Chrysler 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152 2014 | ANNUAL REPORT

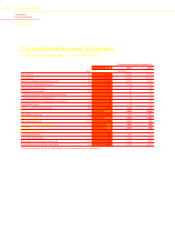

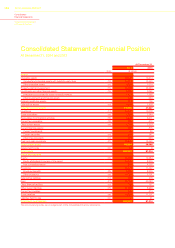

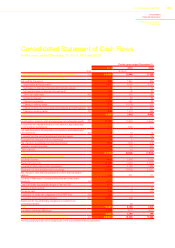

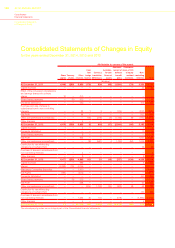

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

Novation of Derivatives and Continuation of Hedge Accounting (Amendments to IAS 39 – Financial Instruments:

Recognition and Measurement)

These amendments, which were adopted from January 1, 2014, allow hedge accounting to continue in a situation

where a derivative, which has been designated as a hedging instrument, is novated to effect clearing with a central

counterparty as a result of laws or regulation, if specific conditions are met. There was no significant effect on the

Consolidated financial statements from the application of these amendments.

Accounting for an obligation to pay a levy that is not income tax (IFRIC Interpretation 21 – Levies an interpretation of

IAS 37 – Provisions, Contingent Liabilities and Contingent Assets)

The interpretation, effective from January 1, 2014, sets out the accounting for an obligation to pay a levy that is not

income tax. The interpretation addresses what the obligating event is that gives rise to pay a levy and when a liability

should be recognized. There was no significant effect on the Consolidated financial statements from the application of

this interpretation.

New standards, amendments and interpretations not yet effective

In November 2013, the IASB published narrow scope amendments to IAS 19 – Employee benefits entitled “Defined

Benefit Plans: Employee Contributions”. These amendments apply to contributions from employees or third parties

to defined benefit plans in order to simplify their accounting in specific cases. The amendments are effective,

retrospectively, for annual periods beginning on or after July 1, 2014 with earlier application permitted. No significant

effect is expected from the first time adoption of these amendments.

In December 2013, the IASB issued Annual Improvements to IFRSs 2010 – 2012 Cycle and Annual Improvements

to IFRSs 2011–2013 Cycle. The most important topics addressed in these amendments are, among others,

the definition of vesting conditions in IFRS 2 – Share-based payments, the disclosure on judgment used in the

aggregation of operating segments in IFRS 8 – Operating Segments, the identification and disclosure of a related

party transaction that arises when a management entity provides key management personnel service to a reporting

entity in IAS 24 – Related Party disclosures, the extension of the exclusion from the scope of IFRS 3 – Business

Combinations to all types of joint arrangements and to clarify the application of certain exceptions in IFRS 13 – Fair

value Measurement. The improvements are effective for annual periods beginning on or after January 1, 2015. No

significant effect is expected from the adoption of these amendments.

In May 2014, the IASB issued amendments to IFRS 11 – Joint arrangements: Accounting for acquisitions of interests

in joint operations, clarifying the accounting for acquisitions of an interest in a joint operation that constitutes a

business. The amendments are effective, retrospectively, for annual periods beginning on or after January 1, 2016 with

earlier application permitted. No significant effect is expected from the adoption of these amendments.

In May 2014, the IASB issued an amendment to IAS 16 – Property, Plant and Equipment and to IAS 38 – Intangible

Assets. The IASB has clarified that the use of revenue-based methods to calculate the depreciation of an asset is

not appropriate because revenue generated by an activity that includes the use of an asset generally reflects factors

other than the consumption of the economic benefits embodied in the asset. The IASB also clarified that revenue

is generally presumed to be an inappropriate basis for measuring the consumption of the economic benefits

embodied in an intangible asset. This presumption, however, can be rebutted in certain limited circumstances.

These amendments are effective for annual periods beginning on or after January 1, 2016, with early application

permitted. The Group is currently evaluating the method of implementation and impact of this amendment on its

Consolidated financial statements.

In May 2014, the IASB issued IFRS 15 – Revenue from contracts with customers. The standard requires a company

to recognize revenue upon transfer of control of goods or services to a customer at an amount that reflects the

consideration it expects to receive. This new revenue recognition model defines a five step process to achieve this

objective. The updated guidance also requires additional disclosures about the nature, amount, timing and uncertainty

of revenue and cash flows arising from customer contracts. The standard is effective for annual periods beginning

on or after January 1, 2017, and requires either a full or modified retrospective application. The Group is currently

evaluating the method of implementation and impact of this standard on its Consolidated financial statements.