Chrysler 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 2014 | ANNUAL REPORT

Sustainability Disclosure

In Brazil, where the Group maintained its market leadership, the realignment of production levels to changes in

market demand was primarily managed through the use of flexible labor mechanisms and reorganization of shifts, in

agreement with the unions.

In 2014, FCA US increased vehicle production through revised operating patterns at its NAFTA facilities in response

to market demand. To support the increase in production output, the company has correspondingly increased

staffing levels, including manufacturing employees to support current and anticipated production volumes, as well as

additional engineering, R&D and other highly-skilled employees to support product development, sales, marketing and

other corporate activities.

Sustainable Supply Chain Management

Group Purchasing has primary responsibility for supplier management, including establishing global purchasing

strategies and processes. The organization works closely with internal clients and suppliers to integrate key

environmental, social and governance considerations into its global purchasing processes, enabling responsible and

sustainable economic success for the Group as a whole. In addition to the buying teams, several other teams within

Group Purchasing support the selection, management and development of a high-quality, high-performing automotive

supply base. These include Supplier Quality, Supplier Relations, Product Development Purchasing, and Integration,

Methods and Strategy. Group Purchasing operates according to eight Foundational Principles whose objective

is to maximize the value of our supplier partnerships. These principles are: 1. mutual transparency, 2. proactive

collaboration, 3. sense of urgency, 4. integrity, 5. long-term mindset, 6. empathy and advocacy, 7. continuous

improvement and 8. personal accountability.

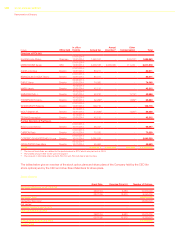

In 2014, Group Purchasing managed around €53.4 billion in direct materials purchases through a base of 3,127 direct

materials suppliers. The supplier base is highly concentrated, with the top 176 suppliers, which are considered

strategic, accounting for approximately 59% of total purchases by value. The Group classifies suppliers as strategic

through a formal process based on the following criteria: allocated spending amount, production and spare parts

capacity, absence of technical and commercially-viable alternatives, and the value of Group procurement orders as a

percentage of the supplier’s annual turnover. Approximately 69% of direct materials purchases (by value) are destined

for plants in NAFTA, 18% for plants in EMEA, and 8% for plants in LATAM, and 5% for plants in APAC. By source,

71% of direct materials purchases are from NAFTA, 16% from EMEA, 2% from LATAM, and 11% from APAC.

Environmental and Social Impacts of Suppliers

FCA aims to prevent or mitigate any adverse environmental or social impacts that may be directly linked to our

own business activities, or to products and services from our suppliers. As partners, suppliers play a key role in

the continuity of our activities and can also have a significant impact on external perceptions of our social and

environmental responsibility. Any adverse event within the supply chain can not only have a direct, material impact on

production and economic performance - both for us and our suppliers - but can also affect our collective reputations.

As such, building and maintaining collaborative, long-term relationships with our suppliers are essential elements in the

effective prevention or mitigation of any potential negative environmental or social impacts of our activities.

Our target for 2020 is to conduct sustainability audits or assessments of all Tier 1 suppliers with potential exposure to

significant environmental or social risks. For strategic suppliers, these audits will be conducted by external auditors.

The assessment of supplier compliance with sustainability criteria is conducted in three phases over a period of

approximately one year. The first phase is the completion of a self-assessment questionnaire. In 2014, Group

Purchasing introduced the Supplier Sustainability Self-Assessment (SSSA) questionnaire in all four operating

regions. This standardized tool - developed by the Automotive Industry Action Group (AIAG) with the contribution

of a workgroup that included FCA and other auto industry OEMs and suppliers - has a three-fold purpose: 1) to

communicate our expectations to suppliers; 2) to determine the effective level of sustainability activity within the

supply base; and 3) to create an effective and efficient tool that reduces the burden of multiple and similar information

requests received by suppliers. The Group has developed a user interface (accessible via the eSupplier Connect

portal), which can be used by suppliers to complete the SSSA online.