Chrysler 2014 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2014 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 | ANNUAL REPORT 207

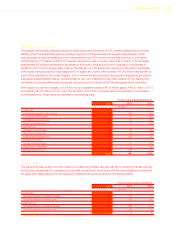

The Mandatory Convertible Securities will automatically convert on the Mandatory Conversion Date into a number of

common shares equal to the conversion rate calculated based on the share price relative to the applicable market

value (“AMV”), as defined in the prospectus, as follows:

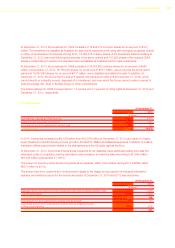

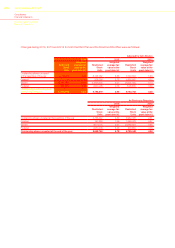

Maximum Conversion Rate: 261,363,375 shares if AMV ≤ Initial Price (U.S.$11), in aggregate the Maximum Number

of Shares(1)

A number of shares equivalent to the value of U.S.$100 (i.e., U.S.$100 / AMV), if Initial Price (U.S.$11) ≤ AMV ≤

Threshold Appreciation Price (U.S.$12.925)(1)

Minimum Conversion Rate: 222,435,875 shares if AMV ≥ Threshold Appreciation Price (U.S.$12.925), in aggregate

the Minimum Number of Shares(1)

Upon Mandatory Conversion: Holders receive: (i) any deferred coupon payments, (ii) accrued and unpaid coupon

payments in cash or in Shares at the election of the Group.

(1) The Conversion Rates, the Initial Price and the Threshold Appreciation Price are each subject to adjustment related to dilutive events. In

addition, upon the occurrence of a Spin-Off (as defined), the Threshold Appreciation Price, the Initial Price and the Stated Amount are also

subject to adjustment.

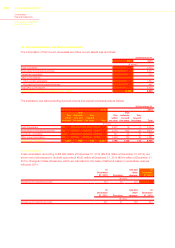

Other features of the Mandatory Convertible Securities are outlined below:

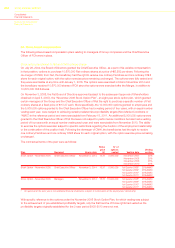

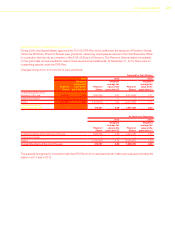

Early Conversion at Option of the Group: FCA has the option to convert the Mandatory Convertible Securities and

deliver the Maximum Number of Shares prior to the Mandatory Conversion Date, subject to limitations around

timing of the planned Ferrari separation. Upon exercise of this option, holders receive cash equal to: (i) any deferred

coupon payments, (ii) accrued and unpaid coupon payments, and (iii) the present value of all remaining coupon

payments on the Mandatory Convertible Securities discounted at the Treasury Yield rate.

Early Conversion at Option of the Holder: holders have the option to convert their Mandatory Convertible Securities

early and receive the Minimum Number of Shares, subject to limitations around timing of the planned Ferrari

separation. Upon exercise of this option, holders receive any deferred coupon payments in cash or in common

shares at the election of FCA.

The Mandatory Convertible Securities also provide for the possibility of early conversion in limited situations upon

occurrence of defined events outlined in the prospectus.

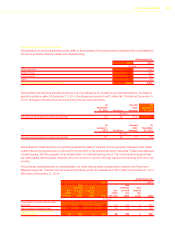

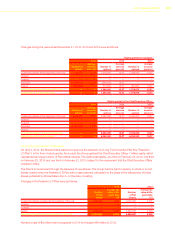

Under IAS 32 - Financial Instruments: Presentation, the issuer of a financial instrument shall classify the instrument,

or its component parts, on initial recognition in accordance with the substance of the contractual arrangement and

whether the components meet the definitions of a financial asset, financial liability or an equity instrument. As the

Mandatory Convertible Securities are a compound financial instrument that is an equity contract combined with a

financial liability for the coupon payments, there are two units of account for this instrument.

The equity contract meets the definition of an equity instrument as described in paragraph 16 of IAS 32 as the equity

contract does not include a contractual obligation to (i) deliver cash or another financial asset to another entity or (ii)

exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable

to FCA. Additionally, the equity contract is a non-derivative that includes no contractual obligation for FCA to deliver

a variable number of its own equity, as FCA controls its ability to settle for a fixed number of shares under the terms

of the contract. Management has determined that the terms of the contract are substantive as there are legitimate

corporate objectives that could cause FCA to seek early conversion of the Mandatory Convertible Securities. As a

result, the equity conversion feature has been accounted for as an equity instrument.

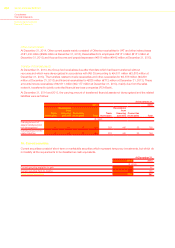

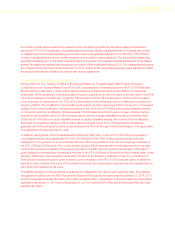

In regard to the obligation to pay coupons, FCA notes that this meets the definition of a financial liability as it is a

contractual obligation to deliver cash to another entity. FCA has the right to, or in certain limited circumstances the

investors can force FCA to prepay the coupons, in addition to settling the equity conversion feature, before maturity.

Under IFRS, the early settlement features would be bifurcated from the financial liability for the coupon payments since

they require the repayment of the coupon obligation at an amount other than fair value or the amortized cost of the

debt instrument as required by IAS 39.AG30(g).