Chrysler 2014 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

232 2014 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

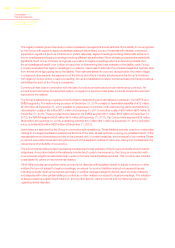

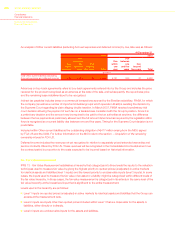

The indenture governing the Secured Senior Notes issued by FCA US includes affirmative covenants, including

the reporting of financial results and other developments. The indenture also includes negative covenants which

limit FCA US’s ability and, in certain instances, the ability of certain of its subsidiaries to, (i) pay dividends or make

distributions of FCA US’s capital stock or repurchase FCA US’s capital stock; (ii) make restricted payments; (iii) create

certain liens to secure indebtedness; (iv) enter into sale and leaseback transactions; (v) engage in transactions with

affiliates; (vi) merge or consolidate with certain companies and (vii) transfer and sell assets. The indenture provides

for customary events of default, including but not limited to, (i) non-payment; (ii) breach of covenants in the indenture;

(iii) payment defaults or acceleration of other indebtedness; (iv) a failure to pay certain judgments and (v) certain events

of bankruptcy, insolvency and reorganization. If certain events of default occur and are continuing, the trustee or the

holders of at least 25.0 percent in aggregate of the principal amount of the Secured Senior Notes outstanding under

one of the series may declare all of the notes of that series to be due and payable immediately, together with accrued

interest, if any. As of December 31, 2014, FCA US was in compliance with all covenants.

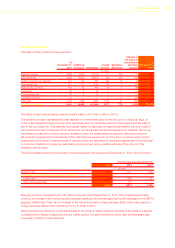

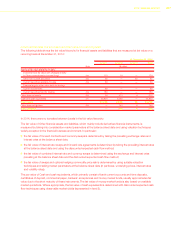

Borrowings from banks

At December 31, 2014, Borrowings from banks includes €2,587 million (€2,119 million at December 31, 2013)

outstanding, which includes accrued interest, on the U.S.$3,250 million (€2,677 million) tranche B term loan maturing

May 24, 2017 of FCA US (“Tranche B Term Loan due 2017”) and €1,421 million outstanding, which includes accrued

interest, on the U.S.$1,750 million (€1,442 million) tranche B term loan maturing December 31, 2018 (“Tranche

B Term Loan due 2018”). The revolving credit facility (described below) was undrawn at December 31, 2014. The

Tranche B Term Loan due 2017, Tranche B Term Loan due 2018 and the revolving credit facility (described below),

are collectively referred to as the “Senior Credit Facilities”.

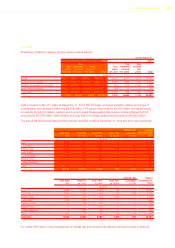

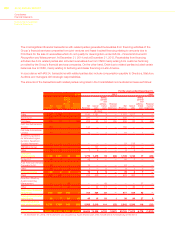

The Tranche B Term Loan due 2017 of FCA US consists of the existing U.S.$3.0 billion tranche B term loan (€2,471

million) that matures on May 24, 2017, (the “Original Tranche B Term Loan”), and an additional U.S.$250 million (€206

million at December 31, 2014) term loan entered into on February 7, 2014 under the Original Tranche B Term Loan

that also matures on May 24, 2017, collectively the “Tranche B Term Loan due 2017”. The outstanding principle

amount of the Tranche B Term Loan due 2017 is payable in equal quarterly installments of U.S.$8.1 million (€6.7

million) commencing March 2014, with the remaining balance due at maturity in May 2017. The Original Tranche B

Term Loan was re-priced in June and in December 2013 and subsequently, all amounts outstanding under Tranche B

Term Loan due 2017 will bear interest, at FCA’s option, at either a base rate plus 1.75 percent per annum or at LIBOR

plus 2.75 percent per annum, subject to a base rate floor of 1.75 percent per annum or a LIBOR floor of 0.75 percent

per annum. For the year ended December 31, 2014, interest was accrued based on LIBOR.

On February 7, 2014, FCA US entered into an agreement for the Tranche B Term Loan due 2018 for U.S.$1,750

million (€1,442 million). The outstanding principal amount for the Tranche B Term Loan due 2018 is payable in equal

quarterly installments of U.S.$4.4 million (€3.6 million), commencing June 30, 2014, with the remaining balance due

at maturity. The Tranche B Term Loan due 2018 bears interest, at FCA US’s option, either at a base rate plus 1.50

percent per annum or at LIBOR plus 2.5 percent per annum, subject to a base rate floor of 1.75 percent per annum or

a LIBOR floor of 0.75 percent per annum.

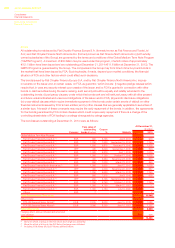

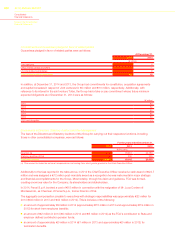

FCA US may pre-pay, refinance or re-price the Tranche B Term Loan due 2017 and the Tranche B Term Loan due

2018 without premium or penalty. FCA US also has the option to extend the maturity date of all or a portion of the

aforementioned term loans with the consent of the lenders.

At December 31, 2014, FCA US had a secured revolving credit facility (“Revolving Credit Facility”) amounting to

US$1.3 billion (€1.1 billion), which remains undrawn and which matures in May 2016. All amounts outstanding under

the Revolving Credit Facility bear interest, at the option of FCA US, either at a base rate plus 2.25 percent per annum

or at LIBOR plus 3.25 percent per annum. Subject to the limitations in the credit agreements governing the Senior

Credit Facilities (“Senior Credit Agreements”) and the indenture governing our Secured Senior Notes, FCA US has

the option to increase the amount of the Revolving Credit Facility in an aggregate principal amount not to exceed

U.S.$700 million (approximately €577 million) at December 31, 2014, subject to certain conditions.