Chrysler 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

46 2014 | ANNUAL REPORT

Overview of Our Business

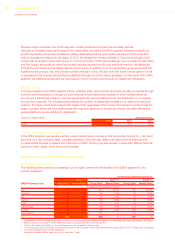

The following table presents our new vehicle market share information and our principal competitors in the U.S.,

our largest market in the NAFTA segment (certain totals in the tables included in this document may not add due to

rounding):

For the Years Ended December 31,

U.S. 2014 2013 2012

Automaker Percentage of industry

GM 17.4% 17.6% 17.6%

Ford 14.7% 15.7% 15.2%

Toyota 14.1% 14.1% 14.1%

FCA 12.4% 11.4% 11.2%

Honda 9.2% 9.6% 9.6%

Nissan 8.2% 7.9% 7.7%

Hyundai/Kia 7.8% 7.9% 8.6%

Other 16.2% 15.9% 16.0%

Total 100.0% 100.0% 100.0%

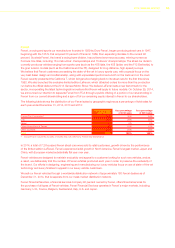

U.S. automotive market sales have steadily improved after a sharp decline from 2007 to 2010. U.S. industry sales,

including medium- and heavy-duty vehicles, increased from 10.6 million units in 2009 to 16.8 million units in 2014,

an increase of approximately 58.5 percent. Both macroeconomic factors, such as growth in per capita disposable

income and improved consumer confidence, and automotive specific factors, such as the increasing age of vehicles in

operation, improved consumer access to affordably priced financing and higher prices of used vehicles, contributed to

the strong recovery.

Our vehicle line-up in the NAFTA segment leverages the brand recognition of the Chrysler, Dodge, Jeep and

Ram brands to offer cars, utility vehicles, pick-up trucks and minivans under those brands, as well as vehicles in

smaller segments, such as the mini-segment Fiat 500 and the small & compact MPV segment Fiat 500L. With the

reintroduction of the Fiat brand in 2011 and the launch of the Dodge Dart in 2012, we now sell vehicles in all vehicle

segments. Our vehicle sales and profitability in the NAFTA segment are generally weighted towards larger vehicles

such as utility vehicles, trucks and vans, while overall industry sales in the NAFTA segment generally are more

evenly weighted between smaller and larger vehicles. In recent years, we have increased our sales of mini, small and

compact cars in the NAFTA segment.

NAFTA Distribution

In the NAFTA segment, our vehicles are sold primarily to dealers in our dealer network for sale to retail customers and

fleet customers. The following table sets forth the number of independent entities in our dealer and distributor network

in the NAFTA segment. The table counts each independent dealer entity, regardless of the number of contracts or

points of sale the dealer operates. Where we have a relationship with a general distributor, this table reflects that

general distributor as one distribution relationship:

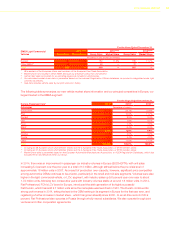

Distribution Relationships At December 31,

2014 2013 2012

NAFTA 3,251 3,204 3,156

In the NAFTA segment, fleet sales in the commercial channel are typically more profitable than sales in the government

and daily rental channels since they more often involve customized vehicles with more optional features and

accessories; however, vehicle orders in the commercial channel are usually smaller in size than the orders made in

the daily rental channel. Fleet sales in the government channel are generally more profitable than fleet sales in the

daily rental channel primarily due to the mix of products included in each respective channel. Rental car companies,

for instance, place larger orders of small and mid-sized cars and minivans with minimal options, while sales in the

government channel often involve a higher mix of relatively more profitable vehicles such as pick-up trucks, minivans

and large cars with more options.