Chrysler 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

48 2014 | ANNUAL REPORT

Overview of Our Business

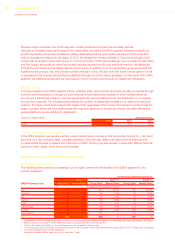

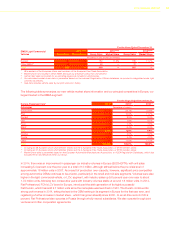

The following table presents our mass-market vehicle market share information and our principal competitors in Brazil,

our largest market in the LATAM segment:

For the Years Ended December 31,

Brazil 2014(1) 2013(1) 2012(1)

Automaker Percentage of industry

FCA 21.2% 21.5% 23.3%

Volkswagen(*) 17.7% 18.8% 21.2%

GM 17.4% 18.1% 17.7%

Ford 9.2% 9.4% 8.9%

Other 34.5% 32.2% 28.9%

Total 100.0% 100.0% 100.0%

(1) Our estimated market share data presented are based on management’s estimates of industry sales data, which use certain data provided

by third-party sources, including IHS Global Insight, National Organization of Automotive Vehicles Distribution and Association of Automotive

Producers.

(*) Including Audi.

The LATAM segment automotive industry decreased 12.5 percent from 2013, to 5.2 million vehicles (cars and light

commercial vehicles) in 2014. The decrease was mainly due to Brazil and Argentina with 6.9 percent and 28.7 percent

decreases, respectively. Over the past four years industry sales in the LATAM segment grew by 1.4 percent, mainly

due to Argentina and Other countries while Brazilian market remained substantially stable driven by economic factors

such as greater development of gross domestic product, increased access to credit facilities and incentives adopted

by Brazil in 2009 and 2012.

Our vehicle sales in the LATAM segment leverage the name recognition of Fiat and the relatively urban population

of countries like Brazil to offer Fiat brand mini and small vehicles in our key markets in the LATAM segment. We are

the leading automaker in Brazil, due in large part to our market leadership in the mini and small segments (which

represent almost 60 percent of Brazilian market vehicle sales). Fiat also leads the pickup truck market in Brazil (with

the Fiat Strada, 56.2 percent of segment share), although this segment is small as a percentage of total industry and

compared to other countries in the LATAM segment.

In Brazil, the automotive industry benefited from tax incentives in 2012, which helped our strong performance in that

year as we were able to leverage our operational flexibility in responding to the sharp increase in market demand.

However, tax incentives have limited the ability of OEMs to recover cost increases associated with inflation by

increasing prices, a problem that has been exacerbated by the weakening of the Brazilian Real. Increasing competition

over the past several years has further reduced our overall profitability in the region. Import restrictions in Brazil have

also limited our ability to bring new vehicles to Brazil. We plan to start production in our new assembly plant in Brazil in

2015, which we believe will enhance our ability to introduce new locally-manufactured vehicles that are not subject to

such restrictions.

LATAM Distribution

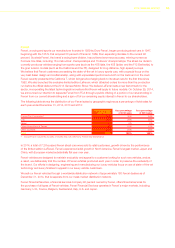

The following table presents the number of independent entities in our dealer and distributor network. In the LATAM

segment, we generally enter into multiple dealer agreements with a single dealer, covering one or more points of sale.

Outside Brazil and Argentina, our major markets, we distribute our vehicles mainly through general distributors and

their dealer networks. This table counts each independent dealer entity, regardless of the number of contracts or

points of sale the dealer operates. Where we have relationships with a general distributor in a particular market, this

table reflects that general distributor as one distribution relationship:

Distribution Relationships At December 31,

2014 2013 2012

LATAM 441 450 436