Chrysler 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 2014 | ANNUAL REPORT

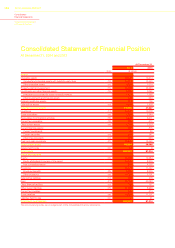

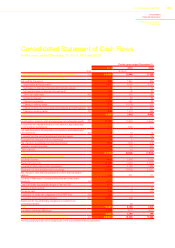

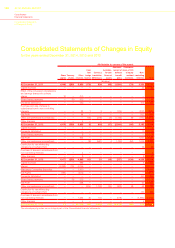

Consolidated

Financial Statements

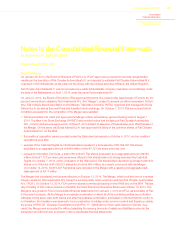

Notes to the Consolidated

Financial Statements

Corporate Information

The Group and its subsidiaries, among which the most significant is FCA US LLC (“FCA US”), formerly known as

Chrysler Group LLC or Chrysler, together with its subsidiaries, are engaged in the design, engineering, manufacturing,

distribution and sale of automobiles and light commercial vehicles, engines, transmission systems, automotive-related

components, metallurgical products and production systems. In addition, the Group is also involved in certain other

activities, including services (mainly captive) and publishing, which represent an insignificant portion of the Group’s

business.

SIGNIFICANT ACCOUNTING POLICIES

Authorization of Consolidated financial statements and compliance with International Financial Reporting

Standards

These Consolidated financial statements, together with notes thereto of FCA, at December 31, 2014 were authorized

for issuance on March 5, 2015 and have been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union (EU-IFRS) and with Part 9 of Book 2 of the Dutch Civil Code. The

Consolidated financial statements are also prepared in accordance with the IFRS adopted by the European Union.

The designation “IFRS” also includes International Accounting Standards (“IAS”) as well as all interpretations of the

IFRS Interpretations Committee (“IFRIC”).

Basis of Preparation

The Consolidated financial statements are prepared under the historical cost method, modified as required for the

measurement of certain financial instruments, as well as on a going concern basis. In this respect, the Group’s

assessment is that no material uncertainties (as defined in paragraph 25 of IAS 1- Presentation of Financial

Statements) exist about its ability to continue as a going concern.

The Group’s presentation currency is Euro (€).

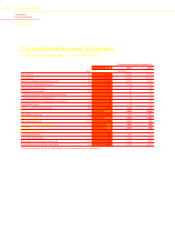

Format of the Consolidated Financial Statements

For presentation of the Consolidated income statement, the Group uses a classification based on the function of

expenses, rather than based on their nature, as it is more representative of the format used for internal reporting

and management purposes and is consistent with international practice in the automotive sector. The Group also

presents a subtotal for Earnings before Interest and Taxes (“EBIT”). EBIT distinguishes between the Profit before

taxes arising from operating items and those arising from financing activities. EBIT is the primary measure used by the

Chief Operating Decision Maker (identified as the Chief Executive Officer) to assess the performance of and allocate

resources to the operating segments.

For the Consolidated statement of financial position, a mixed format has been selected to present current and non-

current assets and liabilities, as permitted by IAS 1 paragraph 60. More specifically, the Group’s Consolidated financial

statements include both industrial and financial services companies. The investment portfolios of the financial services

companies are included in current assets, as the investments will be realized in their normal operating cycle. However,

the financial services companies obtain only a portion of their funding from the market; the remainder is obtained from

Group operating companies through the Group’s treasury companies (included within the industrial companies), which

provide funding to both industrial and financial services companies in the Group, as the need arises. This financial

services structure within the Group does not allow the separation of financial liabilities funding the financial services

operations (whose assets are reported within current assets) and those funding the industrial operations. Presentation

of financial liabilities as current or non-current based on their date of maturity would not facilitate a meaningful

comparison with financial assets, which are categorized on the basis of their normal operating cycle. Disclosure as to

the due date of the financial liabilities is provided in Note 27.

The Consolidated statement of cash flows is presented using the indirect method.