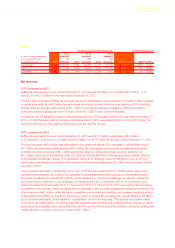

Our business and results of operations depend on our ability to achieve certain minimum vehicle sales volumes. As

is typical for an automotive manufacturer, we have significant fixed costs, and therefore, changes in our vehicle sales

volume can have a significant effect on profitability and liquidity. We generally receive payment for sales of vehicles to

dealers and distributors, shortly after shipment, whereas there is a lag between the time we receive parts and materials

from our suppliers and the time we are required to pay for them. Therefore, during periods of increasing vehicle sales,

there is generally a corresponding positive impact on our cash flow and liquidity. Conversely, during periods in which

vehicle sales decline, there is generally a corresponding negative impact on our cash flow and liquidity. Thus, delays

in shipments of vehicles, including delays in shipments in order to address quality issues, tend to negatively affect our

cash flow and liquidity. In addition, the timing of our collections of receivables for export sales of vehicles, fleet sales

and part sales tend to be longer due to different payment terms. Although we regularly enter into factoring transactions

for such receivables in certain countries, in order to anticipate collections and transfer relevant risks to the factor, a

change in volumes of such sales may cause fluctuations in our working capital. The increased internationalization of

our product portfolio may also affect our working capital requirements as there may be an increased requirement to

ship vehicles to countries different from where they are produced. Finally, working capital can be affected by the trend

and seasonality of sales under vehicle buy-back programs.