Chrysler 2014 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 243

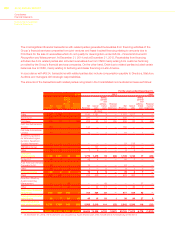

32. Explanatory notes to the Consolidated statement of cash flows

The Consolidated statement of cash flows sets out changes in Cash and cash equivalents during the year. As required

by IAS 7 – Statement of cash flows, cash flows are separated into operating, investing and financing activities.

The effects of changes in exchange rates on cash and cash equivalents are shown separately under the line item

Translation exchange differences.

Cash flows provided by operating activities are mostly derived from the Group’s industrial activities.

The cash flows generated by the sale of vehicles under buy-back commitments and GDP vehicles, net of the amounts

included in Profit/(loss) for the year, are included under operating activities in a single line item which includes changes

in working capital arising from these transactions.

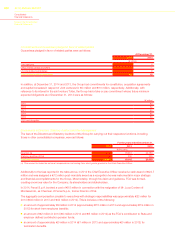

For the year ended December 31, 2014, Other non-cash items of €352 million mainly included (i) €381 million related

to the non-cash portion of the expense recognized in connection with the execution of the UAW MOU entered into by

FCA US on January 21, 2014, as described in the section —Acquisition of the remaining ownership interest in FCA

US, and (ii) €98 million remeasurement charge recognized as a result of the Group’s change in the exchange rate

used to remeasure its Venezuelan subsidiary’s net monetary assets in U.S. Dollars (Note 8) (reported, for the effect on

cash and cash equivalents, within “Translation exchange differences”) which were partially offset by (iii) the non-taxable

gain of €223 million on the remeasurement to fair value of the previously exercised options on approximately 10

percent of FCA US’s membership interest in connection with the Equity Purchase Agreement described above in the

section —Acquisition of the remaining ownership interest in FCA US.

For the year ended December 31, 2013, Other non-cash items of €535 million mainly included €336 million

impairment losses on tangible and intangible assets, €59 million loss related to the devaluation of the official exchange

rate of the VEF relative to the U.S.$ (Note 8) and €56 million write-off of the book value of the Equity Recapture

Agreement Right. For 2012, Other non-cash items of €582 million mainly included impairment losses on fixed assets,

the share of the net profit and loss of equity method investees and the effect of €515 million related to the adjustment

of the Consolidated income statement for 2012 following the retrospective adoption of IAS 19 revised from January 1,

2013, as if the amendment had always been applied.

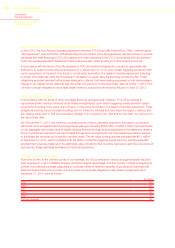

Change in working capital generated cash of €965 million for the year ended December 31, 2014 primarily driven

by (a) €1,495 million increase in trade payables, mainly related to increased production in EMEA and NAFTA as a

result of increased consumer demand for vehicles, and increased capital expenditure, (b) €123 million decrease in

trade receivables in addition to (c) €21 million increase in net other current assets and liabilities, which were partially

offset by (d) €674 million increase in inventory (net of vehicles sold under buy-back commitments), mainly related to

increased finished vehicle and work in process levels at December 31, 2014 compared to December 31, 2013, in

part driven by higher production levels in late 2014 to meet anticipated consumer demand in the NAFTA, EMEA and

Maserati segments.

Change in working capital generated cash of €1,410 million for the year ended December 31, 2013 primarily driven

by (a) €1,328 million increase in trade payables, mainly related to increased production in NAFTA as a result of

increased consumer demand for vehicles, and increased production for Maserati and Ferrari (b) €817 million in net

other current assets and liabilities, mainly related to increases in accrued expenses and deferred income as well as

indirect taxes payables, (c) €213 million decrease in trade receivables, principally due to the contraction of sales

volumes in the EMEA and LATAM segments which were partially offset by (d) €948 million increase in inventory (net of

vehicles sold under buy-back commitments), mainly related to increased finished vehicle and work in process levels at

December 31, 2013 compared to December 31, 2012, in part driven by higher production levels in late 2013 to meet

anticipated consumer demand in the NAFTA, APAC, Maserati and Ferrari segments.