Chrysler 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 195

38. Transactions resulting from unusual and/or abnormal operations

Pursuant to the Consob Communication of July 28, 2006, the Group has not taken part in any unusual and/or abnormal operations

as defined in that Communication (reference should be made to the section Format of the financial statements for a definition of

these).

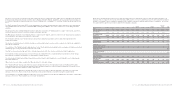

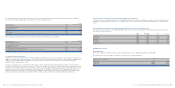

39. Translation of financial statements denominated in a currency other than the euros

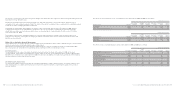

The principal exchange rates used in 2006 and 2005 to translate into euros the financial statements prepared in currencies other

than the euros were as follows:

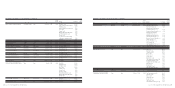

Average At December Average At December

2006 31, 2006 2005 31, 2005

U.S. dollar 1.256 1.317 1.244 1.180

Pound sterling 0.682 0.672 0.684 0.685

Swiss franc 1.573 1.607 1.548 1.555

Polish zloty 3.896 3.831 4.023 3.860

Brazilian real 2.734 2.815 3.027 2.761

Argentine peso 3.879 4.066 3.637 3.589

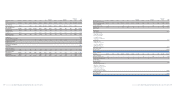

40. Other information

Personnel costs

The income statement includes personnel costs for 6,741 million euros in 2006 (6,158 million euros in 2005).

An analysis of the average number of employees by category is provided as follows:

2006 2005

Average number of employees

-Managers 2,432 2,595

-White-collar 54,351 54,489

-Blue-collar 116,943 112,987

Total 173,726 170,071

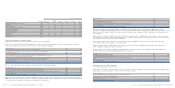

The book value at the disposal date of the net assets sold is summarised in the following table. Specific disclosure is made for

Iveco Finance Holdings Limited given the significance of the amounts involved.

of which

(in millions of euros) Total Iveco Finance Holdings

Non current assets 45 34

Cash and cash equivalents 118 115

Other current assets 2,951 2,874

Total assets 3,114 3,023

Debt 2,698 2,656

Other liabilities 172 127

Total liabilities 2,870 2,783

The consideration received from these sales and the related net cash inflows are as follows:

of which

(in millions of euros) Total Iveco Finance Holdings

Total Consideration received 160 122

Net cash inflows generated:

Consideration received 160 122

Less: Cash and cash equivalents disposed of (118) (115)

Reimbursement of loans extended by the Group’scentralised cash management 2,017 2,017

Total Net cash inflows generated 2,059 2,024

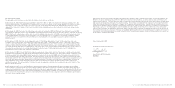

37. Non-recurring transactions

Pursuant to the Consob Communication of July 28, 2006, the significant non-recurring operations carried out by the Fiat Group in

2006 were the purchase of 29% of the shares of Ferrari S.p.A., the sale of Banca Unione di Credito – B.U.C. and the establishment

of the joint venture FAFS with Crédit Agricole. The effects of these operations are discussed in the preceding notes when

significant and in particular in Note 36.

For disclosure purposes it is recalled that the Group has entered certain important targeted industrial and/or commercial sales

agreements during the year (in many cases these are still at the stage of the “Letter of intent”) under which manufacturing and/or

commercial joint ventures will be set up in foreign countries (including India and China), development and growth will be agreed

with other operators in the automotive business and vehicles will be constructed on behalf of other manufacturers and/or the

manufacturing know how will be sold. By December 31, 2006 these agreements, which have by now become part of the Group’s

ordinary operations, had not yet had a significant effect on the amounts stated in the consolidated financial statements.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 194