Chrysler 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 205

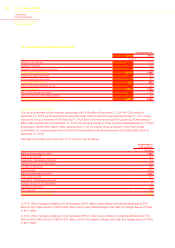

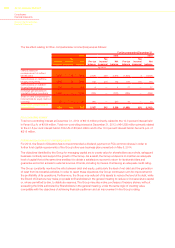

Assets and liabilities held for sale at December 31, 2014 consisted of buildings allocated to the LATAM and

Components segments as well as certain minor investments within the EMEA segment.

At December 31, 2013, Assets and liabilities held for sale primarily related to a subsidiary (Fonderie du Poitou Fonte

S.A.S.) within the Components segment for which the Group disposed of its interest in the subsidiary in May 2014.

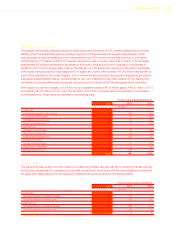

The Group holds a subsidiary which operates in Venezuela whose functional currency is the U.S. Dollar. Pursuant

to certain Venezuelan foreign currency exchange control regulations, the Central Bank of Venezuela centralizes all

foreign currency transactions in the country. Under these regulations, the purchase and sale of foreign currency

must be made through the Centro Nacional de Comercio Exterior en Venezuela from January 1, 2014 (CADIVI until

December 31, 2013). The cash and cash equivalents denominated in VEF amounted to €123 million (VEF 1,785

million) at December 31, 2014 and €270 million (VEF 2,347 million) at December 31, 2013. The reduction, in Euro

terms, is largely due to the adoption of SICAD I rate at March 31, 2014 for the conversion of the VEF denominated

monetary items, as explained in more detail in Note 8, and in part to the payments made by the subsidiary during the

period. In addition, Cash and cash equivalents held in certain foreign countries (primarily, China and Argentina) are

subject to local exchange control regulations providing for restrictions on the amount of cash other than dividends that

can leave the country.

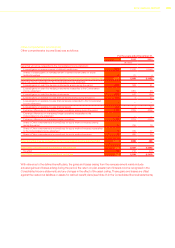

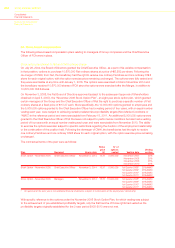

23. Equity

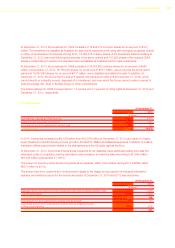

Consolidated shareholders’ equity at December 31, 2014 increased by €1,154 million from December 31, 2013,

mainly due to the issuance of mandatory convertible securities (described in more detail below) resulting in an increase

of €1,910 million, the placement of 100,000,000 common shares (described below) resulting in an aggregate

increase of € 994 million, net profit for the period of €632 million, the increase in cumulative exchange differences

on translating foreign operations of €782 million, partially offset by the decrease of €2,665 million arising from the

acquisition of the 41.5 percent non-controlling interest in FCA US and the disbursement to Fiat shareholders who

exercised cash exit rights.

Consolidated shareholders’ equity at December 31, 2013 increased by €4,215 million from December 31, 2012, mainly

due to an increase of €2,908 million in the remeasurement of defined benefit plans reserve net of related tax impact, the

profit for the period of €1,951 million and an increase of €123 million in the cash flow hedge reserve partially offset by the

decrease of €796 million in the cumulative exchange differences on translating foreign operations.

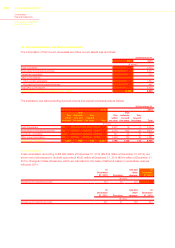

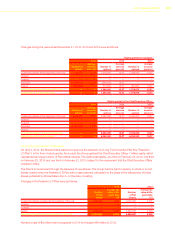

Share capital

At December 31, 2014, fully paid-up share capital of FCA amounted to €17 million (€4,477 million at December 31,

2013) and consisted of 1,284,919,505 common shares and of 408,941,767 special voting shares, all with a par value

of €0.01 each (1,250,687,773 ordinary shares with a par value of €3.58 each of Fiat at December 31, 2013 - see

section Merger, below). On December 12, 2014, FCA issued 65,000,000 new common shares and sold 35,000,000

of treasury shares for aggregate net proceeds of $1,065 million (€849 million) comprised of gross proceeds of $1,100

million (€877 million) less $35 million (€28 million) of transaction costs.

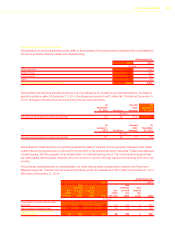

On October 29, 2014, the Board of Directors of FCA resolved to authorize the issuance of up to a maximum of

90,000,000 common shares under the framework equity incentive plan which had been adopted before the closing

of the Merger. No grants have occurred under such framework equity incentive plan and any issuance of shares

thereunder in the period from 2014 to 2018 will be subject to the satisfaction of certain performance/retention

requirements. Any issuances to directors will be subject to shareholders approval.

Treasury shares

There were no treasury shares held by FCA at December 31, 2014 (34,577,867 Fiat ordinary shares for an amount of

€259 million at December 31, 2013) (see section - Merger, below).