Chrysler 2014 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 231

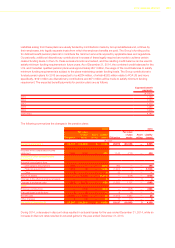

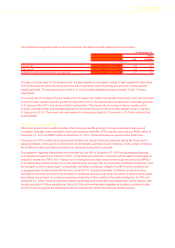

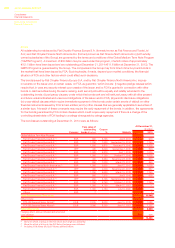

Changes in Global Medium Term Notes during 2014 were mainly due to the:

Issuance of 4.75 percent notes at par in March 2014, having a principal of €1 billion and due March 2021 by Fiat

Chrysler Finance Europe S.A. The proceeds will be used for general corporate purposes. The notes have been

admitted to listing on the Irish Stock Exchange.

Issuance of 4.75 percent notes at par in July 2014, having a principal of €850 million and due July 2022 by Fiat

Chrysler Finance Europe S.A. The notes issuance was reopened in September 2014 for a further €500 million

principal value, priced at 103.265 percent of par value, increasing the total principal amount to €1.35 billion.

Issuance of 3.125 percent notes at par in September 2014 having a principal of CHF250 million and due September

2019 by Fiat Chrysler Finance Europe S.A.

Repayment at maturity of bonds having a nominal value of €900 million and of €1,250 million originally issued by

Fiat Chrysler Finance Europe S.A.

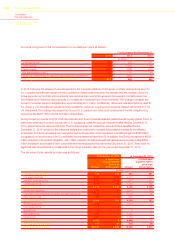

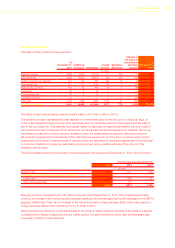

FCA US Secured Senior Notes

In May 2011, FCA US and certain of its U.S. subsidiaries, either as a co-issuer or guarantor, entered into the following

secured senior notes:

secured senior notes due 2019 - issuance of $1,500 million (€1,235 million at December 31, 2014) of 8.0 percent

secured senior notes due June 15, 2019; and

secured senior notes due 2021 - issuance of $1,700 million (€1,400 million at December 31, 2014) of 8.25 percent

secured senior notes due June 15, 2021.

In February 2014, FCA US and certain of its U.S. subsidiaries, either as a co-issuer or guarantor, issued additional

secured senior notes:

secured Senior Notes due 2019 – U.S.$1,375 million (€1,133 million at December 31, 2014) aggregate principal

amount of 8.0 percent secured senior notes (collectively with the May 2011 issuance of the secured senior notes

due 2019, the “2019 Notes”), due June 15, 2019, at an issue price of 108.25 percent of the aggregate principal

amount; and

secured Senior Notes due 2021 – U.S.$1,380 million (€1,137 million at December 31, 2014) aggregate principal

amount of 8.25 percent secured senior notes (collectively with the May 2011 issuance of the secured senior notes due

2021, the “2021 Notes”), due June 15, 2021 at an issue price of 110.50 percent of the aggregate principal amount.

The 2019 Notes and 2021 Notes are collectively referred to as the “Secured Senior Notes”.

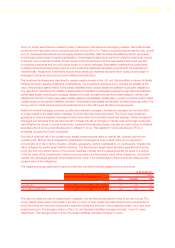

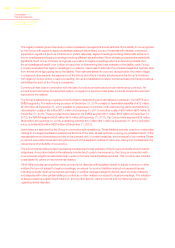

FCA US may redeem, at any time, all or any portion of the Secured Senior Notes on not less than 30 and not more

than 60 days’ prior notice mailed to the holders of the Secured Senior Notes to be redeemed.

Prior to June 15, 2015, the 2019 Notes will be redeemable at a price equal to the principal amount of the 2019

Notes being redeemed, plus accrued and unpaid interest to the date of redemption and a “make–whole” premium

calculated under the indenture governing the Secured Senior Notes. On and after June 15, 2015, the 2019 Notes

are redeemable at redemption prices specified in the 2019 Notes, plus accrued and unpaid interest to the date of

redemption. The redemption price is initially 104.0 percent of the principal amount of the 2019 Notes being redeemed

for the twelve months beginning June 15, 2015, decreasing to 102.0 percent for the twelve months beginning

June 15, 2016 and to par on and after June 15, 2017.

Prior to June 15, 2016, the 2021 Notes will be redeemable at a price equal to the principal amount of the 2021

Notes being redeemed, plus accrued and unpaid interest to the date of redemption and a “make–whole” premium

calculated under the indenture governing the Secured Senior Notes. On and after June 15, 2016, the 2021 Notes

are redeemable at redemption prices specified in the 2021 Notes, plus accrued and unpaid interest to the date

of redemption. The redemption price is initially 104.125 percent of the principal amount of the 2021 Notes being

redeemed for the twelve months beginning June 15, 2016, decreasing to 102.750 percent for the twelve months

beginning June 15, 2017, to 101.375 percent for the twelve months beginning June 15, 2018 and to par on and after

June 15, 2019.