Chrysler 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 179

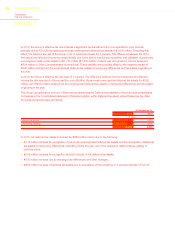

The effects of changes in ownership interests in FCA US was as follows:

Transaction date

(€ million)

Carrying amount of non-controlling interest acquired 3,976

Less consideration allocated to the acquisition of the non-controlling interest (2,916)

Additional net deferred tax assets 251

Effect on the equity attributable to owners of the parent 1,311

In accordance with IFRS 10 – Consolidated Financial Statements, equity reserves were adjusted to reflect the change

in the ownership interest in FCA US through a corresponding adjustment to Equity attributable to the parent. As

the transaction described above resulted in the elimination of the non-controlling interest in FCA US, all items of

comprehensive income previously attributed to the non-controlling interest were recognized in equity reserves.

Accumulated actuarial gains and losses from the remeasurement of the defined benefit plans of FCA US totaling

€1,248 million has been recognized since the consolidation of FCA US in 2011. As of the transaction date,

€518 million, which is approximately 41.5 percent of this amount, had been recognized in non-controlling interest.

In connection with the acquisition of the non-controlling interest in FCA US, this amount was recognized as an

adjustment to the equity reserve for Remeasurement of defined benefit plans.

With respect to the MOU entered into with the UAW, the Group recognized €495 million (U.S.$670 million) in Other

unusual expenses in the Consolidated income statement. The first U.S.$175 million installment under the MOU

was paid on January 21, 2014, which was equivalent to €129 million at that date, and is reflected in the operating

section of the Consolidated statement of cash flows. The remaining outstanding obligation pursuant to the MOU as of

December 31, 2014 of €417 million (U.S.$506 million), which includes €7 million (U.S.$9 million) of accreted interest,

is recorded in Other current liabilities in the Consolidated statement of financial position. The second installment of

$175 million (approximately €151 million at that date) to the VEBA Trust was made on January 21, 2015.

The Equity Purchase Agreement also provided for a tax distribution from FCA US to its members under the terms of

FCA US Group’s Limited Liability Company Operating Agreement (as amended from time to time, the “LLC Operating

Agreement”) in the amount of approximately U.S.$60 million (€45 million) to cover the VEBA Trust’s tax obligation.

As this payment was made pursuant to a specific requirement in FCA US’s LLC Operating Agreement, it is not

considered part of the multiple element transaction.

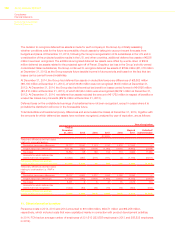

Transactions with non-controlling interests in 2014, 2013 and 2012 were as follows:

Acquisition of the remaining 41.5 percent ownership in FCA US (described above) consummated in January 2014.

In accordance with IFRS 10 - Consolidated Financial Statements, non-controlling interest and equity reserves were

adjusted to reflect the change in the ownership interest through a corresponding adjustment to equity attributable

to the parent.

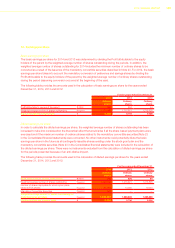

In the context of the Merger described above, in April 2014, Fiat Investments N.V. was incorporated as a public

limited liability company under the laws of the Netherlands and was renamed FCA upon completion of the Merger.

This transaction did not have an effect on the Consolidated financial statements.

In August 2014 Ferrari S.p.A. acquired an additional 21.0 percent in the share capital of the subsidiary Ferrari

Maserati Cars International Trading (Shanghai) Co. Ltd. increasing its interest from 59.0 percent to 80.0 percent

(the Group’s interests increased from 53.1 percent to 72.0 percent). In accordance with IFRS 10 - Consolidated

Financial Statements, non-controlling interest and equity reserves were adjusted to reflect the change in the

ownership interest through a corresponding adjustment to Equity attributable to the parent.

On January 2012, FCA’s ownership interest in FCA US increased by an additional 5.0 percent on a fully-diluted basis.

On October 28, 2013, FCA acquired the remaining 50.0 percent interests in VM Motori Group.