Chrysler 2014 Annual Report Download - page 275

Download and view the complete annual report

Please find page 275 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

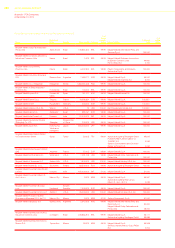

2014 | ANNUAL REPORT 273

9. The Board of Directors shall have power to declare one or more interim distributions of profits, provided that

the requirements of paragraph 7 hereof are duly observed as evidenced by an interim statement of assets and

liabilities as referred to in Section 2:105 paragraph 4 of the Dutch Civil Code and provided further that the policy of

the Company on additions to reserves and distributions of profits is duly observed. The provisions of paragraphs 2

and 3 hereof shall apply mutatis mutandis.

10. The Board of Directors may determine that distributions are made from the Company’s share premium reserve

or from any other reserve, provided that payments from reserves may only be made to the Shareholders that are

entitled to the relevant reserve upon the dissolution of the Company.

11. Distributions of profits and other distributions shall be made payable in the manner and at such date(s) - within four

weeks after declaration thereof - and notice thereof shall be given, as the general meeting of Shareholders, or in

the case of interim distributions of profits, the Board of Directors shall determine.

12. Distributions of profits and other distributions, which have not been collected within five years and one day after

the same have become payable, shall become the property of the Company.

On January 28, 2015 the Board of Directors has declined to recommend a dividend payment on FCA common shares

in order to further fund capital requirements of the Group’s five-year business plan presented on May 6, 2014.

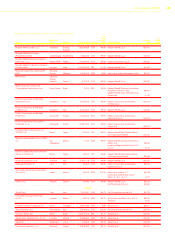

Disclosures pursuant to Decree Article 10 EU-Directive on Takeovers

In accordance with the Dutch Besluit artikel 10 overnamerichtlijn (the Decree), the Company makes the following

disclosures:

a. For information on the capital structure of the Company, the composition of the issued share capital and the

existence of the two classes of shares, please refer to Note 13 to the Company financial statements in this Annual

Report. For information on the rights attached to the common shares, please refer to the Articles of Association

which can be found on the Company’s website. To summarize, the rights attached to common shares comprise

pre-emptive rights upon issue of common shares, the entitlement to attend the general meeting of Shareholders

and to speak and vote at that meeting and the entitlement to distributions of such amount of the Company’s profit

as remains after allocation to reserves. For information on the rights attached to the special voting shares, please

refer to the Articles of Association and the Terms and Conditions for the Special Voting Shares which can both be

found on the Company’s website and more in particular to the paragraph “Loyalty Voting Structure” of this Annual

Report in the chapter “Corporate Governance”. As at 31 December 2014, the issued share capital of the Company

consisted of 1,284,919,505 common shares, representing 76 per cent. of the aggregate issued share capital and

408,941,767 special voting shares, representing 24 per cent. of the aggregate issued share capital.

b. The Company has imposed no limitations on the transfer of common shares. The Articles of Association provide in

Article 13 for transfer restrictions for special voting shares.

c. For information on participations in the Company’s capital in respect of which pursuant to Sections 5:34, 5:35 and

5:43 of the Dutch Financial Supervision Acts (Wet op het financieel toezicht) notification requirements apply, please

refer to the chapter “Major Shareholders” of this Annual Report. There you will find a list of Shareholders who are

known to the Company to have holdings of 3% or more at the stated date.

d. No special control rights or other rights accrue to shares in the capital of the Company.

e. No restrictions apply to voting rights attached to shares in the capital of the Company, nor are there any deadlines

for exercising voting rights. The Articles of Association allow the Company to cooperate in the issuance of

registered depositary receipts for common shares, but only pursuant to a resolution to that effect of the Board of

Directors. The Company is not aware of any depository receipts having been issued for shares in its capital.