Chrysler 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

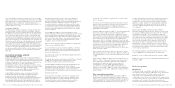

(in millions of euros) 2006 2005

A) Cash and cash equivalents at beginning of period 6,417 5,767

B) Cash flows from (used in) operating activities during the period:

Net result 1,151 1,420

Amortisation and depreciation (net of vehicles sold under buy-back commitments) 2,969 2,590

(Gains) losses on disposal of:

-Tangible and intangible assets (net of vehicles sold under buy-back commitments) 32 (109)

-Investments (607) (905)

Other non-cash items (a) 7(547)

Dividends received 69 47

Change in provisions 229 797

Change in deferred income taxes (26) 394

Change in items due to buy-back commitments (b) (18) (85)

Change in working capital 812 114

Total 4,618 3,716

C) Cash flows from (used in) investment activities:

Investments in:

-Tangible and intangible assets (net of vehicles sold under buy-back commitments) (3,789) (3,052)

-Investments in consolidated subsidiaries (931) (39)

-Other investments (686) (28)

Proceeds from the sale of:

- Tangible and intangible assets (net of vehicles sold under buy-back commitments) 387 427

-Investments in consolidated subsidiaries 47 46

-Other investments 1,157 27

Net change in receivables from financing activities (876) (251)

Change in current securities 223 (159)

Other changes (c) 3,078 2,494

Total (1,390) (535)

D) Cash flows from (used in) financing activities:

New issuance of bonds 2,414 –

Repayment of bonds (2,361) (1,868)

Issuance of other medium-term borrowings 1,078 916

Repayment of other medium-term borrowings (2,144) (1,175)

Net change in other financial payables and other financial assets/liabilities (d) (717) (712)

Proceeds from the increase in capital stock (d) 16 –

Proceeds from the sale of treasury stock 6–

Dividends paid (23) (29)

Total (1,731) (2,868)

Translation exchange differences (173) 337

E) Total change in cash and cash equivalents 1,324 650

F) Cash and cash equivalents at end of period 7,741 6,417

of which: Cash and cash equivalents included as Assets held for sale 5–

G) Cash and cash equivalents at end of period as reported in Consolidated financial statements 7,736 6,417

(a) In 2005 this included, amongst other items, the unusual financial income of 858 million euros arising from the extinguishment of the Mandatory Convertible Facility.

(b) The cash flows for the two periods generated by the sale of vehicles with a buy-back commitment, net of the amount already included in the net result, are included in operating activities

for the period, in a single item which includes the change in working capital, capital expenditures, depreciation, gains and losses and proceeds from sales at the end of the contract term,

relating to assets included in Property, plant and equipment.

(c) The item Other changes includes for an amount of approximately 3 billion euros the reimbursement of loans extended by the Group’s centralised cash management to the financial services

companies of Fiat Auto transferred to the FAFS joint venture. In 2005, this item included approximately 2 billion euros for the reimbursement of loans extended by the Group’s centralised

cash management to the financial services companies sold by Iveco, and 500 million euros as part of the effects of the unwinding of the joint venture with General Motors.

(d) In 2005, this item was net of the repayment of the Mandatory Convertible Facility of 3 billion euros and of the debt of approximately 1.8 billion euros connected with the Italenergia

Bis operation, as neither of these gave rise to cash flows.

Fiat Group Consolidated Financial Statements at December 31, 2006 89

Consolidated Statement of Cash Flows

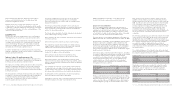

(in millions of euros) Note At December 31, 2006 At December 31, 2005

LIABILITIES

Stockholders’ equity: (25) 10,036 9,413

-Stockholders’ equity of the Group 9,362 8,681

-Minority interest 674 732

Provisions: 8,611 8,698

-Employee benefits (26) 3,761 3,950

-Other provisions (27) 4,850 4,748

Debt: (28) 20,188 25,761

-Asset-backed financing 8,344 10,729

-Other debt 11,844 15,032

Other financial liabilities (22) 105 189

Trade payables (29) 12,603 11,777

Other payables: (30) 5,019 4,821

-Current tax payables 311 388

-Others 4,708 4,433

Deferred tax liabilities (11) 263 405

Accrued expenses and deferred income (31) 1,169 1,280

Liabilities held for sale (24) 309 110

TOTAL STOCKHOLDERS’ EQUITY AND LIABILITIES 58,303 62,454

- Total stockholders’ equity and liabilities adjusted for asset-backed financing transactions 49,959 51,725

Fiat Group Consolidated Financial Statements at December 31, 200688

Consolidated Balance Sheet (continued)